Bitcoin (BTC) starts the second week of June in familiar territory — but a breakout is coming, investors say.

After a calm weekly close, BTC/USD is firmly in its established trading range, while under the hood, market participants are preparing for some dramatic shifts.

It has been a long time coming — and for seasoned traders, the signs are increasingly pointing to volatility making a comeback.

There is little by way of macroeconomic triggers due this week, making the focus shift elsewhere for cues as to what BTC price action might do in the short term.

On-chain analysis provides other interesting insights, reinforcing the idea that in Bitcoin currently, the only "boring" part is spot price.

Cointelegraph takes a look at the key factors at play as BTC/USD hovers around $27,000 for another week.

Weekly close preserves key trend line

BTC/USD may not have inspired with its latest weekly close, but some popular traders are seeing fresh cause for optimism.

Despite remaining firmly in its narrow trading range, as confirmed by from Cointelegraph Markets Pro and TradingView, the chances of a breakout toward $30,000 are increasing.

“Feels like it's a matter of time until Bitcoin finally breaks that 30k level once and for all,” trader Jelle wrote in part of his latest analysis.

Jelle, like others, noted that the 200-week moving average (MA) — a key support line — remained intact.

Also intact were various support structures on trader and analyst Rekt Capital’s radar covering daily timeframes.

“So far, so good,” he summarized about the potential for an exit higher, potentially invalidating a bearish “head and shoulders” structure from the weeks prior.

#BTC successfully retesting not just the top of the red downtrending channel but also the bottom of the red box

— Rekt Capital (@rektcapital) June 4, 2023

So far, so good$BTC #Crypto #bitcoin https://t.co/a0VCL61Qvm pic.twitter.com/V7SnIMlpJZ

An additional tweet mentioned a “successful retest” of support in the offing.

“BTC broke down from a head and shoulders pattern in May. But there's classic whipsaw action around the neckline,” trading account Game of Trades nonetheless acknowledged.

“The pattern remains valid unless the price moves above the right shoulder.”

An accompanying chart gave a potential downside target of just $24,000 for BTC/USD as a result of the head and shoulders event.

Others looked for less movement, such as trader Crypto Tony, who eyed $25,300 as a possible destination, subject to $28,350 staying unflipped as resistance.

$BTC / $USD - June / July plan

— Crypto Tony (@CryptoTony__) June 4, 2023

So right now we are consolidating following the drop from the 14th April high. I am looking for

- $25,300 target to look for longs

- Must remain below $28,350 for the downside target

- Combo corrective pattern

I will update daily as always pic.twitter.com/Q93mr4hjGH

Macro lull comes as traders eye dollar rebound

In an unusual week of calm for traders, June 5 through June 9 will see little by way of macroeconomic data come out of the United States.

With the debt ceiling debacle left behind, the next potential volatility catalysts will come in the form of macro reports for May, such as the Consumer Price Index (CPI) print — these nonetheless not due for another week.

With that, attention is focusing on oil production cuts from Opec+ members, as prices continue to fall despite existing reductions in output.

A more direct potential headwind for Bitcoin and crypto, meanwhile, comes in the form of the U.S. dollar.

The strength of the greenback has been forming a rebound since the start of May, and since then, the U.S. dollar index (DXY) — traditionally inversely correlated with risk assets — has gained around 3.5%.

Popular analyst Matthew Hyland noted increasing relative strength index (RSI) scores for DXY on weekly timeframes.

DXY Weekly opens: pic.twitter.com/nRIGyKm4tl

— Matthew Hyland (@MatthewHyland_) June 4, 2023

Fellow trader Skew flagged 104.7%, the current June high, as a key level to close above to form a bullish DXY trend.

“Strong close & moving higher in early EU trading session,” he commented on the day.

“If USD closes above $104.7, I would consider that as USD strength. So far this looks risk off but we see later on.”

$DXY 1D

— Skew Δ (@52kskew) June 5, 2023

Strong close & moving higher in early EU trading session.

if USD closes above $104.7, I would consider that as USD strength.

So far this looks risk off but we see later on. https://t.co/F28baIv2JV pic.twitter.com/3SLDs5wtos

Over the weekend, meanwhile, TraderSZ described DXY as “bullish until proven otherwise.”

Stocks buoy bullish crypto case

The debt ceiling resolution had an immediate cathartic effect on equities, but crypto markets have broadly failed to copy their enthusiasm.

This may still change, market participants argue, as the S&P 500 hits ten-month highs.

