Bitcoin (BTC) Eyes Uptrend as SEC Delays ETF Decision

Bitcoin (BTC) is trying to sustain above the overhead resistance of $38,000 for the second consecutive day and start the next leg of the uptrend. The excitement among market observers may have increased after the United States Securities and Exchange Commission (SEC) delayed its decision on the applications of Franklin Templeton and Hashdex exchange-traded funds. Bloomberg ETF analyst James Seyffart speculated in a X (formerly Twitter) post that the SEC may have taken this step "to line every applicant up for potential approval by the Jan. 10, 2024 deadline."

Analysts Warn of Potential Correction Before Uptrend Resumes

While many analysts believe that the ETF listing will be a watershed moment for Bitcoin, there are concerns that traditional finance investors may exit the trade close to the ETF announcement when retail investors try to get in. However, macroeconomic conditions in early 2024 may limit the downside, as Pershing Square Capital Management CEO Bill Ackman predicts that the U.S. Federal Reserve will cut rates sooner than expected.

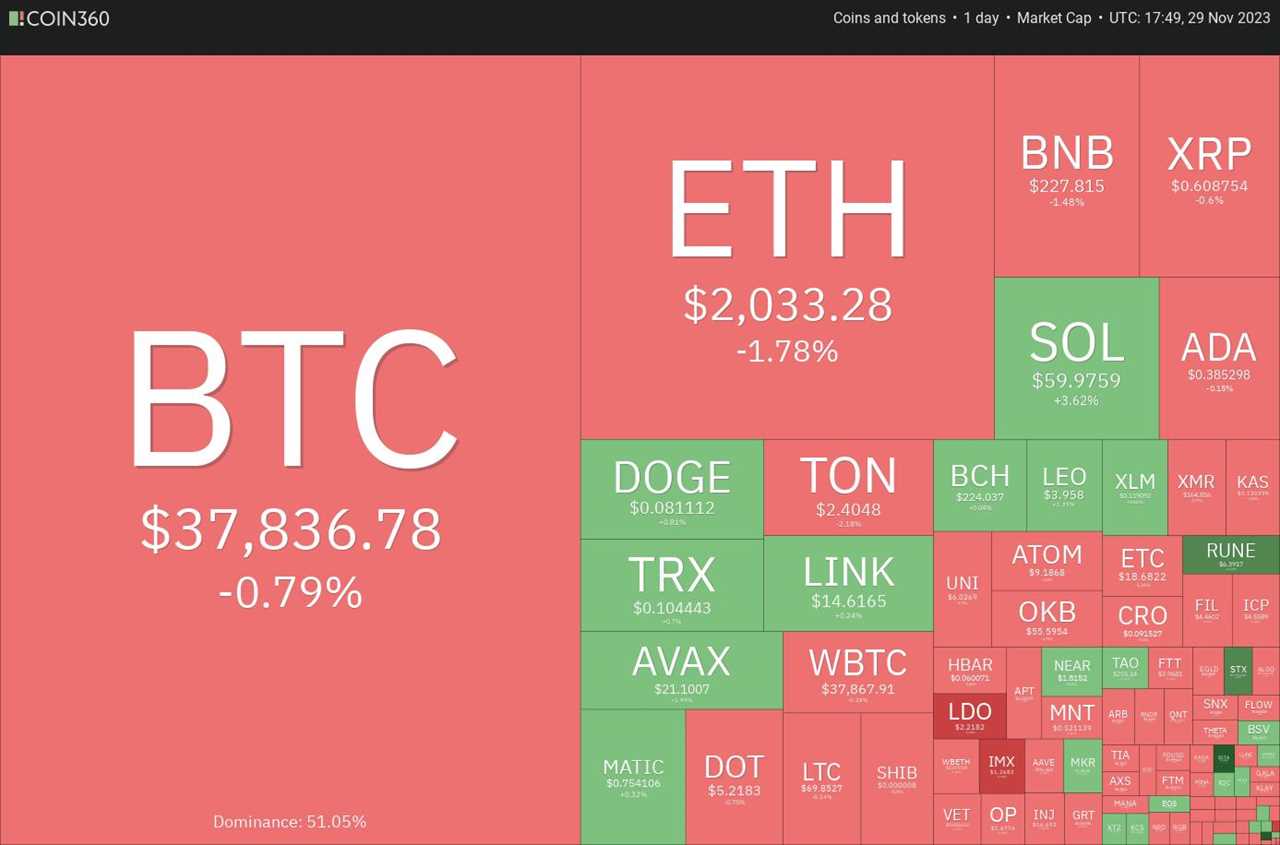

Bitcoin and Top 10 Cryptocurrencies: Chart Analysis

Let's analyze the charts of the top 10 cryptocurrencies to determine if they will resume their uptrend or experience a shallow correction.

Bitcoin Price Analysis

Bitcoin price rose above the $37,980 resistance but failed to close above it, indicating strong resistance from bears. Bulls need to sustain the price above the 20-day exponential moving average ($36,820) to improve the chances of a rally to $40,000.

Ether Price Analysis

Ether (ETH) found support at the 20-day EMA ($2,006), showing that buyers view dips as buying opportunities. If buyers can push the price above the resistance zone between $2,137 and $2,200, it may start a new uptrend with a target of $3,400.

BNB Price Analysis

BNB (BNB) held support at $223, indicating demand at lower levels. Bulls need to push the price above the 20-day EMA ($235) to initiate a meaningful recovery. Otherwise, a break below $223 may lead to a drop to $203.

XRP Price Analysis

XRP (XRP) has been indecisive, trading between moving averages. Buyers need to push the price above the 20-day EMA ($0.61) to rise to $0.67. On the other hand, a sharp decline below the 20-day EMA and the 50-day SMA ($0.58) may signal bearish control.

Solana Price Analysis

Solana (SOL) bounced back from the 20-day EMA ($54.71), indicating positive sentiment. Bulls need to overcome resistance at $62.10 to invalidate the head-and-shoulders pattern and start a sharp rally to $85. However, a break below $51 could lead to a deeper correction.

Cardano Price Analysis

Cardano (ADA) saw aggressive buying at the 20-day EMA ($0.38), suggesting potential for an upside breakout. If bulls push the price above $0.40, the ADA/USDT pair could gain momentum and climb to $0.46. A break below the 20-day EMA may lead to a fall to $0.34.

Dogecoin Price Analysis

Dogecoin (DOGE) found support at the 20-day EMA ($0.08), indicating buying at lower levels. With upsloping moving averages and positive RSI, the path of least resistance is to the upside. Buyers may aim for $0.09 and $0.10, while a break below the 20-day EMA may lead to a drop to $0.06.

Toncoin Price Analysis

Toncoin (TON) has been struggling to surpass the $2.59 resistance, suggesting weakening demand. Bears may attempt to pull the price below the moving averages, leading to a decline to $2 and $1.89. However, a break above $2.59 could start a new uptrend to $4.03.

Chainlink Price Analysis

Chainlink (LINK) found support at the 20-day EMA ($14.07), indicating strong defense from bulls. The LINK/USDT pair may face selling at $15.40, but a break above this level could lead to a challenge of the local high at $16.60 and a potential rally to $18.30.

Avalanche Price Analysis

Avalanche (AVAX) rebounded from the 20-day EMA ($19.35), indicating positive sentiment. Bulls need to overcome resistance at $22 to strengthen their position and potentially rally to $28.50. However, a turn down from $22 could favor bears, with a potential drop to $18.90.

Note: This article does not contain investment advice. Conduct your own research before making any investment decisions.