Bitcoin stuck in tight range and faces uncertainty

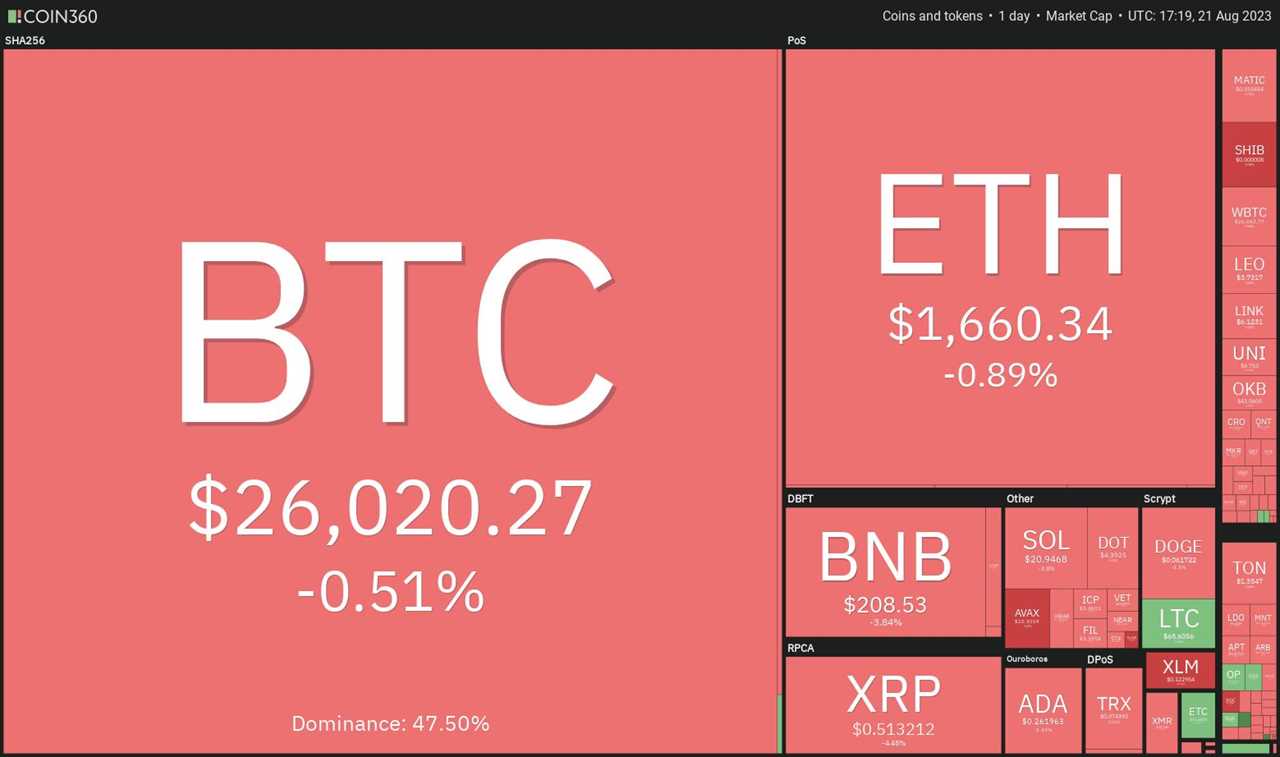

Bitcoin (BTC) has struggled to make a significant move following the sharp fall on Aug. 17, indicating a state of indecision amongst investors. The current situation suggests a battle between bullish and bearish sentiment, with no clear direction for the cryptocurrency's next move.

Short-term Holders bear the brunt of Bitcoin's fall

As Bitcoin experienced its recent drop, Glassnode's weekly newsletter, "The Week On-Chain," reported that approximately 88% of Bitcoin held by Short-term Holders (STHs) has resulted in losses. This group consists of holders who have possessed Bitcoin for 155 days or less. Glassnode further warns that STHs are becoming increasingly sensitive to price changes, possibly indicating a lack of confidence.

Long-term Holders remain stoic despite market downturn

In contrast to the Short-term Holders, long-term holders have not reacted with panic or excessive buying during this period of decline. This suggests that these investors have stronger belief in Bitcoin's future potential and are taking a more patient approach to their holdings.

All eyes on Powell's speech at Jackson Hole

Traders are eagerly awaiting the annual Jackson Hole Economic Symposium on Aug. 25, where the United States Federal Reserve Chairman, Jerome Powell, is scheduled to speak. Powell's speech may prove pivotal for the market, as a negative surprise could have adverse effects on risk assets. However, based on historical trends, the week following the Jackson Hole event tends to be favorable for U.S. stocks.

Analyzing key support and resistance levels for Bitcoin

With uncertainty surrounding Bitcoin's direction, traders will be closely monitoring the cryptocurrency's support and resistance levels. By analyzing charts, experts hope to gain insight into where Bitcoin and altcoins may be headed in the near future.

S&P 500 Index faces its own price challenges

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/crypto-exchange-coinbase-increases-offer-on-debt-buyback-program-after-lackluster-demand