Despite concerns that Bitcoin Ordinals are clogging the network, there is little evidence to suggest inscriptions are taking blockspace away from higher-value Bitcoin (BTC) monetary transfers.

Minimal Evidence of Displacement

According to on-chain analytics firm Glassnode, there is minimal evidence that inscriptions are displacing monetary transfers. This is likely because inscription users tend to set low fee rates, expressing willingness to wait longer periods of time for confirmation. Glassnode explains that inscriptions appear to be buying and consuming the cheapest available blockspace, and are readily displaced by more urgent monetary transfers.

Inscriptions vs Mining Fees

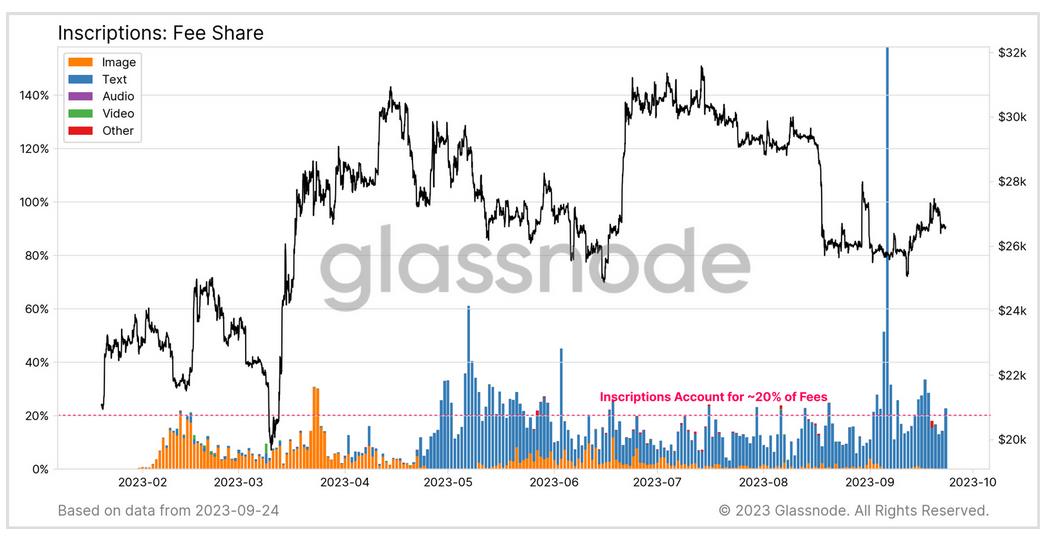

Bitcoin Ordinals were introduced in February 2023, and have since accounted for the majority of network activity in terms of daily transaction count. However, this hasn’t necessarily been reflected in its share of mining fees. Inscriptions only account for about 20% of Bitcoin transaction fees, according to Glassnode.

More Revenue, But a Catch

While inscriptions have increased the base-load demand for blockspace and boosted fees for miners, Glassnode notes that Bitcoin’s hashrate has also increased by 50% since February. This has led to tougher competition among miners for revenue fees. Glassnode warns that unless BTC prices increase in the near term, miners may face income stress as a result of extreme competition and the upcoming halving event.

The Future of Inscriptions

Currently, most inscriptions come from BRC-20 tokens, introduced one month after Casey Rodamor launched the Ordinals protocol on Bitcoin in February. However, on September 25, Rodarmor proposed "Runes" as a potential alternative to BRC-20s. He suggested that a UTXO-based fungible token protocol would not leave as much "junk" unspent transaction outputs on the Bitcoin network.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/crypto-lender-blockfi-gets-court-approval-to-repay-customers