Cryptocurrency traders are scrambling and scratching their heads after a sharp drop in Bitcoin (BTC) price triggered a market-wide sell-off that has nearly every token in the top-200 flashing red today.

Data from Cointelegraph Markets Pro and TradingView shows that Bitcoin price dropped as low as $58,609 before finding buyers who bid the price back to $60,500.

Here’s a look at what some traders and market analysts are saying about this recent downside move and whether or not it is simply a shakeout or a sign that darker clouds are gathering.

BTC is exploring support and resistance levels

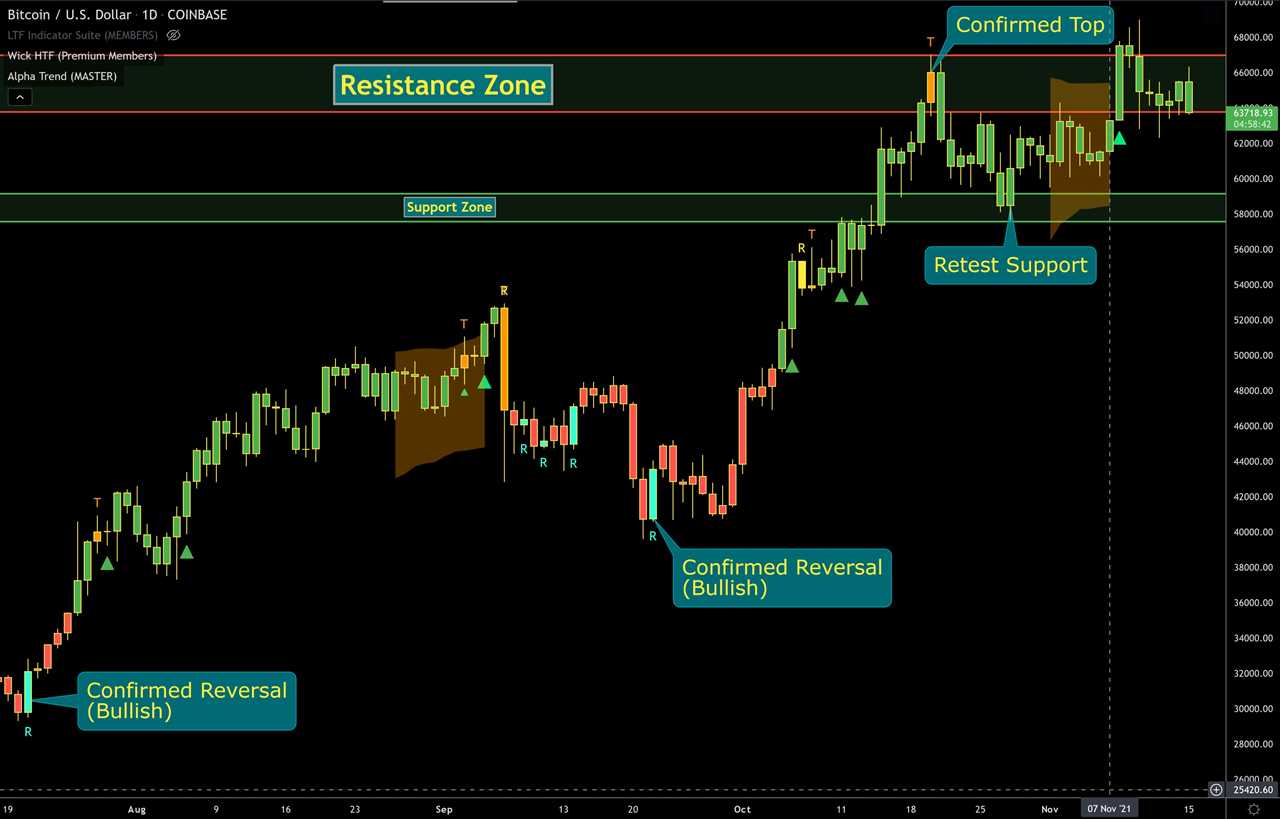

Insight into BTC's daily price action was offered by options trader and pseudonymous Twitter user ‘John Wick’, who posted the following chart highlighting some important support and resistance zones.

Wick said that Bitcoin is just exploring the resistance zone around its new all-time high and he highlighted the possibility of a drop into the $58,000 to $59,500 range, similar to the move that was seen in the early trading hours on Nov. 15.

Wick said,

“We are simply testing the range low of the resistance zone. If we break it on the close may test support zone.”

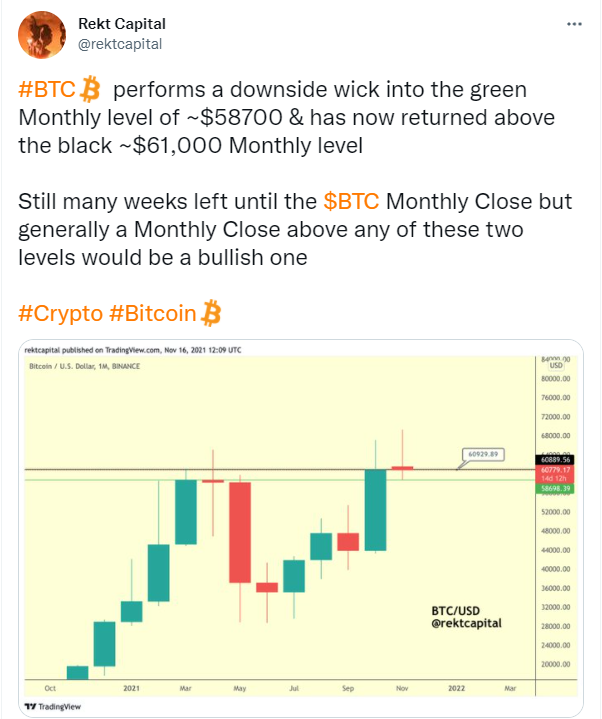

Similar observations were made by market analyst and pseudonymous Twitter user ‘Rekt Capital’, who posted the following tweet that zoomed out and looked at the price action for BTC on the monthly chart.

