Bitcoin Cash (BCH) holders have no reason to celebrate, despite the 46% year-to-date gains in U.S. dollar terms. One year ago, the altcoin was the third-largest by market capitalization. It now risks dropping out of the top ten, having been surpassed by other cryptocurrencies including Litecoin (LTC) and Chainlink (LINK).

After three years of continuous devaluation, BCH has finally traded below 0.01 Bitcoin (BTC) on Feb. 22. Besides being psychological support, it marks a 96.5% devaluation from its highest close of 0.285 BTC on Aug. 2, 2017.

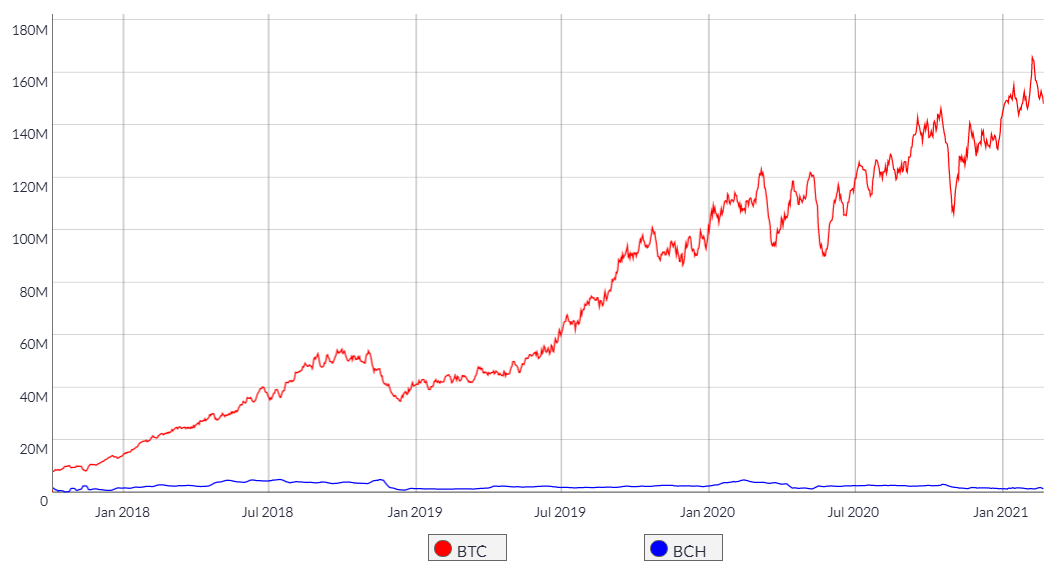

Even though both cryptocurrencies' combined hash rate was somewhat comparable at the time, it has since become a one-sided battle with BTC's hash rate dominance now over 98% versus BCH and Bitcoin SV (BSV) combined.

As depicted above, the BCH hash rate currently stands at 1% of BTC's 150 exahashes per second. However, BCH proponents argue that Bitcoin Cash's 10-block checkpoint system defends the blockchain against hostile reorgs, so less hash rate is needed.

Nevertheless, while the risk of a "deep reorg" is reduced, checkpoints come with tradeoffs, particularly the increased risk of a consensus chain split, according to BitMex.

The addition of checkpoints has also led to criticism from Bitcoin proponents, who argue that this solution compromises the decentralization of the Bitcoin Cash network.

Just woke up:

— WhalePanda (@WhalePanda) November 16, 2018

So apparently Jihan took a lot of hashpower from Bitcoin to mine on $BCH. He got really scared and is burning a lot of money. https://t.co/RbObgu5fiS

They added a checkpoint to prevent attacks. It means that 1 person is saying what is the valid chain = centralized.

