The bull market is gone and the reality of a long crypto winter is surely giving traders a bad case of the shivers. Bitcoin’s (BTC) price has fallen to lows not even the bears expected, and some investors are likely scratching their heads and wondering how BTC will come back from this epic decline.

Prices are dropping daily, and the current question on everyone’s mind is: “when will the market bottom and how long will the bear market last?”

While it’s impossible to predict when the bear market will end, studying previous downtrends provides some insight into when the phase is coming to a close.

Here’s a look at five indicators that traders use to help know when a crypto winter is coming to a close.

The crypto industry begins to recover

One of the classic signs that a crypto winter has set in is widespread layoffs across the crypto ecosystem as companies look to trim expenses to survive the lean times ahead.

News headlines throughout 2018 and 2019 were filled with layoff announcements from major industry players, including technology companies like ConsenSys and Bitmain, as well as crypto exchanges like Huobi and Coinfloor.

The recent rash of layoff announcements such as the 18% reduction in staff for Coinbase and a 10% cut at Gemini are concerning, and given that the current bear market just started, layoffs are likely to crescendo. This means that it’s probably too early to refer to this metric as proof that the bear market is in decline.

A good sign that a crypto spring is approaching is when companies begin to hire again and new projects launch with notable funding announcements. These are indications that funds are beginning to flow back into the ecosystem and the worst of the bear market is in the past.

Watch to see if Bitcoin’s 200 week SMA becomes resistance or support

A technical development that has signaled the end of a bearish period multiple times in Bitcoin’s history is when the price falls below the 200-week simple moving average (SMA) and then climbs back above it.

As shown in the areas highlighted by purple arrows on the chart above, previous instances where the price of BTC dipped below the 200-week SMA, the light blue line, and then climbed back above the metric preceded uptrends in the market.

A solid BTC price recovery back above the realized price, which is the aggregate purchase price of all Bitcoin and is represented by the green line in the chart above, can also be used as an added confirmation that the market trend may be turning positive as well.

The RSI is king at calling bottoms

Another technical indicator that can offer insight into when the lows of a bear market may be in is the relative strength index (RSI).

More specifically, previous bear markets have seen the Bitcoin RSI drop into oversold territory and fall below a score of 16 around the time that BTC established a low.

Based on the two instances highlighted above with orange circles, the confirmation that the low is in doesn’t come until the RSI climbs back above 70 into overbought territory, signaling that an increase in demand has once again returned to the market.

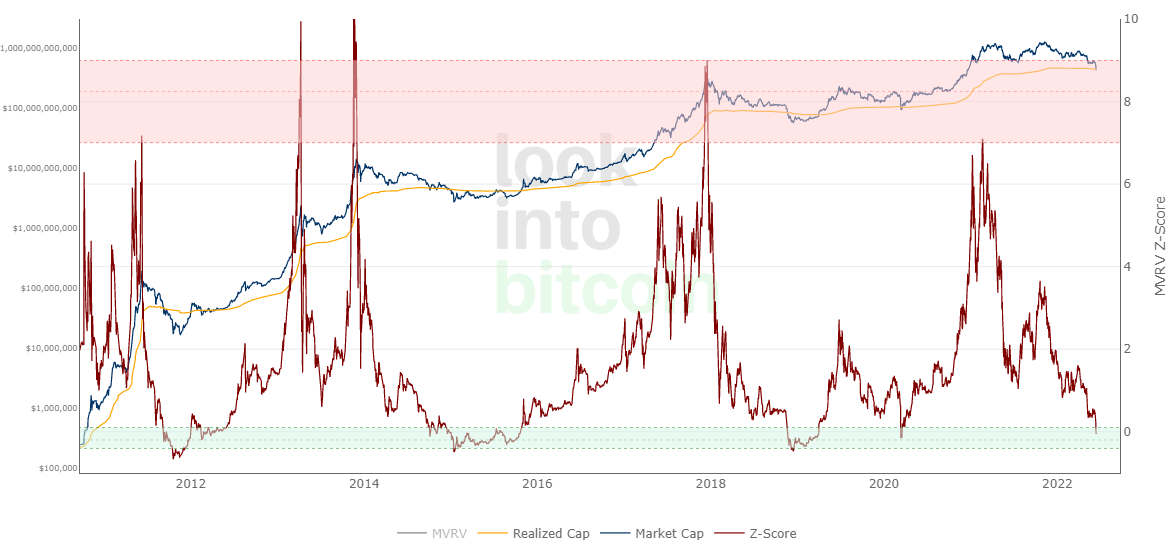

Market value to realized value

The market value to realized value (MVRV) Z-score is a metric that is designed to “identify periods where Bitcoin is extremely over or undervalued relative to its ‘fair value.’”

