Inactive BTC Supply Reaches All-Time Highs

New on-chain data suggests that Bitcoin (BTC) holders are actively accumulating BTC. Exchange holdings of the cryptocurrency have dropped to yearly lows, while the percentage of inactive BTC supply has reached all-time highs. Glassnode's Bitcoin supply last active chart shows that the amount of inactive BTC that has not moved from an address for more than 1, 3, and 5-year time frames has been steadily increasing since July 2023.

The Majority Holding BTC for Over a Year

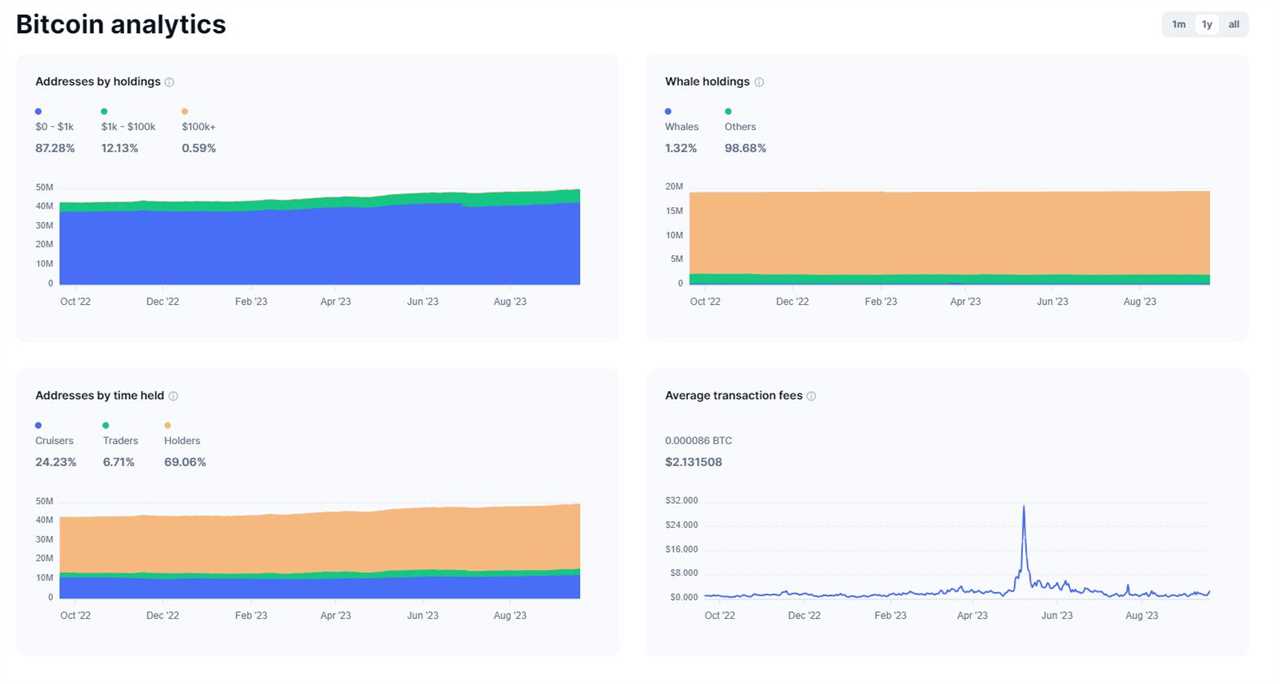

Coinmarketcap's Bitcoin analytics also confirm this trend, revealing that around 69% (or 36.8 million addresses) of wallet holders have been holding BTC for more than a year. This indicates a strong belief in the long-term value and potential of the cryptocurrency.

Bitcoin Outflows from Exchanges Decline

CryptoQuant's charts further support this narrative, showing a continuous decline in Bitcoin outflows from exchanges since July 2021. Currently, only just over 2 million BTC remains on exchanges, indicating a shift towards long-term holding strategies by investors.

Tracking BTC Holdings on Major Exchanges

Coinglass's Bitcoin on exchanges tracker provides insight into the amount of circulating BTC held by major centralized exchanges. Binance leads the pack with 543,281 BTC on its books, but the exchange has experienced significant Bitcoin outflows in the past month, with 21,645 BTC being withdrawn. Coinbase Pro follows closely with a BTC balance of 435,530, and it has seen 3,612 BTC withdrawn over the last 30 days. Only OKX recorded a significant inflow of Bitcoin in the past month, with 4,630 BTC being moved onto the platform.

Positive Outlook for Bitcoin

Market commentators and analysts have expressed optimistic predictions for the future value of Bitcoin, especially with the highly-anticipated mining reward halving scheduled for 2024. This event is expected to further increase the scarcity and value of Bitcoin, leading to potentially higher prices.