BTC buyer interest remains low

Bitcoin (BTC) edged closer to $27,000 following the Wall Street open on August 30, as digital asset manager Grayscale secured a legal victory. However, Bitcoin analysts remain skeptical about the ongoing price rally.

According to data from Cointelegraph Markets Pro and TradingView, BTC price volatility cooled down after a 7.5% gain upon Grayscale's positive verdict against US regulators.

While Bitcoin briefly reached $28,143 on Bitstamp, its highest level in almost two weeks, it soon consolidated at a lower level. Analysts caution that despite closing the daily candle above key moving averages, these averages have yet to act as definitive intraday support.

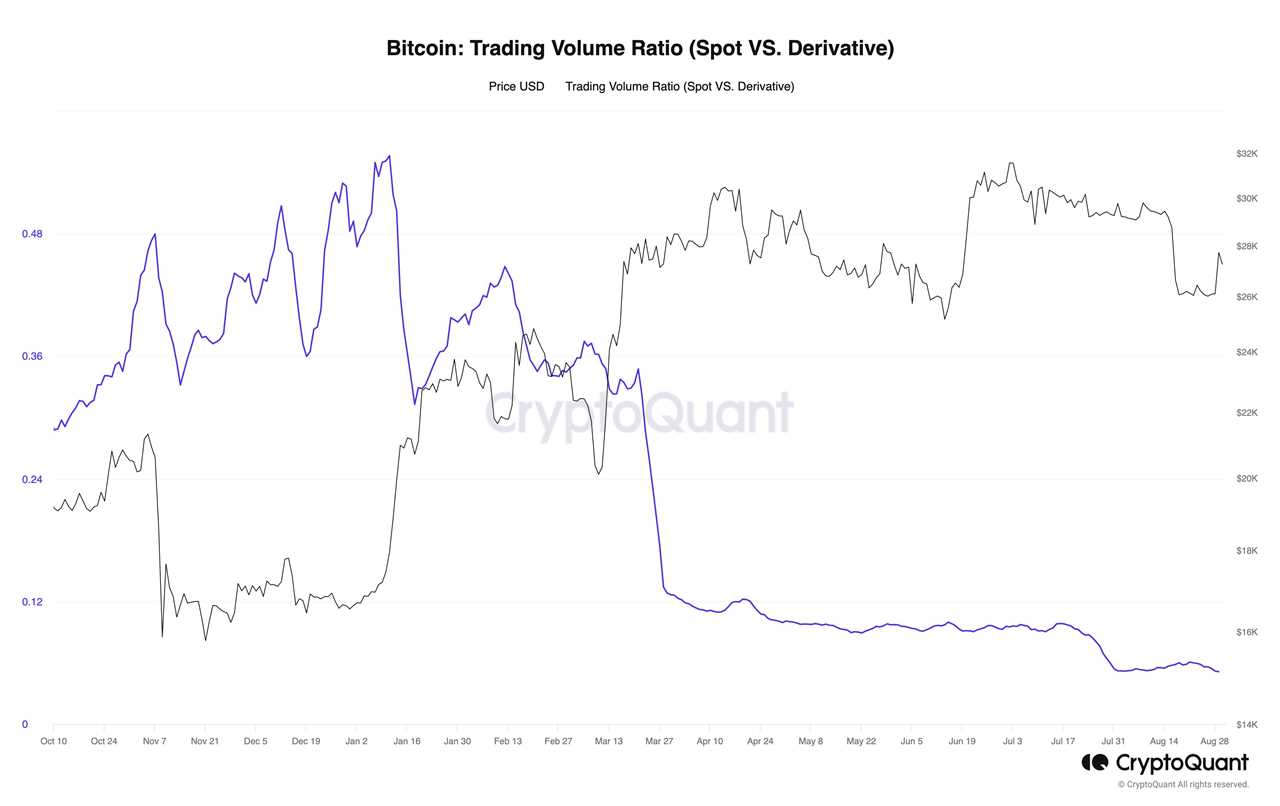

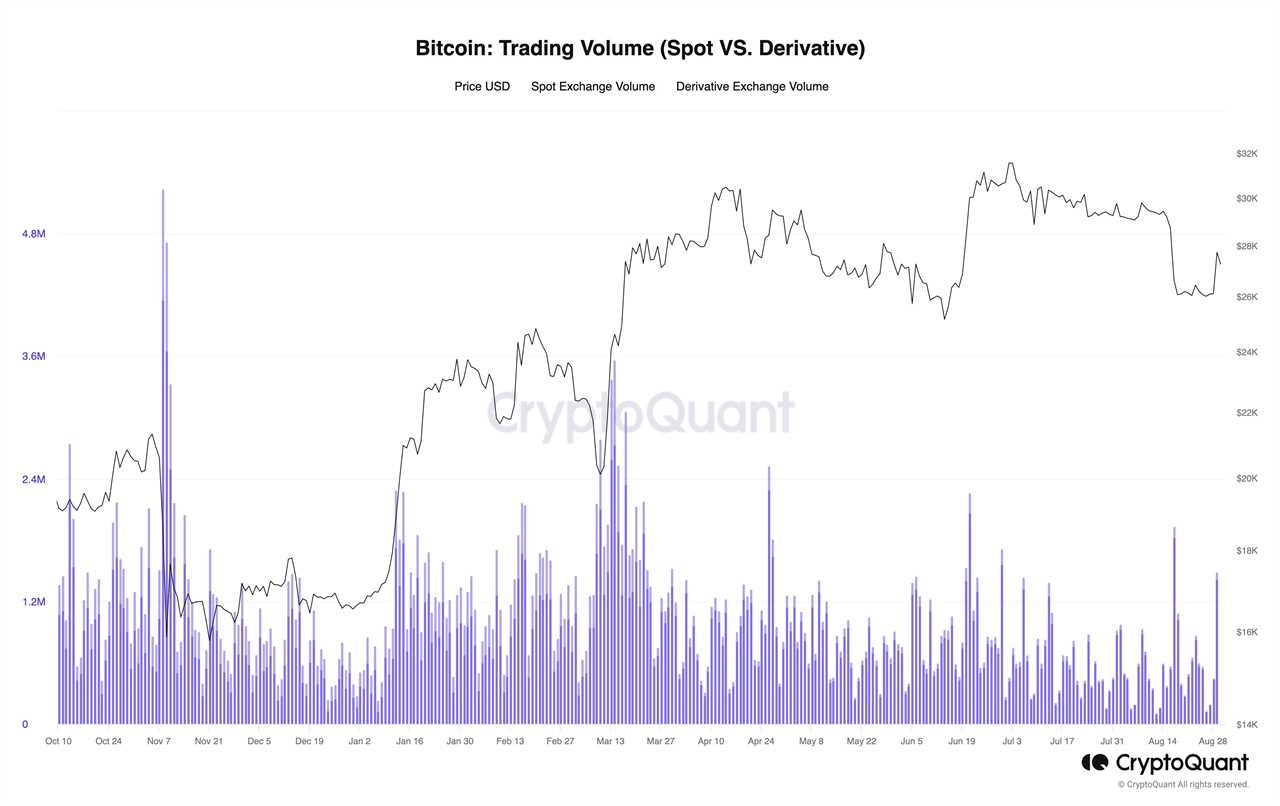

In a post on on-chain analytics platform CryptoQuant, contributor MAC_D pointed out that the Grayscale move originated on derivatives exchanges, with no significant buyer interest on spot markets.

"First, looking at the 'Funding Rate,' it is not an extreme value, so it is not expected to cause a sharp price correction," MAC_D wrote, indicating that the spot exchange did not drive the price increase. The Trading Volume Ratio (Spot VS. Derivative) also showed a decrease rather than an increase.

Additional data revealed that trading volumes remained below those seen during previous upticks in 2023. MAC_D added that the overall liquidity in the cryptocurrency market has decreased, making it necessary to be cautious about this rally leading to a significant price increase.

"Many similarities" to Bitcoin price all-time high

Popular trader and analyst Rekt Capital also expressed a conservative long-term outlook on Bitcoin. In a recent YouTube update, Rekt Capital noted similarities between BTC's current price action and the double top formation seen in 2021 around its all-time high.

Rekt Capital warned that if these similarities continue, BTC/USD could experience a full fractal pattern, with $26,000 switching from support to resistance and triggering further downside.

Prior to this, there were reports of a potential price bottom for BTC, with $23,000 gaining increasing significance. Rekt Capital identified $23,000 as a crucial level based on the inverse head and shoulders pattern from the 2022 bear market.

Please note that this article is not intended as investment advice or recommendations. Readers should conduct their own research before making any investment or trading decisions. All investment and trading moves involve risks.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/lenders-of-bankrupt-cryptocurrency-lender-genesis-not-satisfied-with-inprinciple-settlement-agreement