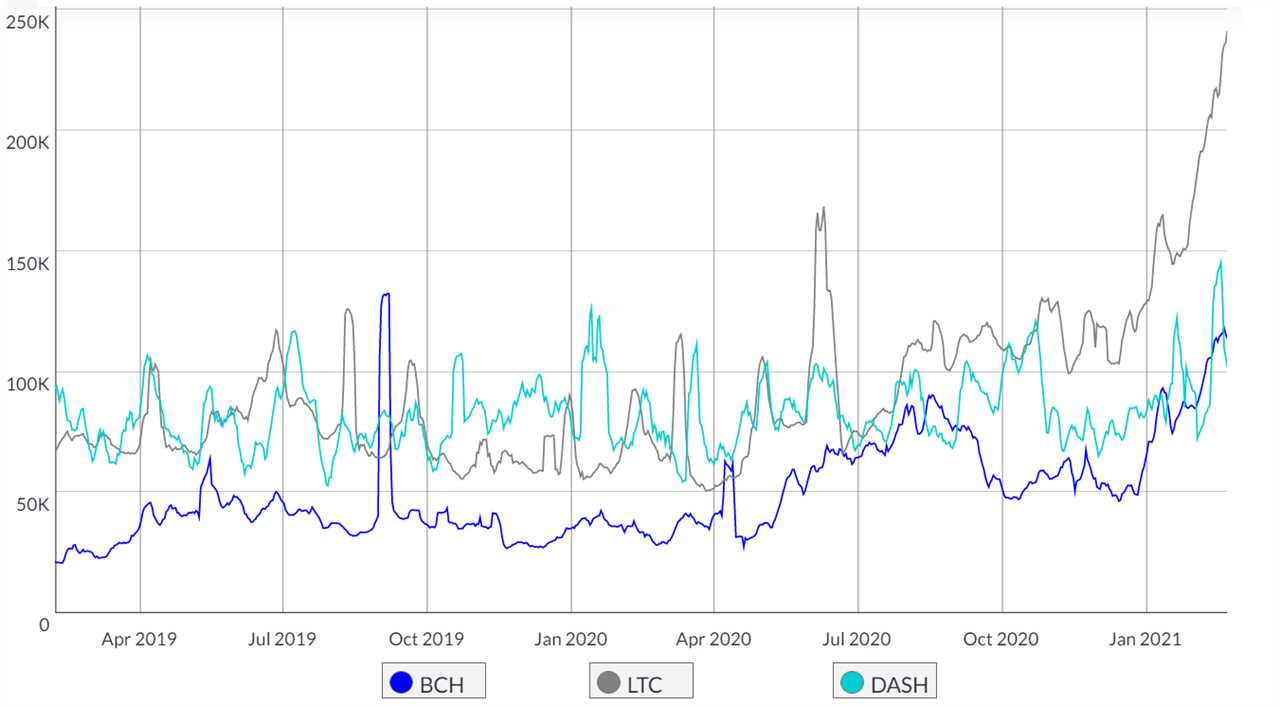

Litecoin's active addresses outshine BCH

Daily active addresses are a vital on-chain metric, albeit often inflated when the lower transaction costs are considered alongside network security tradeoffs. Nevertheless, comparing BCH with Litecoin and DASH seems reasonable as the three networks have average fees below $0.05.

As the data indicates, Litecoin currently has double the number of BCH daily active addresses. Therefore, the activity on the Bitcoin Cash network is more similar to that of DASH, an altcoin with a $2.2 billion market cap.

Additionally, the VORTECS™ metric from Cointelegraph Markets Pro began dropping on Feb. 18 just days before the price peaked.

The VORTECS™ score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from multiple data points including market sentiment, trading volume, recent price movements, and Twitter activity.

The score fell to sub-50 levels and the drop in BCH price came four days later, losing the important $670 support level.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: Bitcoin Cash is on the brink of falling below 1% of Bitcoin’s price

Sourced From: cointelegraph.com/news/bitcoin-cash-is-on-the-brink-of-falling-below-1-of-bitcoin-s-price

Published Date: Thu, 25 Feb 2021 14:30:00 +0000