Bitcoin and Ether prices hit new multi-year low in August

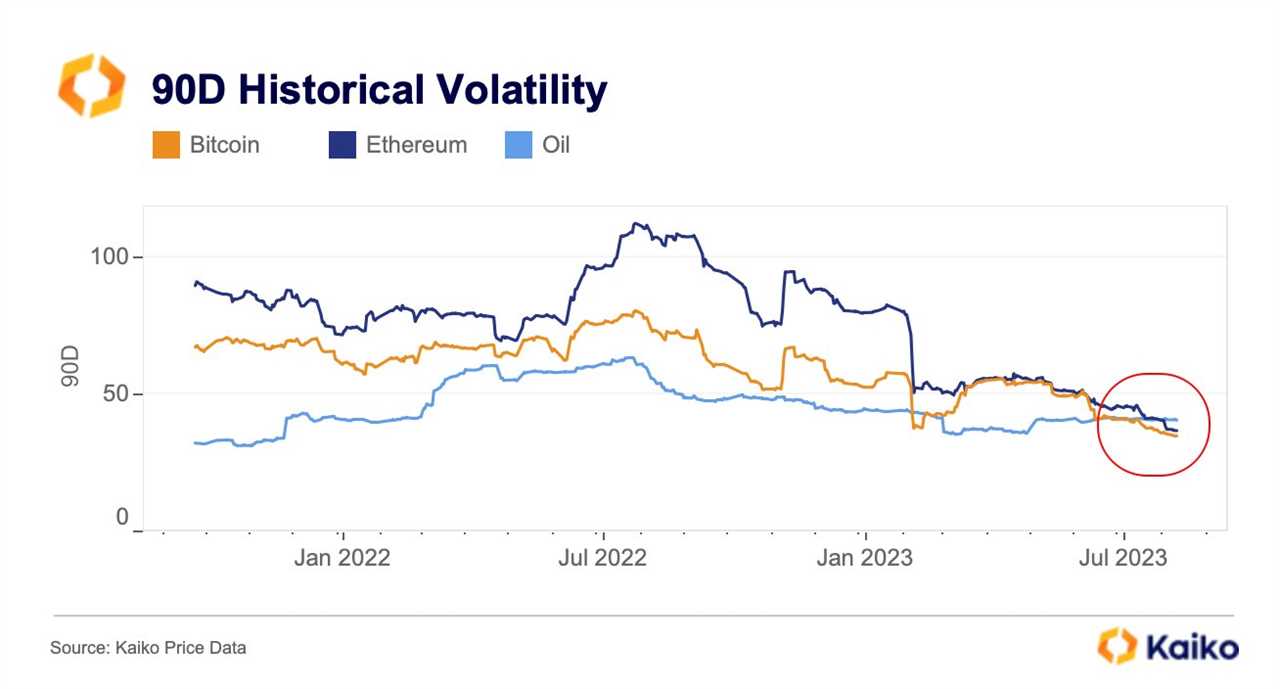

The 90-day price volatility of Bitcoin (BTC) and Ether (ETH) has reached a new multi-year low, according to data shared by crypto analytic firm Kaiko. Both cryptocurrencies have been trading below key resistance levels, with BTC below $30,000 and ETH below $2,000. The 90-day volatility of BTC and ETH is now 35% and 37% respectively, making them less volatile than oil, which has a volatility of 41%. This decline in price momentum is the lowest since 2016.

Bullish signs for the crypto ecosystem

August is typically considered a bullish month for the crypto ecosystem. The chart above shows that BTC and ETH price volatility is now more than half of what it was at the same time last year. This declining price fluctuation is seen as a positive indicator by many in the industry.

