Sometimes all Bitcoin (BTC) needs to pump 10% is a positive remark from someone like Elon Musk.

The Tesla CEO has been pointed to as the culprit for the recent downturn after the company’s May 12 announcement explaining that it would no longer accept Bitcoin payments due to environmental concerns. Musk followed up by saying that he was looking into other cryptocurrencies that required 99% less energy consumption.

However, on June 13, the situation reversed as Musk reassured the public that Tesla did not sell any additional Bitcoin. The post also said that the electric-car producer would resume taking BTC payments as soon as its Bitcoin mining relied on a minimum of 50% clean energy.

In bear markets, top traders act with caution

While retail investors and algorithmic trading bots jump into action as soon as bullish or bearish signals and news flash, top traders tend to act more with more caution. Those who have been around the crypto markets long enough know that positive news might end up being ignored or severely downplayed in bear markets.

On the other hand, even potentially negative news seems to have little to no impact during bull runs. For example, on Sept. 26, 2020, Kucoin was hacked for $150 million. The following week, on Oct. 1, the United States Commodity Futures Trading Commission charged BitMEX for operating an unregistered trading platform and violating Anti-Money Laundering regulations.

Two weeks later, police reportedly questioned the founder of OKEx, forcing the exchange to suspend crypto withdrawals. Had this series of negative news happened while Bitcoin was flat or in a bearish phase, the price would have undoubtedly have stalled during a bear market.

As shown above, Bitcoin barely had any negative impact in late September and October 2020. In fact, by the end of November 2020, Bitcoin was up 74% in two months. This is the main reason why top traders tend to ignore positive news during bear markets and vice-versa.

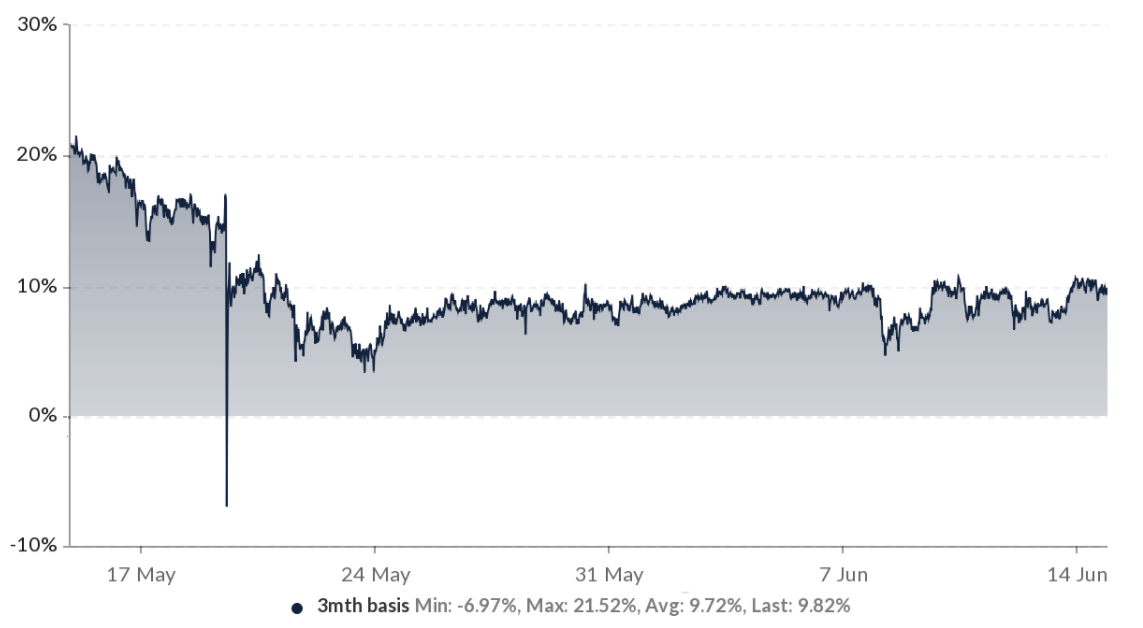

The 3-month futures premium is neutral

A futures contract seller will usually demand a price premium to regular spot exchanges. This situation is not exclusive to crypto markets and happens in every derivatives market because in addition to the exchange liquidity risk, the seller is postponing settlement and this results in a higher price.

The 3-month futures premium (basis rate) usually trades at a 5% to 15% annualized premium in healthy markets. When futures are trading below the regular spot exchange price, it signals a short-term bearish sentiment.

As shown above, the future basis has been below 11% since May 20 and flirting with bearish territory on multiple occasions as it tested 5%. The current level indicates a neutral position from top traders.

The options skew is no longer signaling fear

The 25% delta skew compares similar call (buy) and put (sell) options side-by-side. It will turn positive when the protective put options premium is higher than similar risk call options.

The opposite holds when market makers are bullish and this causes the 25% delta skew indicator to enter the negative range.

The above chart confirms that top traders, including arbitrage desks and market markers, are currently uncomfortable with Bitcoin price as the neutral-to-bearish put options premium is higher. However, the current 7% positive skew is far from the 20% exaggerated fear seen in late May.

Derivatives markets show no evidence of top traders getting excited about the recent $40,000 hike. On the bright side, there is room for leverage buyers to mount positions. Stronger upswings usually occur when investors are least expecting, and the current scenario seems to be a perfect example.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Bitcoin derivatives data shows pro traders ignored today’s $41K pump

Sourced From: cointelegraph.com/news/bitcoin-derivatives-data-shows-pro-traders-ignored-today-s-41k-pump

Published Date: Tue, 15 Jun 2021 00:40:48 +0100