Crypto firm Bakkt has announced that it is shifting its focus back to digital asset custody and will be adding support for six new coins. In addition to Bitcoin (BTC) and Ether (ETH), Bakkt will now offer custodial support for Bitcoin Cash (BCH), Dogecoin (DOGE), Ethereum Classic (ETC), Litecoin (LTC), Shiba Inu (SHIB), and USD Coin (USDC). The company plans to add more coins to its custodial services in early 2024.

Importance of Custody Services

The custody of digital assets is crucial for safeguarding cryptographic keys that enable access and transfer of assets. Bakkt, like other custodians, employs various security measures such as cold storage of coins and multisignature technology that requires multiple approvals for access.

Quarterly Earnings Report and Partnerships

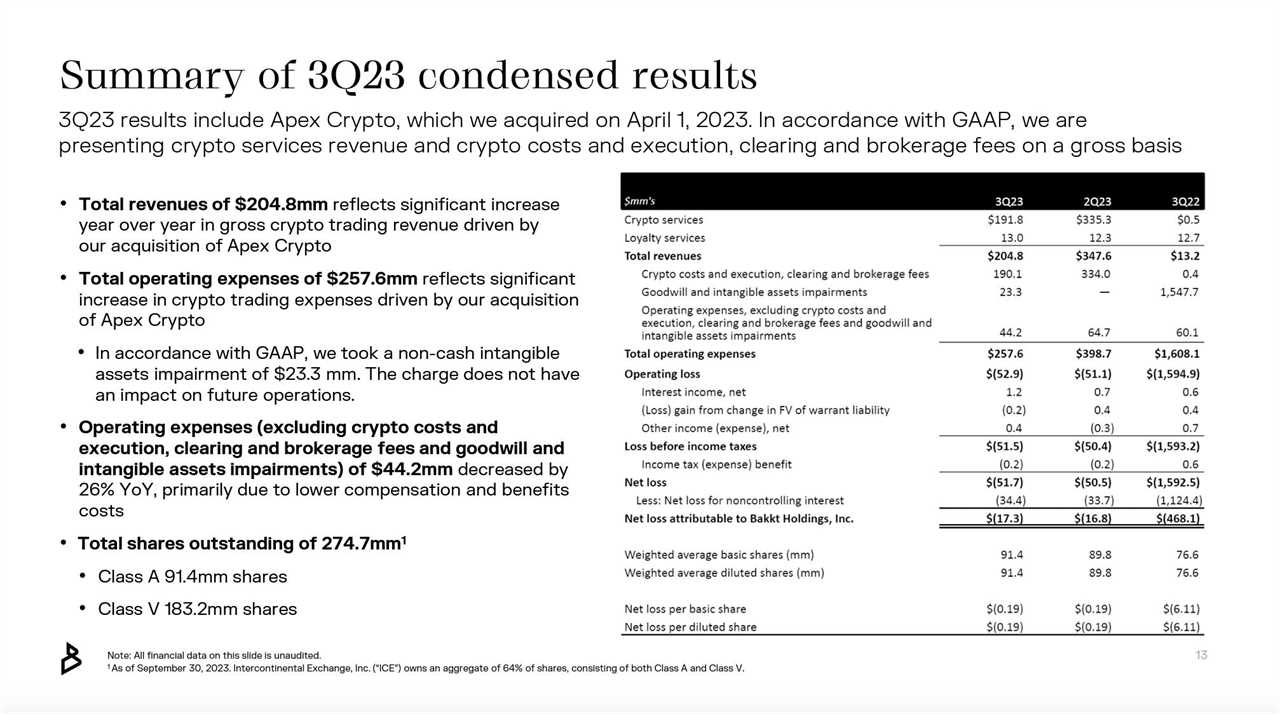

Bakkt recently released its quarterly earnings report, revealing an adjusted EBITDA loss of $21.6 million, a 30% decrease year-over-year. The company attributed the decrease to a reduction in compensation and benefits. However, Bakkt's crypto revenue reached $191.8 million in the third quarter of 2023, thanks to its acquisition of Apex Crypto earlier this year. Bakkt also reported $505.7 million in assets under custody, a decrease of 28% compared to the previous year.

To strengthen its crypto custody arm, Bakkt is developing partnerships. It plans to offer clearing and custodial services for the Wall Street-backed crypto exchange EDX Markets and has already onboarded new clients such as Bitcoin platform Unchained and LeboBTC, a crypto consulting firm for institutional investors.

Targeting Business-to-Business Clients

Bakkt's expansion of custody services is part of its strategy to target business-to-business clients. Earlier this year, the company announced that it would sunset its consumer-facing app to focus on institutions. This move aligns with the trend among traditional financial institutions, such as BNY Mellon and DZ Bank, who have also entered the digital asset custody space to cater to institutional investors.

"The events of the past year have revealed why qualified crypto custody is so necessary," said Gavin Michael, CEO of Bakkt.