CoinFLEX Creditors Accuse OPNX of Using Assets Without Consent

Several creditors of cryptocurrency futures exchange CoinFLEX are claiming that OPNX, a new crypto exchange co-founded by Kyle Davies and Su Zhu of Three Arrows Capital, was established using CoinFLEX assets without their permission. Creditors have filed a writ of summons in the High Court of Hong Kong, alleging that former CoinFLEX CEO Mark Lamb misappropriated assets and diverted them to OPNX, thereby harming the interests of CoinFLEX creditors.

Accusations Against Mark Lamb

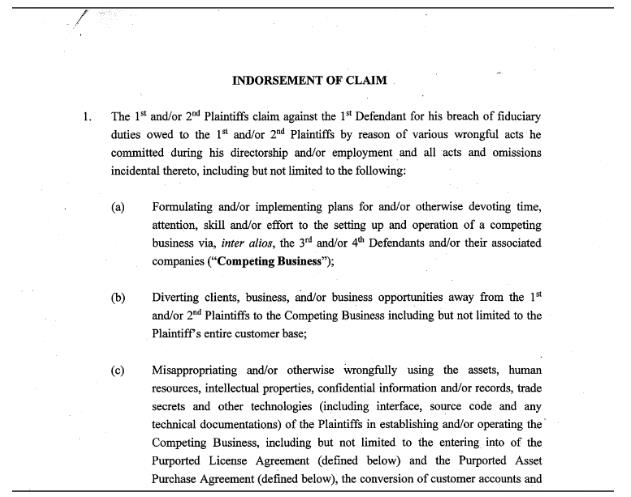

According to the writ of summons, Mark Lamb allegedly used CoinFLEX's assets, human resources, intellectual properties, trade secrets, and other technologies to set up OPNX while still being employed as the CEO of CoinFLEX. The document claims that Lamb diverted clients and business opportunities to OPNX, misappropriated assets belonging to the creditors, and disclosed confidential trade secrets to third parties. Furthermore, Lamb is accused of soliciting employees and contractors to move to OPNX and forging a fake nondisclosure agreement.

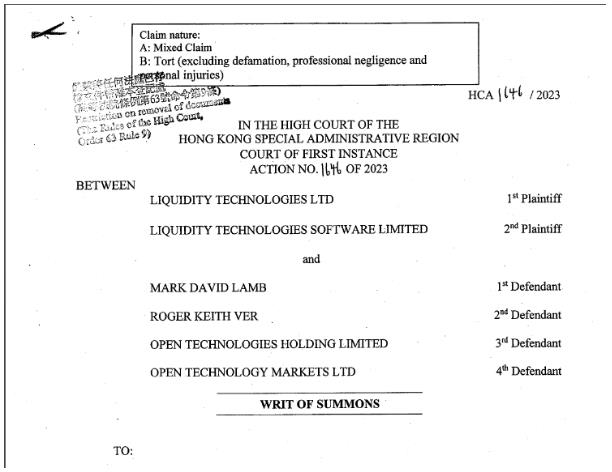

Legal Action in Hong Kong

CoinFLEX's terms of service required users to settle disputes through arbitration in Hong Kong, which is why the creditors have taken legal action in the High Court of Hong Kong. The allegations have not been proven in court. The plaintiffs listed in the document are Liquidity Technologies and Liquidity Technologies Software, the Seychelles-based legal entities associated with CoinFLEX. The defendants include Mark Lamb, crypto investor Roger Ver, Open Technologies Holdings, and Open Technology Markets, which are claimed to be associated with OPNX.

Leaked Pitch Deck and Controversy

In January, a leaked pitch deck for OPNX confirmed the involvement of Kyle Davies, Su Zhu, Mark Lamb, and Sudhu Arumugam as co-founders. However, critics have questioned the credibility of OPNX founders, given their previous involvement in losing millions, if not billions, of dollars in customer assets. Despite the criticism, OPNX argued that it would benefit creditors of bankrupt firms by allowing them to sell their claims on the exchange for quick cash.

Allegations from CoinFLEX Creditors

A CoinFLEX creditor, identified as "Kirill," claimed to have lost a significant amount of money when CoinFLEX stopped processing withdrawals. After forming an ad hoc creditor committee, Kirill and other creditors discovered Mark Lamb's alleged actions against their interests. They filed a Writ of Summons and obtained an injunction against Lamb, stating that he cannot make decisions for CoinFLEX without the board's majority consent.

Tender Offer and Legal Dispute

The official OPNX account posted a "Creditor Tender Offer" to CoinFLEX stakeholders, offering them equity in OPNX and tokens. However, Kirill argued that the offer lacks legal validity and necessary financial information for investors to make informed decisions. CoinFLEX also accused Roger Ver of defaulting on a written margin agreement, leading to the exchange's inability to process withdrawals.

Response from OPNX and Current Operations

A spokesperson for OPNX declined to comment on the allegations. Since its launch, OPNX has developed a credit currency for margin trading called "oUSD" and obtained a license for spot trading throughout the EU. According to Coingecko, OPNX currently processes significant daily volumes in spot trading and derivatives.

Criminal and civil proceedings against OPNX co-founders Kyle Davies and Su Zhu are still ongoing.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/ftxs-ftt-token-surges-30-is-it-due-to-the-binance-effect-or-ftx-20-reopening