Bitcoin, the world's most popular cryptocurrency, experienced a sudden and significant price drop on August 18. In just 10 minutes, the price of Bitcoin plummeted by over 8%, causing a ripple effect across the wider cryptocurrency market. The crypto community has been left puzzled, with no clear consensus on the cause of this dramatic dip. However, several market analysts have put forward their theories on what may have triggered the decline.

SpaceX's Bitcoin Sale and Interest Rate Fears

One theory proposed by eToro market analyst Josh Gilbert suggests that the drop in Bitcoin's price could be attributed to a report indicating that Elon Musk's SpaceX may have sold its Bitcoin holdings, amounting to $373 million. The report was published online approximately 2.5 hours before the sudden price plunge. Gilbert also highlights the possibility that the broader market's expectations of future interest rate hikes from the U.S. Federal Reserve could have negatively impacted sentiment, leading to the sell-off.

Government Bond Yields

Market analyst Tina Teng from CMC Markets has a different perspective, pointing to the recent increase in government bond yields as the underlying factor behind the sell-off. Typically, rising bond yields signify reduced liquidity in the broader market. Teng suggests that this could be the primary reason for the decline in cryptocurrencies. While Teng acknowledges that the Evergrande crisis may have influenced sentiment toward the Chinese economy and investors, she does not view it as a direct cause of the downturn.

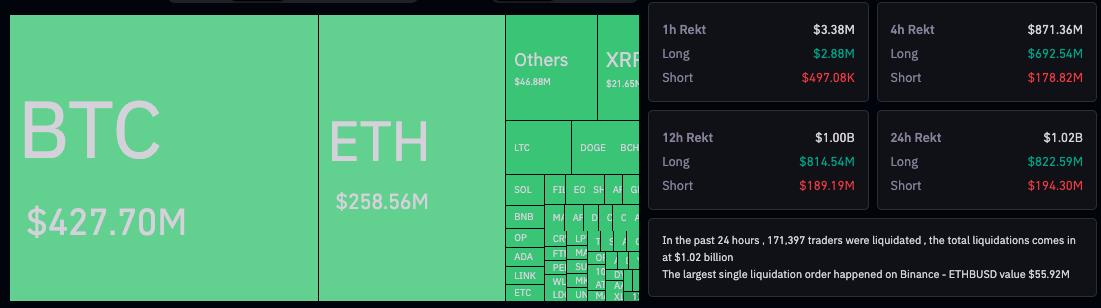

Large-Scale Selling by Whales

Pseudonymous derivatives trader @TheFlowHorse suggests that a single large player making a significant sell-off could have triggered the sudden downward movement in Bitcoin's price. Subsequently, this may have further intensified pressure on derivatives. Data from crypto analytics platform Coinglass reveals that over $822 million worth of liquidations occurred in the past 24 hours amongst traders with open long positions. The decline, according to @TheFlowHorse, could have been strategically timed with reports of the SEC's potential approval of an Ethereum Futures ETF, indicating that a large fund may have offloaded their Bitcoin to provoke a shift toward buying ETH.

Recovery and Positive News

Since the crash, Bitcoin has managed to recover slightly, with a 1.2% gain in the last two hours. At the time of publication, its price stands at $26,619. This recovery may be attributed to news suggesting that the SEC is considering approving an Ethereum Futures ETF product as early as October.

If you're interested in learning more about the risks associated with crypto exchanges, check out our in-depth article: "What do crypto exchanges really do with your money?"

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoins-price-plummets-to-twomonth-lows-brief-dip-below-26k