Bitcoin Derivatives Show Bearish Trends

Bitcoin (BTC) derivatives are pointing towards a potential price correction down to $22,000 as bearish tendencies emerge. The recent victory by Grayscale Asset Manager against the US Securities and Exchange Commission (SEC) and the postponement of several spot BTC exchange-traded fund (ETF) requests by the SEC have dampened investor sentiment.

Spot Bitcoin ETF Hype Fading

The hype around a spot Bitcoin ETF is fading as investor optimism wanes. The 19% rally that followed BlackRock ETF initial filing has fully retracted, and an attempt to reclaim the $28,000 support failed. With the S&P 500 index closing only 6.3% below its all-time high and gold hovering 6.5% away from its all-time high, the overall feeling among Bitcoin investors is less positive than expected.

Regulatory Actions Against Exchanges

Analysts attribute Bitcoin's lackluster performance to ongoing regulatory actions against Binance and Coinbase. The US Department of Justice (DOJ) is reportedly planning to indict Binance in a criminal probe for alleged money laundering and potential sanctions violations involving Russian entities.

Spot ETF Approval Could Outweigh Risks

Bitcoin supporter Pentoshi believes that the potential gains from a spot ETF approval outweigh the impact of regulatory actions against exchanges. However, it's important to consider that US inflation has decreased and the Federal Reserve has been draining liquidity from the markets, which could negatively affect Bitcoin's inflation protection thesis.

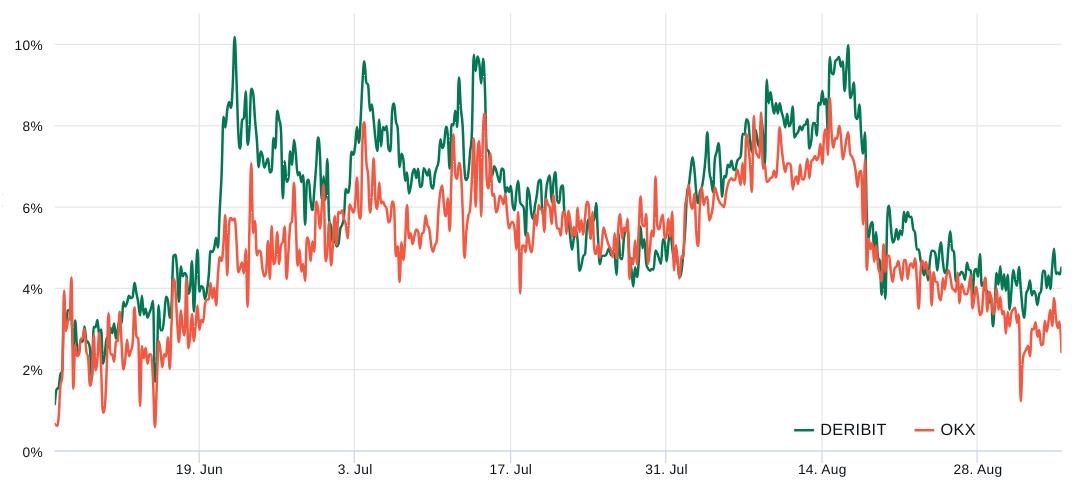

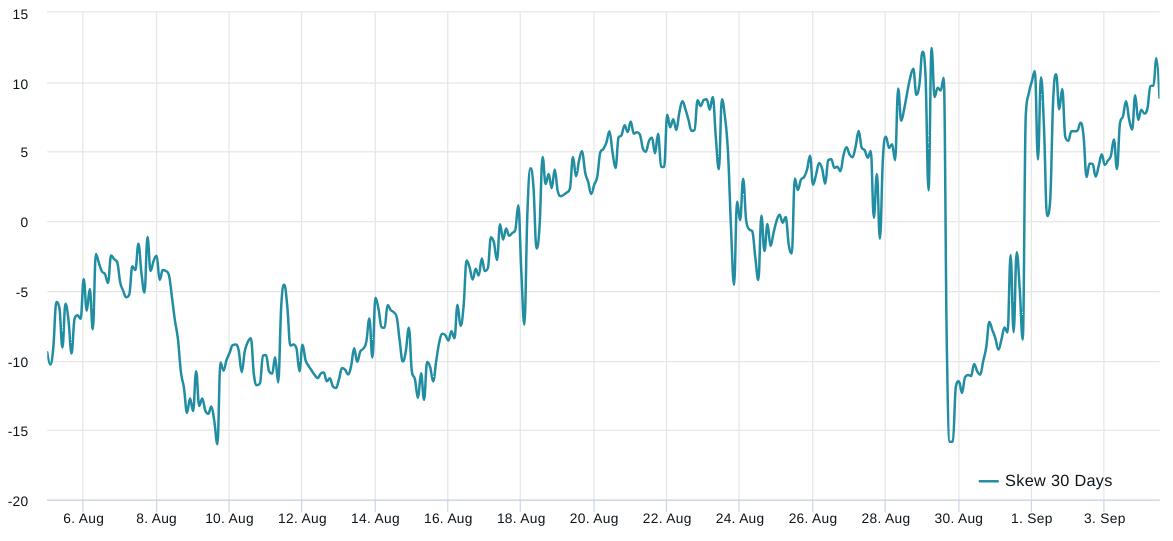

Bearish Momentum in Bitcoin Derivatives

Bitcoin futures data suggests that the bearish momentum is gaining strength. The current futures premium is at its lowest point since mid-June, indicating decreased demand for leverage buyers. Additionally, options data shows a recent entry into bearish territory, with protective put options trading at a premium compared to similar call options.

$22,000 Retracement Likely

Considering the regulatory uncertainties and the inability to sustain positive price momentum despite the increased chances of a spot Bitcoin ETF approval, a retracement down to $22,000 is the most likely scenario. This level was last seen when Bitcoin's futures premium was at 3.5%.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/australian-lawmakers-send-back-crypto-bill-calling-for-amendments