Prediction: US Government Could Trigger Bitcoin Bull Market

A new prediction suggests that Bitcoin (BTC) could enter a full bull market thanks to actions taken by the US government. Arthur Hayes, former CEO of crypto exchange BitMEX, argues that ballooning yields in the US treasury indicate a forthcoming macroeconomic flashpoint that will benefit Bitcoin and the crypto market as a whole.

Understanding the "Bear Steepener"

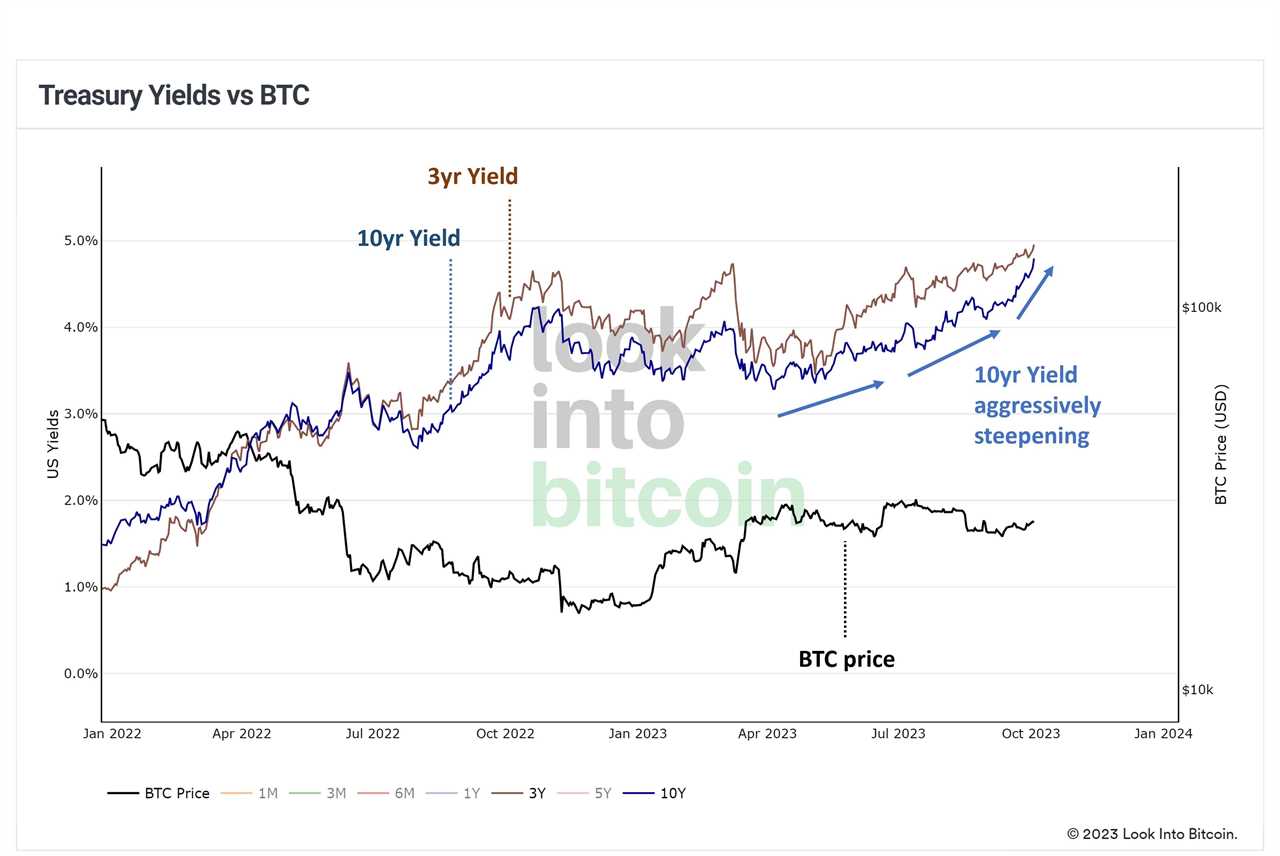

Hayes points to a phenomenon known as the "bear steepener" to support his claim. This describes a scenario in which long-term interest rates rise more rapidly than short-term rates. Currently, US treasury yields are "screaming higher," and Hayes believes that this will lead to increased pressure across the economy.

According to Hayes, the rise in the 2s30s curve (the difference between 30-year and 2-year yields) combined with the increase in long and short-term interest rates will force banks to sell bonds or pay fixed on IRS as rates rise. This selling pressure will negatively impact bond prices and ultimately lead to a return to mass liquidity injections.

Crypto Markets Set to Benefit

The quantitative tightening seen since late 2021 has placed pressure on the crypto markets. However, Hayes argues that a faster rise in the bear steepener will force the recognition that there is no way out other than money printing to save government bond markets. This, in turn, will pave the way for a return to the crypto bull market.

Hayes acknowledges that there will likely be major casualties along the way, but he remains optimistic about the prospects for Bitcoin and other cryptocurrencies.

Supporting Data and Expert Opinions

Data from TradingView shows that the 30-year US government bonds yield reached 5% this week for the first time since August 2007, just before the Global Financial Crisis.

Philip Swift, creator of statistics resource LookIntoBitcoin and co-founder of trading suite Decentrader, supports Hayes' prognosis. He suggests that a return to money supply expansion would be the major catalyst for the Bitcoin bull market.

Rising US Debt

In addition to the bear steepener, the US continues to accumulate record-high national debt. Just two weeks after surpassing $33 trillion, the government added another $275 billion in a single day. Financial commentators have taken note of this alarming trend.

Samson Mow, CEO of Bitcoin adoption firm Jan3, highlights the magnitude of the US debt increase, equating it to over half of Bitcoin's entire market cap. Despite this, some people are still unsure about the value of investing in Bitcoin.

No Investment Advice

It's important to note that this article does not contain investment advice or recommendations. All investment and trading decisions involve risk, and readers should conduct their own research before making any decisions.