Bitcoin (BTC) received a substantial boost this week as the U.S. inflation levels for February came along the lines of market expectations. On March 14, the BTC/USD pair surged to a new 2023 peak at $26,550 after the news.

But while the macroeconomic conditions mat currently be favoring risk-on buyers, certain on-chain and market indicators hint at a potential correction in the near term.

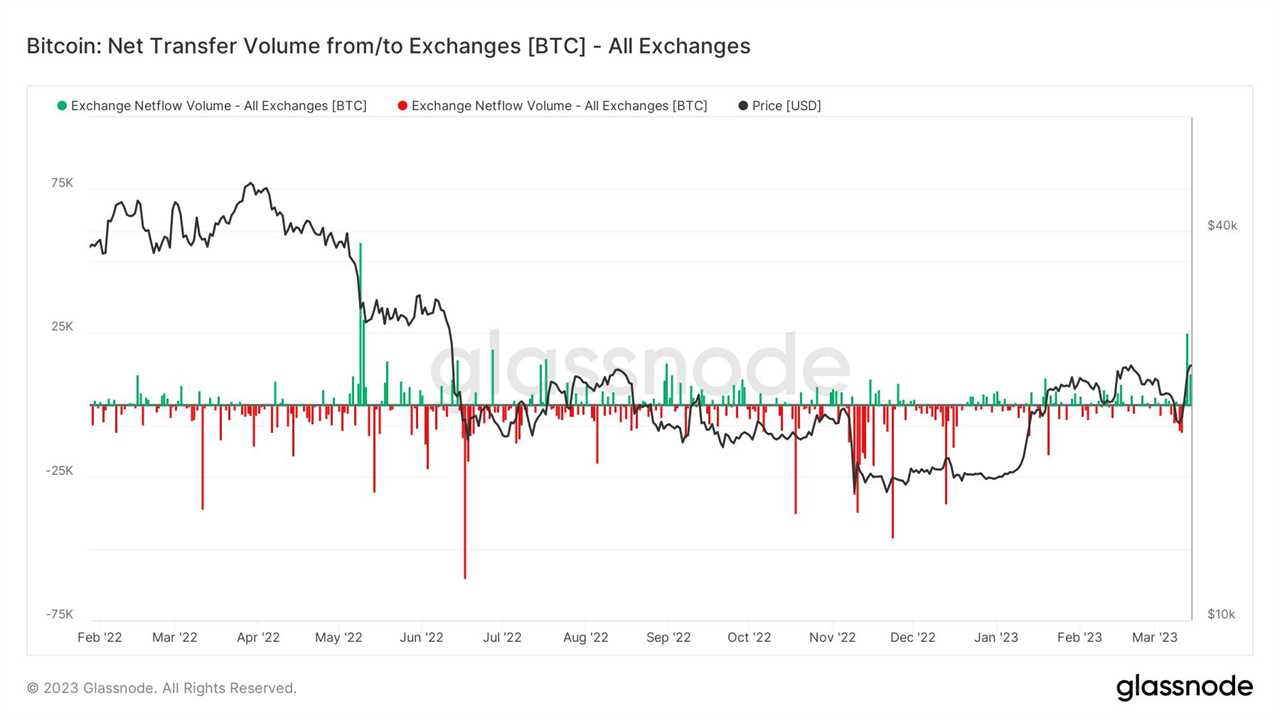

BTC flows back to exchanges as price rises

Glassnode’s exchange flow data recorded the largest inflow to exchanges on March 13 since May 2022. This means more supply on exchanges and a potentially higher amount of selling pressure.

The Coin Days Destroyed indicator, which measures the time-weighted transfers of Bitcoin, also shows a small spike, indicating that old hands are moving coins. The indicators might signal profit booking by long-term holders, which can lead to a correction.

Bitcoin funding rates, RSI jump

Moreover, the funding rate for Bitcoin perpetual swaps is now also elevated with the latest CPI print. In other words, more traders are betting on upside with leveraged positions, increasing the risk of a correction.

The sharp price movement has also recorded a significant spike in the Relative Strength Index (RSI), a technical momentum indicator, with a reading of as high as 82. This means that BTC/USD is generally considered "overbought" in the short term.

BTC vs. USD painting a bearish pattern

BTC price is currently forming a broadening wedge pattern, which depicts the heightened level of volatility. Both buyers and sellers are pushing the price beyond support and resistance levels with the reversals coming quickly.

Buyers failed to stage a pattern breakout on March 14 and are now facing resistance at its ceiling of $26,700 level. At the same time, there is a chance that the price will correct back toward the bottom of the pattern around $19,500 in the coming days.

On the contrary, if Bitcoin price break above the top trendline, the bulls will likely pile in to push the price higher toward $30,000. There are potentially welcome signs for the bulls for this to happen, namely in the BTC options and futures markets.

As Cointelegraph reported, there's still room to run as the indicators have yet to reach previous peak levels.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Title: 4 signs the Bitcoin price rally could top out at $26K for now

Sourced From: cointelegraph.com/news/4-signs-the-bitcoin-price-rally-could-top-out-at-26k-for-now

Published Date: Wed, 15 Mar 2023 08:03:04 +0000