Stablecoin Buying Power Weakens Ahead of Bitcoin ETF

Bitcoin (BTC) has been reaching 17-month highs, and with just 164 days to go until the next Bitcoin halving event, there is anticipation for the approval of a spot Bitcoin exchange-traded fund (ETF) in the coming months.

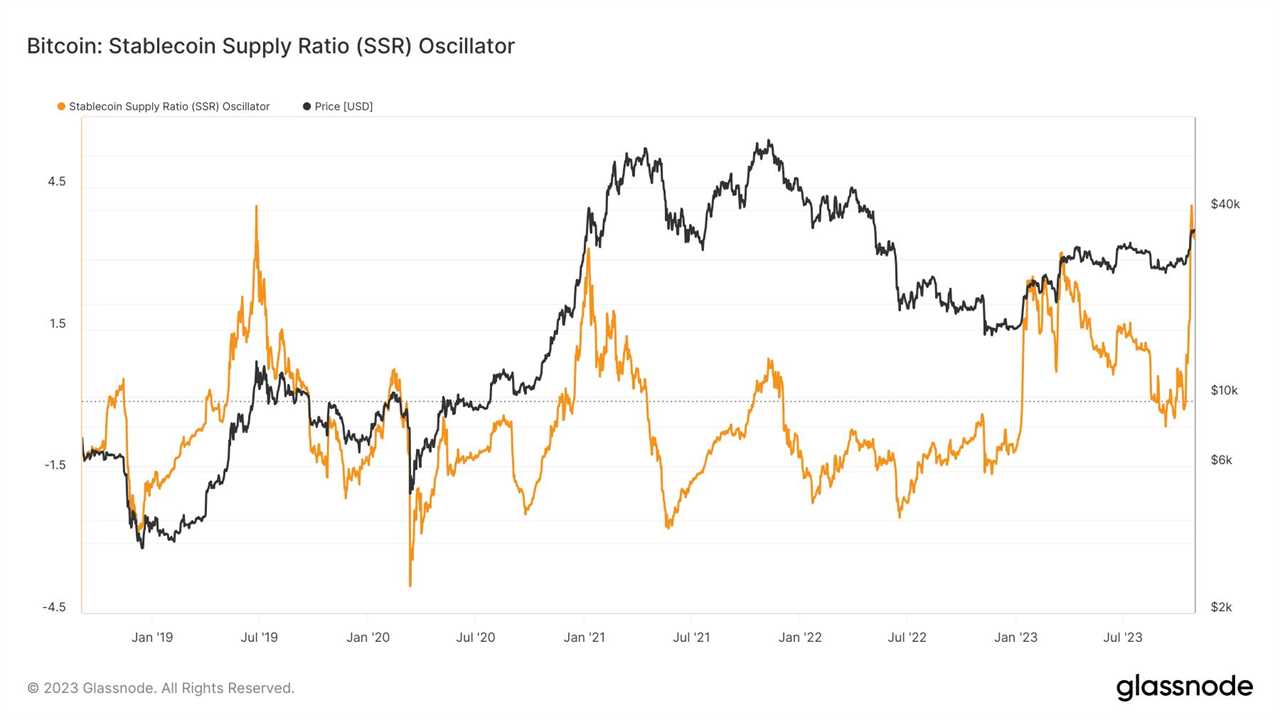

However, despite Bitcoin's impressive year-to-date gains of 106.38%, a key metric called the stablecoin supply rate oscillator (SSRO) is raising a major flag. This metric measures the dominance of stablecoins versus Bitcoin, and it has surged to a new all-time high of 4.13 on October 25, indicating a strong appetite for Bitcoin accumulation on-chain.

But here's the catch: the high SSRO level also suggests that the purchasing power of stablecoins is currently at a relative all-time low. In fact, this is the highest divergence of the SSRO since 2019, when it reached 4.12 exactly 320 days before the May 2020 halving event.

This could potentially mean that we are heading towards a retracement period before the next halving event in April 2024. While a local top similar to the one in 2019 is possible, historically, high SSRO levels have also aligned with the start of bigger bull market cycles.

"Reserve Risk" Suggests a Different BTC Rally

As the possibility of a spot Bitcoin ETF approval excites the market and raises implications for Bitcoin's price, another metric called the reserve risk (RR) indicator is painting a unique picture of market sentiment, suggesting that this Bitcoin rally might be different from the one in 2019.

The RR indicator measures the risk-reward incentives in relation to the current "HODL bank" and spot BTC price. Currently, despite the record-high SSRO reading, the RR is at multi-year lows at the bottom of the green band. Historically, buying Bitcoin when the RR is at such low levels has resulted in significant returns.

This indicates that despite Bitcoin's price reaching 17-month highs, confidence remains very high in Bitcoin's future performance. Long-term holders who control an all-time high of the total supply may be well-positioned for major gains. Furthermore, the potential multibillion-dollar inflows into a Bitcoin ETF further support the growing commonality of six-figure BTC price predictions for the post-halving period.

Please note that this article does not contain investment advice or recommendations. Every investment and trading move carries risk, and readers should conduct their own research before making any decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/paypal-granted-crypto-license-in-uk