On Jan. 29 Bitcoin (BTC) price briefly rallied to $38,500 before retracing the move and spending the majority of the day struggling to reclaim $35,000.

The wild breakout in Bitcoin price has partially been attributed to Elon Musk changing his Twitter profile to simply “#Bitcoin,” which Musk subsequently followed up with a cryptic tweet saying “In retrospect, it was inevitable.”

Dogecoin (DOGE) also continued to make waves across Twitter and with crypto traders. After reaching a new all-time high at $0.078 on Jan. 28, DOGE price corrected by 41% before rebounding to trade at $0.045.

Developments related to DOGE and r/Wallstreetbets led FTX crypto exchange to create a Wall Street Bets (WSB) index which tracks the price of Nokia (NOK), BlackBerry (BB), AMC Theaters (AMC), GameStop (GME), Silver (SLV), DOGE, and the FTX Token (FTT) using a weighted average of their prices.

The exploits of the popular Reddit group have also not gone unnoticed by the United States Securities and Exchange Commission, which announced that it will be taking a closer look at how Robinhood handled the trading of GME stock on its platform.

Bitcoin price holds strong despite miners selling

Despite the recent volatility, institutional investors continue to show an increased interest in Bitcoin and are willing to pay a premium to get exposure to CME’s Bitcoin futures contracts.

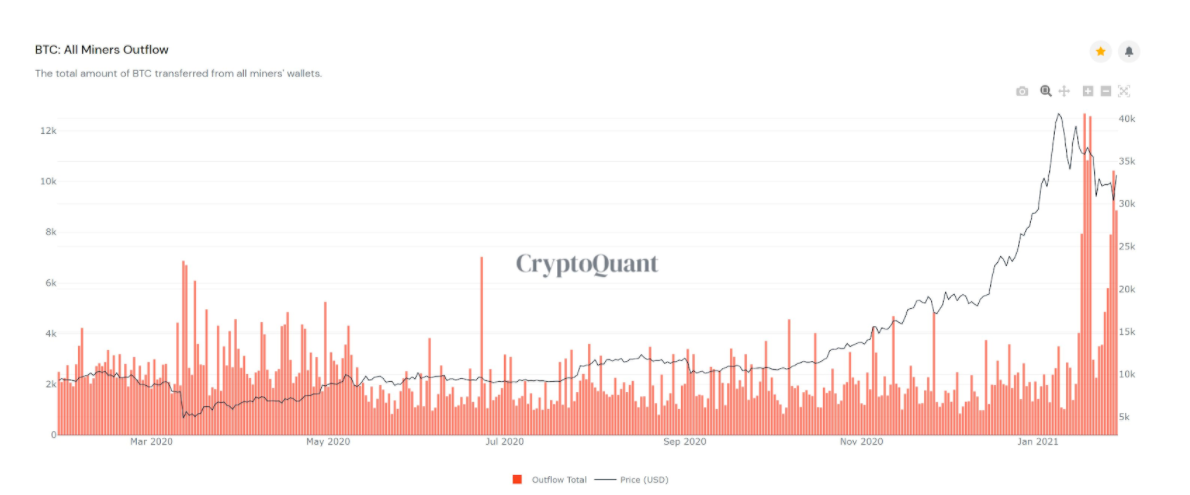

Even selling pressure from Bitcoin miners, who have been selling at levels not seen since BTC price topped out at $14,000 in July 2019, has not been able to satisfy increasing demand. Unlike previous years, mass selling from miners is not negatively affecting the long-term price of BTC, as shown by data from CryptoQuant.

According to Lennard Neo, the head of research at Stack Funds, the current miner sell-off is likely to continue in the near-term due to the upcoming Chinese New Year holiday.

Neo said:

“Miners are increasingly exiting their positions as the holiday approaches. This also suggests that the floor price for which miners are comfortable holding Bitcoins has yet to be found and we expect this volatility to persist in the coming weeks.”