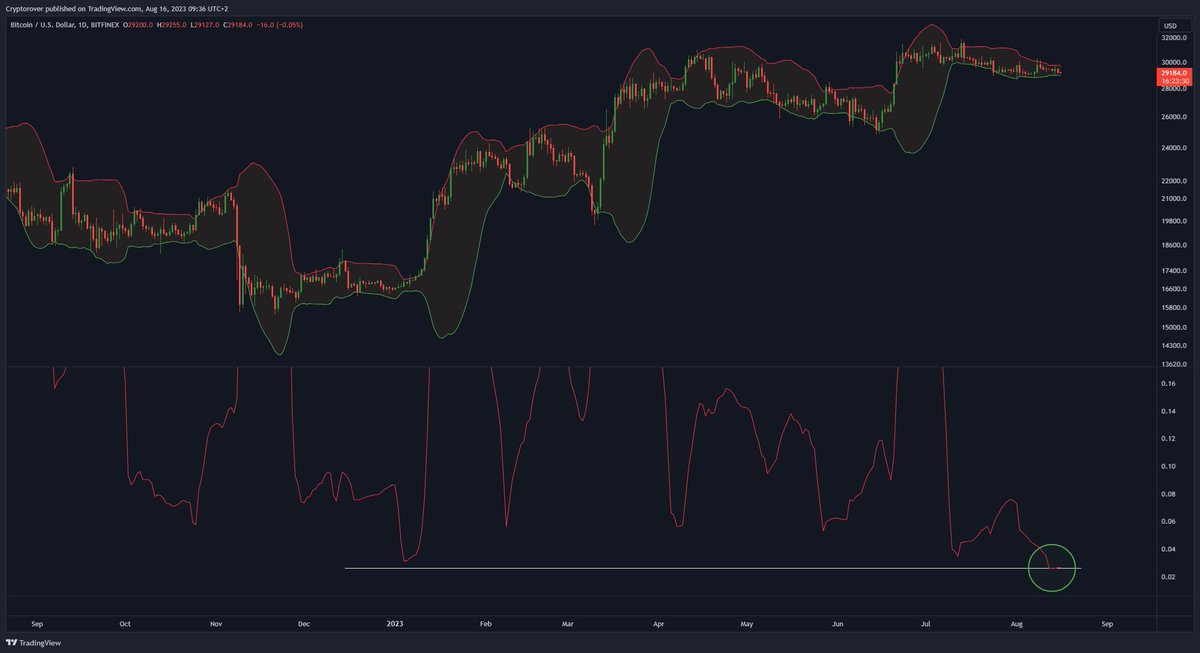

Lowest daily Bitcoin volatility in 5 years

In addition to the 90-day volatility hitting a multi-year low, the daily Bitcoin volatility is also at its lowest point in 5 years. This suggests a period of stability for the top cryptocurrency.

Predicting the next Bitcoin move

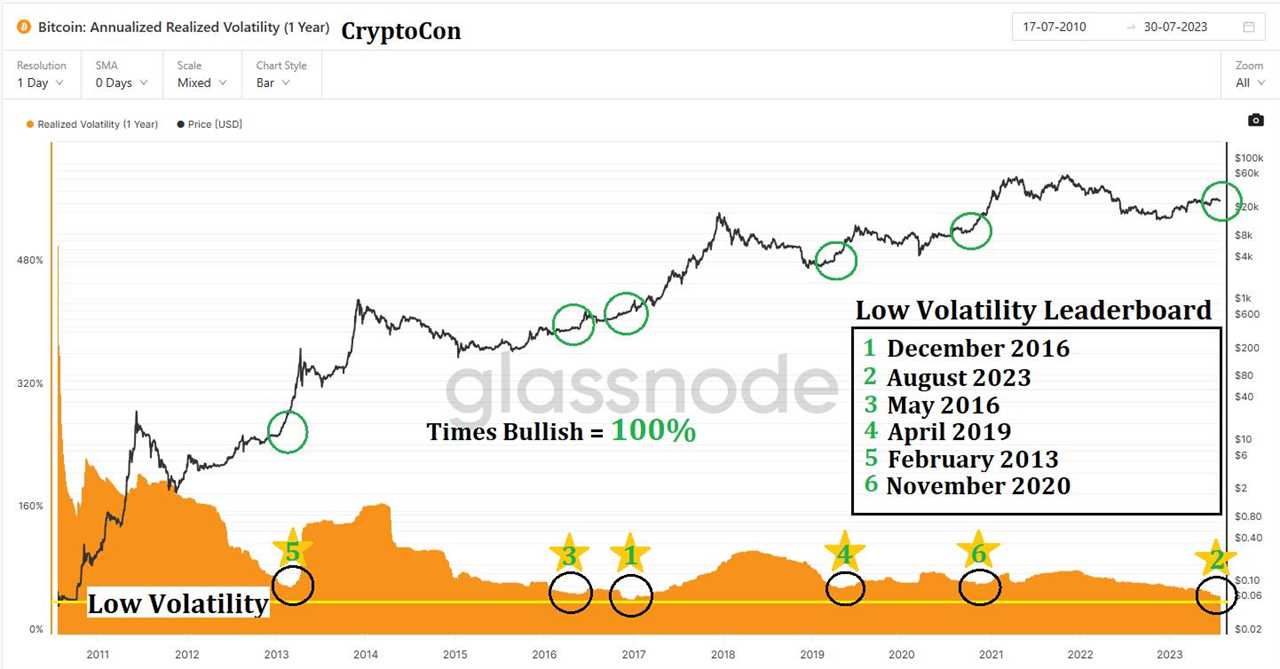

A Bitcoin technical analyst known as Cryptocon shared observations about the decline in Bitcoin price volatility on the social media platform X. He compared it to a similar cycle of low volatility in 2020 before the bull market took off. However, he cautioned against the sideways movement of the top cryptocurrency.

In 2020, BTC experienced a Black Swan event where the price fell over 50% in a day to below $5,000. But it quickly recovered the following month. When the price approached $10,000, volatility decreased again, leading to a period of sideways movement. After three months of low volatility, BTC broke out and reached new highs before encountering resistance and entering another period of sideways movement.

Based on this analysis, Cryptocon concluded that major periods of low volatility are often followed by significant price movements. He suggests that Bitcoin may soon experience a similar leap after the current period of low volatility, creating new highs against key resistance levels in the process.