Bitcoin needs to reclaim one key moving average to "regain its bullish status," one popular analyst argues.

In analysis issued to subscribers on Aug. 22, CryptoCon warned that bulls remained too optimistic over $26,000 BTC price support holding.

20-week EMA as BTC price line in the sand

Bitcoin staged a modest recovery above $26,500 around its latest daily close, but a sober market synopsis says that bulls have much more work ahead of them.

For CryptoCon, the 20-week exponential moving average (EMA), now at $27,750, must be won back as support in order for the uptrend to be safe.

"I have been covering this moving average a lot recently, but I believe it is critical for Bitcoin to regain its bullish status," he wrote.

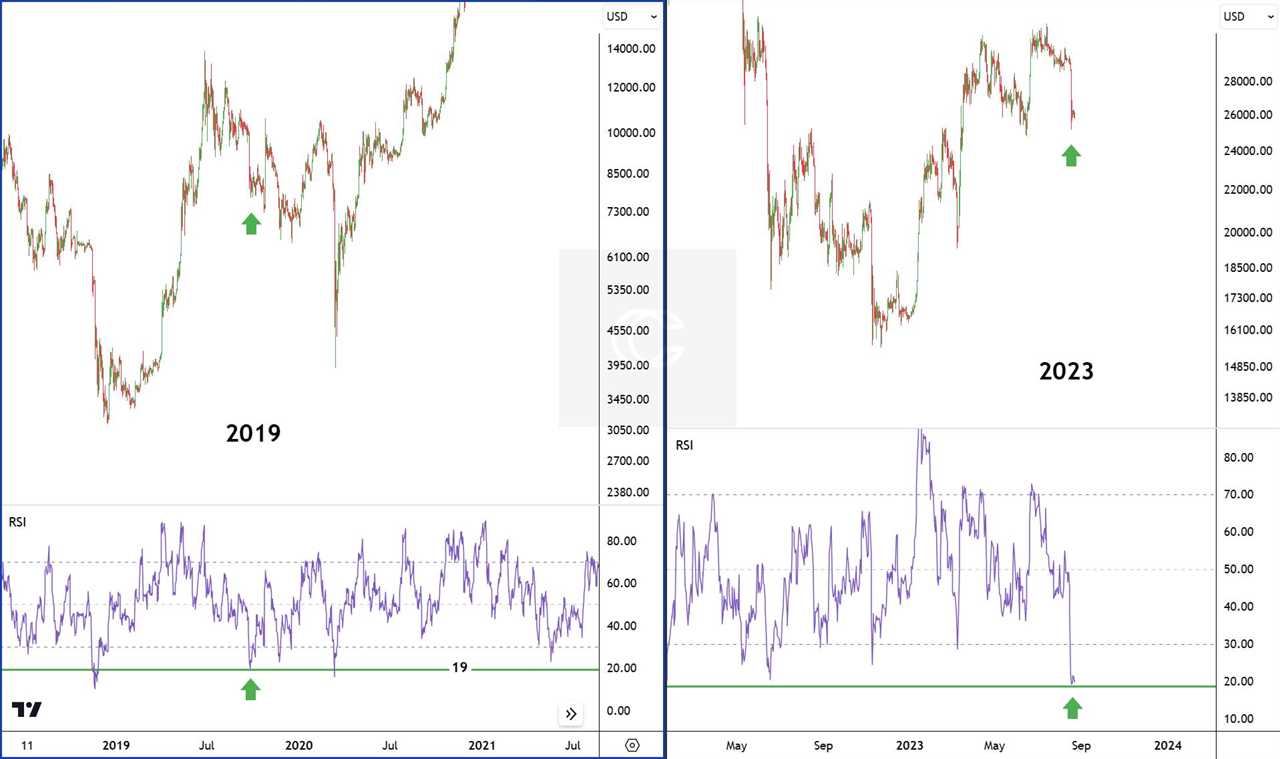

The analysis compared current BTC price action to its rebound from 2018 cycle lows. Then, it took such a reclaim of the 20-week EMA to launch the path to what ultimately became Bitcoin’s 2021 all-time highs of $69,000.

Prior to that, however, an unsuccessful challenge was met with a firm rejection.

"It is very important that Bitcoin both rises above and retests the 20 Week EMA as support."

An accompanying chart showed the similarities between 2019 and 2023, with the retest and subsequent successful EMA reclaim circled.

"All I see is weakness"

Elsewhere, CryptoCon questioned the validity of the current bullish argument surrounding Bitcoin’s relative strength index (RSI) readings.

"I would love to say that very oversold RSI is a good thing but the only thing I can see is weakness," he admitted.

"This is combined with being below healthy supports, and early reversal signs in market structure. At the real bottom, I believe even the most bullish analysts will be questioning themselves. I remain optimistic to be proved wrong, but also realistic based on long-term data."

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.