Growing interest from institutions and the emergence of DeFi are big drivers of Bitcoin price growth. As the market heads into the Chinese New Year holiday, the key level of support to watch is now $34,000 while a move higher is likely to face resistance at $38,000.

The $4.9 billion worth of BTC futures that expired on Jan. 29 appears to have little effect on the market as this past week’s Robinhood ordeal is bringing more attention to the cryptocurrency industry.

The traditional markets faced a new wave of pressure which led to the worst weekly performance for the S&P 500. The Dow, NASDAQ and S&P 500 all finished the day negative, down 2.03%, 2.0% and 1.93% respectively.

Altcoins show signs of growth

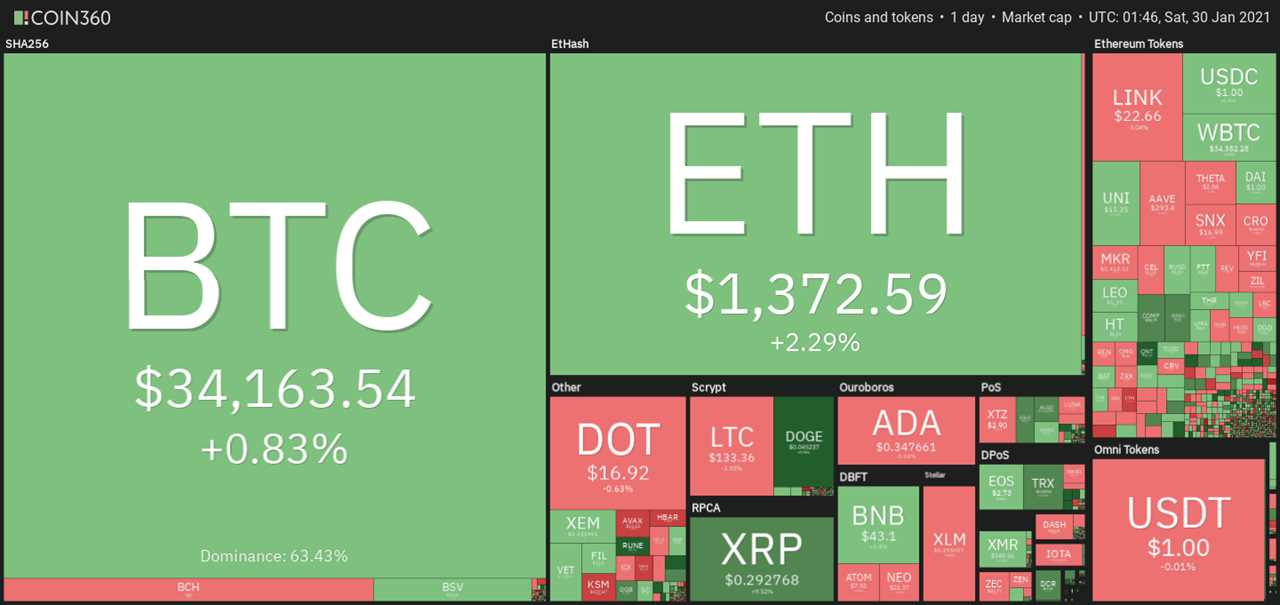

While Bitcoin price struggled to hold the $34,000 level, DOGE made its way into the top-10 and a number of altcoins saw bullish breakouts.

XRP and Stellar (XLM) have both rose by roughly 9% in the past 24-hours, while Voyager Token (VGX) continued to climb higher, currently up 70% and trading at $1.77.

The overall cryptocurrency market cap now stands at $1.01 trillion and Bitcoin’s dominance rate is 63.5%.

Title: Analyst says Bitcoin price sell-off may occur as Chinese New Year approaches

Sourced From: cointelegraph.com/news/analyst-says-bitcoin-price-sell-off-may-occur-as-chinese-new-year-approaches

Published Date: Sat, 30 Jan 2021 01:49:05 +0000