Some analysts argue that Bitcoin (BTC) rallied too fast and too soon and the weakness that we see today is a result of that. Currently, a new Covid variant has caused the Chinese government to implement severe restrictions on Shanghai and other major cities and persistent regulatory concerns continue to weigh down on sentiment within the crypto sector.

Another concerning development is the March 31 European Parliament's Committee on Economic and Monetary Affairs (ECON) vote to update the regulations in regards to exchange platforms’ ability to deal with noncustodial crypto wallets.

Should the regulatory project make it to the legislative phase in the upcoming months, it would place strict disclosure requirements on transactions for crypto exchanges in the European Union.

Not everything has been negative for Bitcoin because the cost of moving Bitcoin across the network has hit decade lows, according to research by Galaxy Digital. The Bitcoin median transaction fee has plummeted to 0.00001292 Bitcoin ($0.59) in 2022, the lowest in 11 years.

According to Glassnode on-chain analyst James Check, the "batching and Segwit is certainly part of the mix," because it increases the number of transactions that fit in a block.

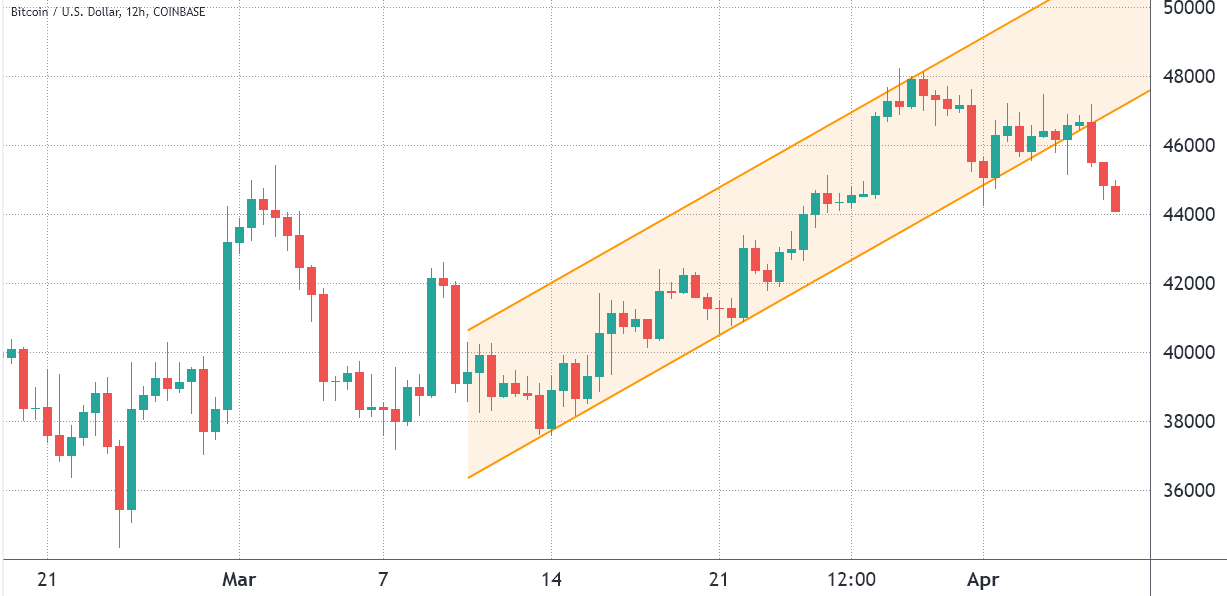

Bulls were taken by surprise

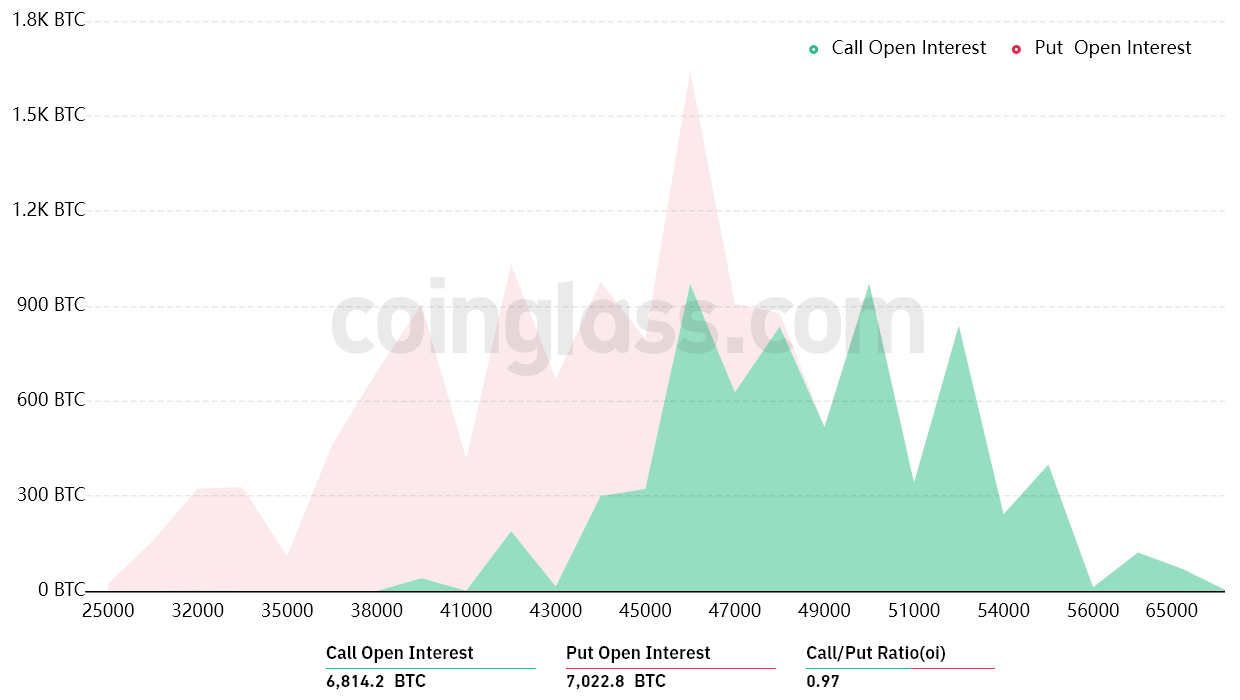

Bitcoin's drop below $45,000 on April 6 took bulls by surprise because only 8% of the call (buy) option bets for April 8 have been placed below this price level.

Bulls might have been fooled by the recent attempt to overtake $48,000 on March 29 and this is shown in their bets for Friday's $610 million options expiry that go all the way to $65,000.

A broader view using the 0.97 call-to-put ratio shows balanced bets between the $300 million call (buy) open interest stands and the $310 million put (sell) options. Now that Bitcoin is now back below $45,000, most of these bullish bets will become worthless.

For example, if Bitcoin price remains below $45,000 at 8:00 am UTC on April 8, only $24 million worth of these call (buy) options will be available. This difference happens because there is no use in a right to buy Bitcoin at $50,000 if it trades below this level at expiry.

