A recent sell-off in the Bitcoin (BTC) market pushed its prices below the key psychological support of $30,000.

While the cryptocurrency's move downhill prompted many analysts, including Luno exchange's Vijay Nayyar and Kinetic Capital's Jehan Chu, to predict a further depressive move below $25,000, Anthony Pompliano offered a contrasting bullish outlook.

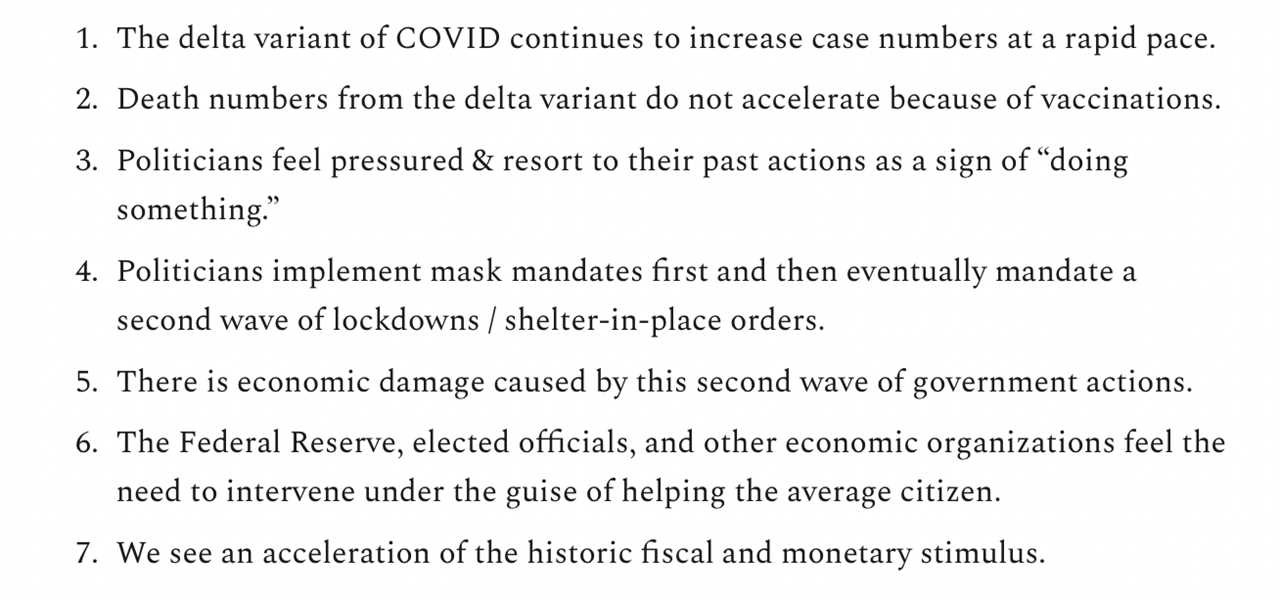

The Morgan Creek Digital Assets founder pitted risk-on markets against the fears of the fast-spreading Delta variant of the Covid-19. He noted that governments, on the whole, would introduce "more aggressive monetary stimulus" programs should the new coronavirus strain spread at the scale of its alpha version.

"History is not necessarily an indicator of the future, but it is hard to imagine a scenario where if we had a second wave of lockdowns, we wouldn’t also get more aggressive monetary stimulus efforts," Pompliano wrote.

"If that occurred, we would likely see all assets continue to go higher and higher."

In saying so, Pompliano envisioned that the road to more dollar liquidity would like come in seven successive stages, as shown in the snapshot below:

Risk-on FOMO expected

Pompliano's statements appeared as the Bitcoin market fell in sync with other risk-on assets across the globe on Monday.

For instance, all the three Wall Street indexes—the S&P 500, the Nasdaq Composite, and the Dow Jones—logged their steepest declines in weeks. Also, gold at one point in time fell to as low as $1,795.12 an ounce but recovered to $1,812.145 an ounce to close the session.

Meanwhile, the U.S. government bond rallied alongside the dollar, showing that investors were heading for safe-havens amid the global market turmoil.

Behind the rout, global media reported, was a growing list of worries about the recovery. In detail, the Delta variant of the Covid-19 has spread rapidly, reigniting the dialogue in several countries about whether authorities should reimpose lockdown and curb economic activity.

"The hope was that [the Covid-19] vaccines would provide us with the endgame," Mohammed Kazmi, a portfolio manager at Union Bancaire Privée, told Financial Times. "Now investors are looking at the UK and there’s a bit of fear with regards to reopening so aggressively when cases are still so high."

Kazmi added that markets are now stepping from hopes of a V-shaped recovery, and are feeling uncertain about the future of their economies.

Related: Stock-to-flow model possibly invalidated as Bitcoin price loses $30K

Pompliano's comments also appeared as the Federal Reserve flirted with the idea of hiking its near-zero lending rates by the end of 2023 to curb rising inflation.

Additionally, several central bank officials also favored the idea of tapering their aggressive $120B a month asset purchase program, albeit chairman Jerome Powell clarified that the Fed intends to run the quantitative easing policy hot until the U.S. economy recovers completely.

James Wo, founder & chief executive of global blockchain and digital asset investment firm Digital Finance Group also noted that even though the Bitcoin industry has encountered downside volatility during this current market cycle, the fundamentals that have driven its and other markets' value higher all across 2020 continue unaffected. He added:

"Any combination of narratives that have brought digital assets to this discounted price can be checked off of lists of FUD that would have eventually affected the price of the whole market."

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Bitcoin bull outlines 7 steps to more fiscal stimulus and higher BTC prices

Sourced From: cointelegraph.com/news/bitcoin-bull-outlines-7-steps-to-more-fiscal-stimulus-and-higher-btc-prices

Published Date: Tue, 20 Jul 2021 15:30:00 +0100