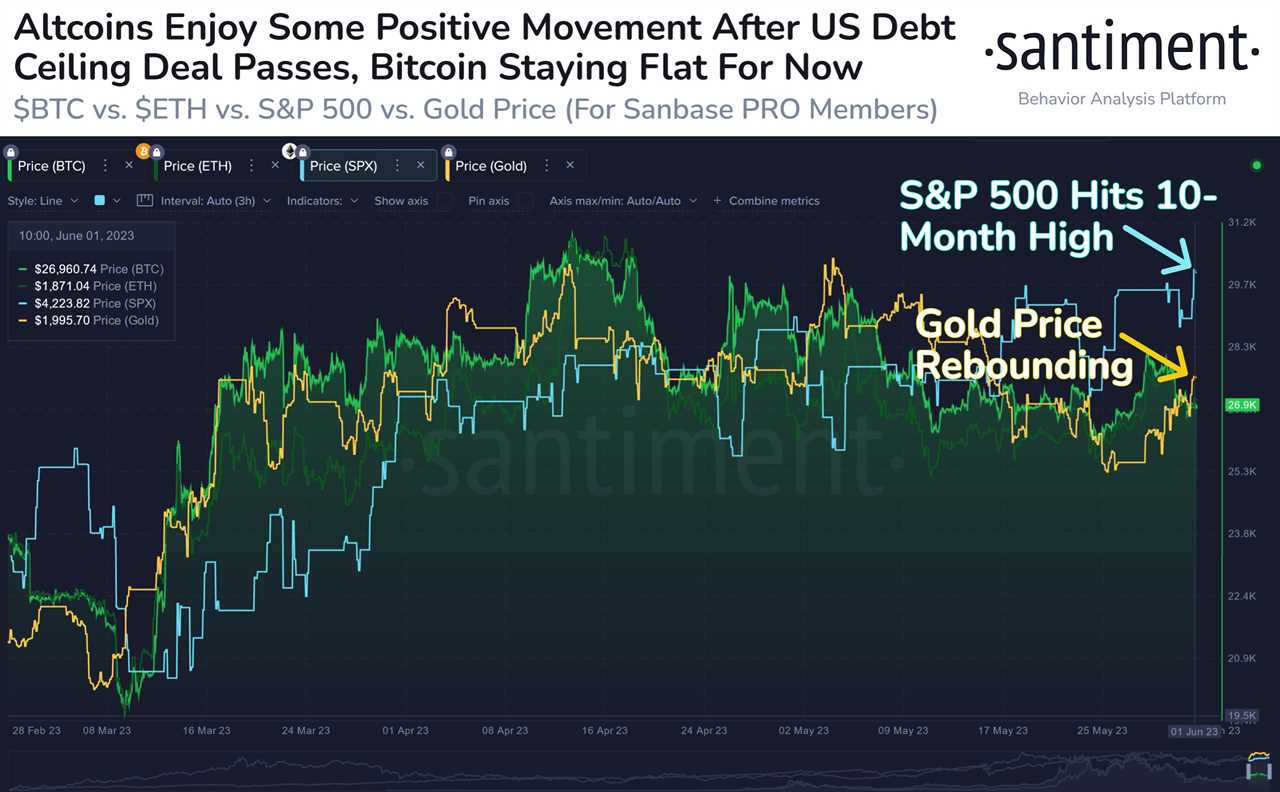

“The US House has passed a key debt ceiling deal, launching the #SP500 to its highest price since August. Altcoins like $LTC, $LEO, and $FGC have jumped today,” research firm Santiment wrote on June 2.

“With crypto lagging behind equities, there could be some $BTC catch-up time coming soon.”

An accompanying chart also tracked a “rebound” for gold, this nonetheless short lived with a retracement setting in to mark the new week.

At the time, as Cointelegraph reported, others were also eyeing positive correlation between Bitcoin and a resurgent S&P 500.

Bitcoin hodlers comfortably in profit

“It's easy to ‘feel’ that the Bitcoin rally is over, but the facts say it's not,” popular technical analyst CryptoCon wrote in findings last month.

At the time, BTC/USD was almost $1,000 higher than current levels, but enthusiasm was just as lacking.

CryptoCon was analyzing the state of Bitcoin holder profitability, using the Net Unrealized Profit/Loss (NUPL) metric created in 2019 by entrepreneur and analyst Tuur Demeester and others.

For the past several months, NUPL has stayed practically stationary around a value of 0.25 — indicating that overall, the BTC supply are modestly “in the black.”

NUPL measures the difference between unrealized profit and unrealized loss, both of these calculated by gathering unspent transaction outputs (UTXOs) to see how much coins are worth compared to when they last moved on-chain.