Bears are aiming for a $145 million profit

Listed below are the four most likely scenarios based on the current price action. The number of options contracts available on April 8 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side makes up the theoretical profit:

- Between $42,000 and $44,000: 250 calls vs. 3,650 puts. The net result favors the put (bear) instruments by $145 million.

- Between $44,000 and $45,000: 550 calls vs. 2,800 puts. The net result favors bears by $100 million.

- Between $45,000 and $46,000: 700 calls vs. 2,150 puts. The net result benefits put (bear) options by $60 million.

- Between $46,000 and $47,000: 1,800 calls vs. 1,500 puts. The net result is balanced between call (buy) and put (sell) instruments.

This crude estimate considers the call options used in bullish bets and the put options exclusively in neutral-to-bearish trades. Even so, this oversimplification disregards more complex investment strategies.

For instance, a trader could have sold a put option, effectively gaining positive exposure to Bitcoin above a specific price, but unfortunately, there is not an easy way to estimate this effect.

Related: Scaramucci sees bright future for crypto but ‘very worried’ about US politicians

Bears have incentives to suppress Bitcoin price

Bitcoin bears need to push the price below $44,000 on April 8 to secure a $145 million profit. On the other hand, the bulls' best case scenario requires a 4.3% gain from the current $44,200 to $46,000 zone to balance the scales.

Bitcoin bulls had $65 million in leveraged long positions liquidated on April 6, so they probably have fewer resources to push the price higher in the short term. With this said, bears will likely try to suppress BTC below $45,000 before the April 8 options expiry.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: Bears have a $100M reason to keep Bitcoin price under $45K until Friday’s options expiry

Sourced From: cointelegraph.com/news/bears-have-a-100m-reason-to-keep-bitcoin-price-under-45k-until-friday-s-options-expiry

Published Date: Thu, 07 Apr 2022 21:14:39 +0100