As mentioned by the analyst, the price action on Nov. 16 was a retest of the monthly support/resistance level at $58,700. Now that BTC has successfully rebounded near the monthly $61,000 level, a bullish case can be made in the weeks ahead if the price manages to close the month above the level.

There's still a chance that $54,000 will be hit

A level-headed view of the latest price action was provided by market analyst and Cointelegraph contributor Michaël van de Poppe, who posted the following chart of a possible BTC price trajectory over the next week.

van de Poppe said,

“So far, so good on Bitcoin. Bouncing from support, but still needing to break some crucial areas here, which didn't happen yet. Let's go for that first. $63,000 is important. No breakout there [leads to] further downwards momentum.”

According to the chart provided by van de Poppe, if the downward momentum continues, the price of BTC could drop to its next support level at $54,000.

Related: Bitcoin stages ‘picture-perfect rebound’ at $58.5K as crypto liquidations top $875M

Fractal patterns suggest an approaching price rally

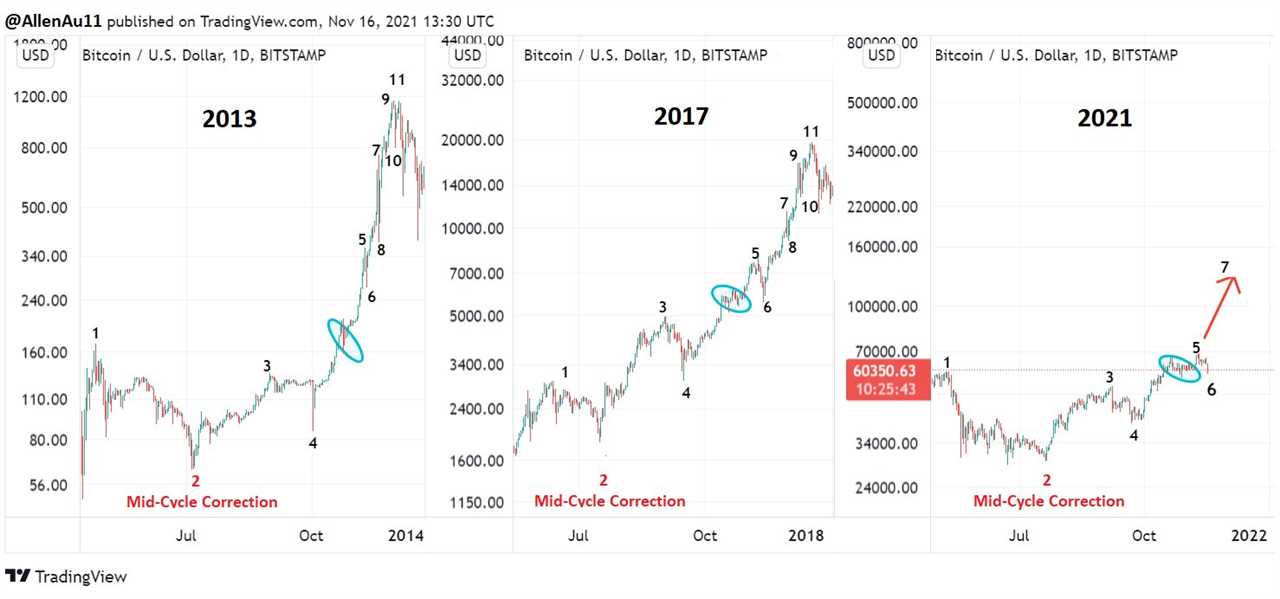

Crypto Twitter analyst ‘Allen Au’ posted the following side-by-side charts of Bitcoin from 2013, 2017 and 2021 in response to concerns about $69,000 being the cycle peak.

According to the analyst, the latest downturn is not the cycle top, but was in fact the Wave 6 move seen in previous cycles. This means that “if its low is in, BTC could be onto Wave 7 soon!”

Should the outlined wave sequence play out, then a Wave 5 peak could be $69,000, a Wave 6 low near $58,600 with the potential to drop as low as $53,000 and a cycle peak somewhere between $190,000 and $260,000 happening sometime in December 2021.

The overall cryptocurrency market cap now stands at $2.651 trillion and Bitcoin’s dominance rate is 43.2%.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: 3 reasons why traders want to buy the Bitcoin price dip to $58.5K

Sourced From: cointelegraph.com/news/3-reasons-why-traders-want-to-buy-the-bitcoin-price-dip-to-58-5k

Published Date: Tue, 16 Nov 2021 18:53:45 +0000

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/the-power-of-cheap-transactions-can-solanas-growth-outpace-ethereum