Bitcoin loses momentum as Ether futures fail to deliver

Bitcoin experienced a 5.5% increase to $28,600 on October 2, but its rally was short-lived as the launch of Ether futures exchange-traded funds (ETFs) failed to generate significant trading volumes. This setback dampened investor enthusiasm and hampered Bitcoin's upward momentum.

Economic concerns weigh on Bitcoin's performance

The United States Federal Reserve's concerns about an impending economic downturn have put downward pressure on Bitcoin. The Fed's Vice Chair for Supervision, Michael Barr, highlighted the potential slowdown in economic growth due to higher interest rates constraining economic activity. This, combined with the uncertainty surrounding the current monetary policy, has contributed to Bitcoin's struggles to rally above $28.5K.

Lackluster trading metrics indicate weak support

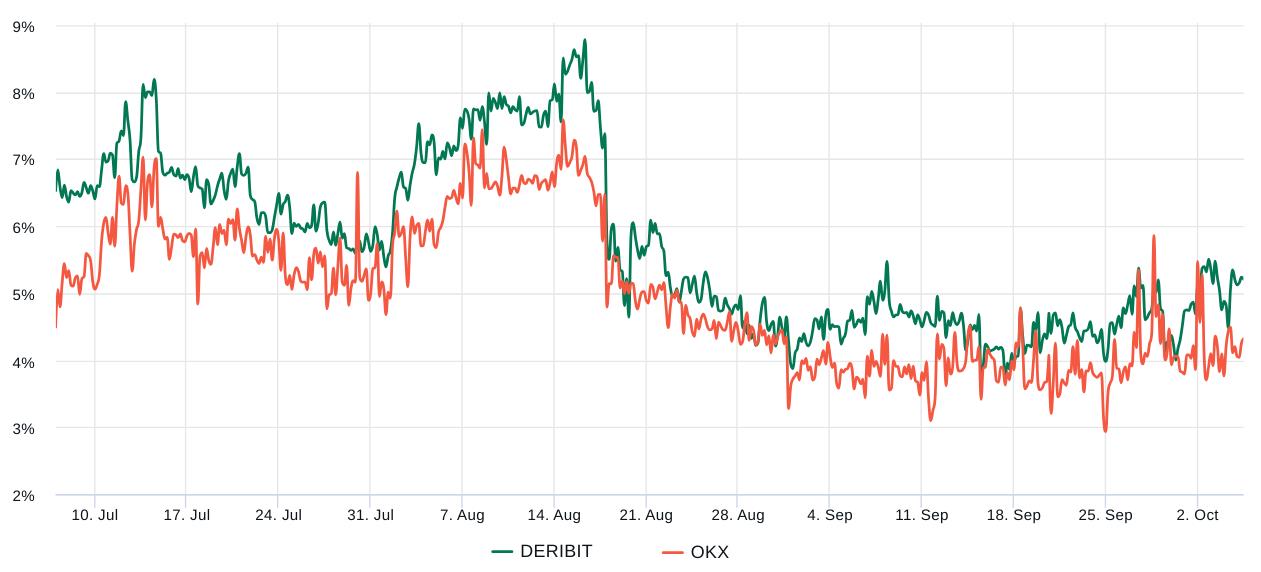

Three key trading metrics point to a lack of support for Bitcoin. Spot market volumes, derivatives, and confidence in the approval of a spot Bitcoin ETF have all shown diminished activity. Spot trading activity on traditional exchanges has reached its lowest levels since late 2020, indicating reduced participation by institutional investors. Additionally, the BTC futures premium remains below the 5% neutral threshold, suggesting a lack of demand for leveraged long positions.

These factors, combined with the decrease in trading volumes and the lack of confidence in the approval of a spot Bitcoin ETF, have hindered Bitcoin's ability to break above the $28,500 resistance level. With Federal Reserve representatives warning of impending economic pressures, the short-term prospects of a rally seem unlikely.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/starsarena-web3-app-on-avalanche-exploited-funds-drained-in-malicious-attack