Investment firm ARK Invest, led by Bitcoin advocate Cathie Wood, has made a significant purchase of Robinhood stock.

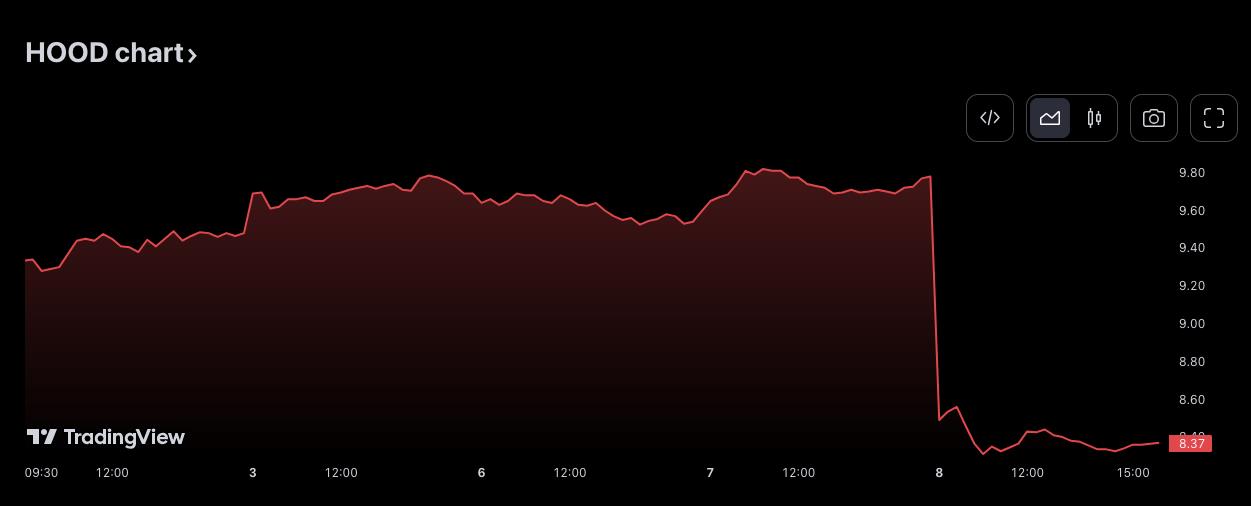

ARK Invest, the investment firm founded by major Bitcoin (BTC) advocate Cathie Wood, is actively accumulating stock of the crypto-friendly app Robinhood (HOOD). On Nov. 8, ARK made a massive Robinhood stock purchase, bagging a total of 1.1 million shares for about $9.5 million in one day, according to a trade notification seen by Cointelegraph.

Three ARK-managed ETFs involved in the purchase

The purchase involved three innovation exchange-traded funds (ETF) managed by ARK, including ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF). ARKK has allocated the biggest amount of shares in the purchase, buying 888,500 HOOD shares, or 78% of the entire daily buy. ARKW and ARKF allocated 152,849 shares and 99,697 shares, respectively.

Continued buying as Robinhood plans European expansion

The mega purchase followed steady Robinhood equity-buying by ARK, though the most recent purchases involved significantly smaller amounts. On Oct. 23, ARK purchased 197,285 Robinhood shares for its ARKW funds, following a 259,628 HOOD buy on the previous day. The latest buy came as Robinhood on Nov. 8 disclosed plans to expand into Europe in the coming weeks, particularly exploring establishing brokerage operations in the United Kingdom.

ARK sells Grayscale Bitcoin Trust shares

While actively buying Robinhood, ARK has continued to sell Grayscale Bitcoin Trust (GBTC) shares, with ARKW dumping another 48,477 GBTC for $1.4 million on Nov. 8. ARK started selling GBTC shares in late October 2022, following a year's break from touching the GBTC stock. Since Oct. 24, ARK has sold a total of 427,573 GBTC shares, worth about $11.9 million at the time of writing.

Launch of new ETFs focused on Bitcoin and Ether futures contracts

ARK has concurrently announced the launch of new ETFs focused on Bitcoin and Ether futures contracts in collaboration with its major crypto ETF partner, 21Shares. According to joint prospectuses, the firms expect to launch trading of five new crypto products on the Chicago Board Options Exchange on by Nov. 16.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/maine-state-treasurer-aims-to-manage-abandoned-cryptocurrency-accounts