The blue line on the chart above represents the current market value of Bitcoin, the orange line represents the realized price and the red line represents the Z-score which is a “standard deviation test that pulls out the extremes in the data between market value and realized value.”

As seen on the chart, previous bear markets coincided with a Z-score below 0.1, which is highlighted by the green box at the bottom. The start of a new uptrend wasn’t confirmed until the metric climbed back above a score of 0.1.

Based on the historical performance, this metric suggests that there could still be more downside in the near future for Bitcoin, followed by an extended period of sideways price action.

Related: Three Arrows Capital weighs bailout as Kyle Davies breaks silence: Report

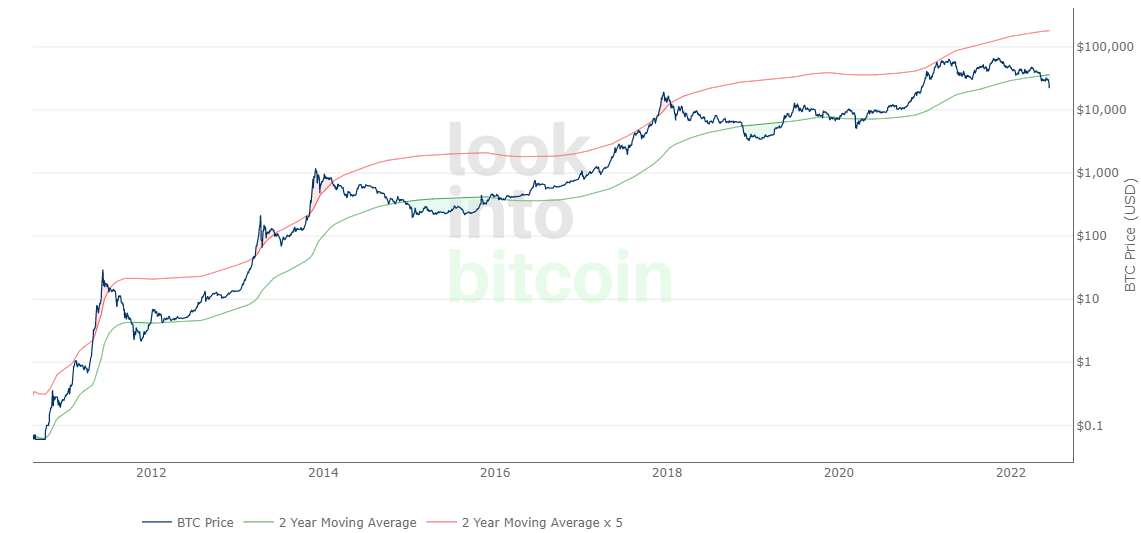

2-year moving average multiplier

A final metric that can offer a simplified way for Bitcoin investors to know when the bear market is over is the 2-year moving average multiplier. This metric tracks the 2-year moving average and a 5x multiplication of the 2-year moving average (MA) with Bitcoin’s price.

Anytime the price of BTC fell below the 2-year MA, the market entered bear market territory. Once the price climbed back above the 2-year MA, an uptrend would ensue.

On the flip side, the price climbing above the 2-year MA x5 line signaled a full-on bull market and presented an opportune time to take profits.

Traders can use this metric as a signal of when it might be a good time for accumulation, as highlighted by the green shaded areas, or they can wait until the price of BTC clears the 2-year as a signal that the bear market is over.

Whichever way a trader chooses to apply the indicators outlined above, it’s important to remember that no indicator is perfect and there is always a risk of more downside.

Want more information about trading and investing in crypto markets?

- Crypto users take to Twitter to lament the ongoing market downturn

- Binance CEO plans to leverage crypto winter

- Almost $100M exits US crypto funds in anticipation of hawkish monetary policy

- How to survive in a bear market? Tips for beginners

- Large Bitcoin liquidations mean one man’s pain is another man’s pleasure — Time to buy the dip?

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: 5 indicators traders can use to know when a crypto bear market is ending

Sourced From: cointelegraph.com/news/5-indicators-traders-can-use-to-know-when-a-crypto-bear-market-is-ending

Published Date: Fri, 17 Jun 2022 22:00:00 +0100