“Any value above zero indicates that the network is in a state of net profit, while values below zero indicate a state of net loss. In general, the further NUPL deviates from zero, the closer the market trends towards tops and bottoms,” analytics firm Glassnode explains in an introduction.

While calm in recent months, NUPL has delivered an uptrend retest, which is cause for confidence, CryptoCon now says.

“31k was not the end, hope you're ready!” he concluded in an update this weekend.

An accompanying chart of NUPL showed its behavior versus investor sentiment at various stages over the past ten years.

#Bitcoin has seen a lot of sideways price action recently, but during that time two very important things have happened on the NUPL:

— CryptoCon (@CryptoCon_) June 4, 2023

- Retest of trend

- Support made on Hope / Fear sector

The next step, a leap to the belief/denial range

31k was not the end, hope you're ready! pic.twitter.com/yi1GMO1hri

Largest Bitcoin whales at center of "dichotomy"

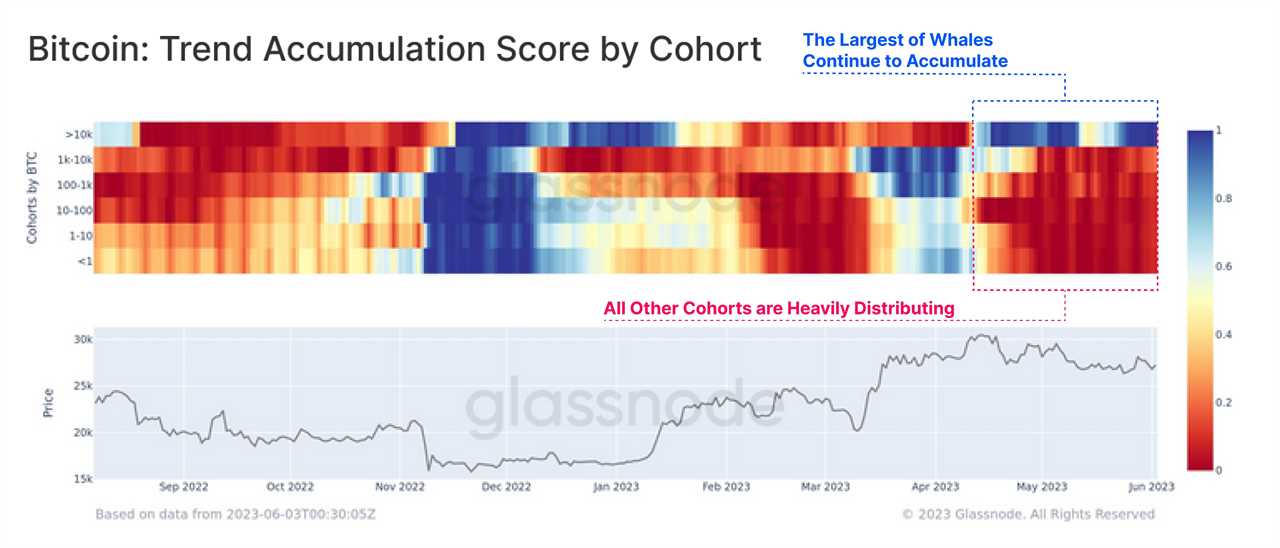

On the topic of investor sentiment, the current view of the market varies heavily between classes of hodler.

Related: Bitcoin ‘big move’ due in July after March $30K push — Latest analysis

As noted by Glassnode itself, most remain distinctly risk-off on Bitcoin — since May, selling has dominated despite the lack of capitulatory events.

The one exception, it appears, is the largest class of Bitcoin “whales.”

Uploading a chart of accumulation versus distribution adjusted by cohort, Glassnode showed that wallets holding at least 10,000 BTC are adding to their positions, while everyone else is reducing exposure.

“An interesting dichotomy across the Bitcoin Accumulation Trend Score persists, as the largest of Whales (>10K BTC) continue to aggressively accumulate, whilst all other major cohorts experience heavy distribution,” researchers commented.

The last accumulation phase from these “mega whales” was in late 2022, with BTC/USD beginning its 2023 rebound weeks later.

The whales then paused in mid-January, entering a distribution phase of their own before flipping back to accumulation in May.

Magazine: Home loans using crypto as collateral: Do the risks outweigh the reward?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Title: ‘$31K was not the end’ — 5 things to know in Bitcoin this week

Sourced From: cointelegraph.com/news/31k-was-not-the-end-5-things-to-know-in-bitcoin-this-week

Published Date: Mon, 05 Jun 2023 09:51:53 +0100