Bitcoin's (BTC) whipsaw volatility has been on full display throughout June, leaving traders confused and in search of the latest technical indicator or major news announcement that might provide some hint at which way the price will move.

As the month of June comes toward an end, traders are now focused BTC's on the monthly close to determine if the forward outlook is tilted toward bulls or bears.

At the time of writing, Bitcoin price is still 47% away from its all-time high at $64,873 and analysts have a mixed view on whether or not the bullish momentum will return in the short term. Here are three perspectives analysts have in mind as the market prepares to head into the month of July.

Bitcoin needs to hold the $34,500 support

A survey of crypto Twitter shows that many chart watchers have identified $34,500 as a crucial price level that needs to be defended to establish the bull case for Bitcoin moving forward.

So far, this current period in the 2021 cycle is very similar to the 2013 mid-cycle correction

— Rekt Capital (@rektcapital) June 30, 2021

A #BTC Monthly Candle Close above ~$34500 would mean that BTC will continue to respect historical Mid-Cycle tendencies$BTC #Crypto #Bitcoin

According to Rekt Capital, a pseudonymous trader on Twitter, a close near this level would put the market on a similar trajectory to the BItcoin price pattern seen during the 2013 bull market which included a mid-cycle correction before price broke out to a new all-time high later in the year.

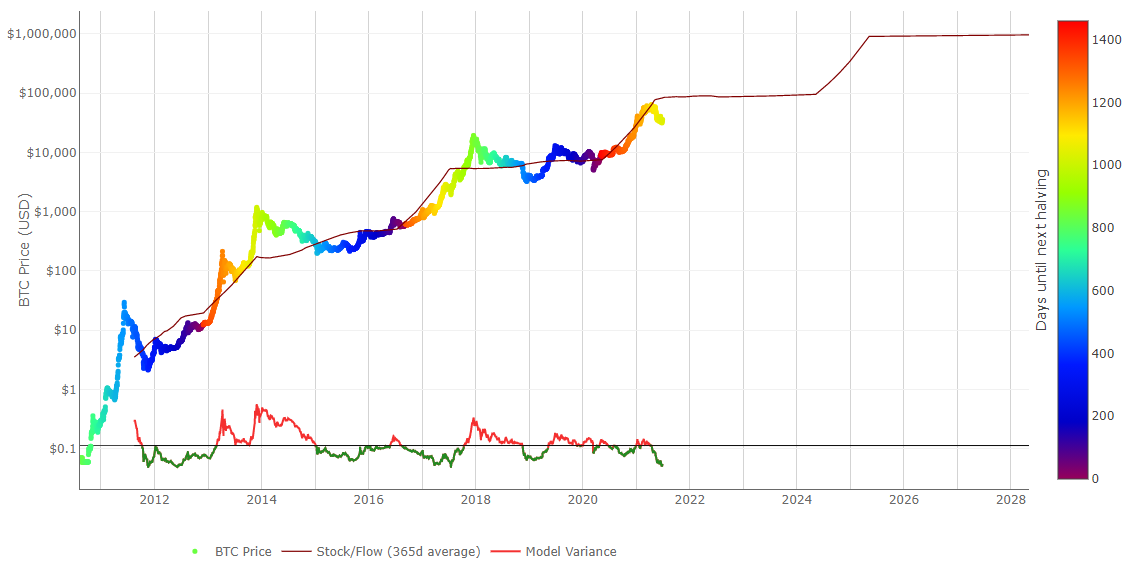

From this bullish perspective, the price of Bitcoin should soon continue the uptrend that began in late 2020 and will theoretically lead to a new all-time high later in 2021 or early 2022 which is projected to surpass $100,000 according to the Bitcoin stock-to-flow model.

Despite the widespread acceptance and faith in the S2F model, Bitcoin's recent price action led even Plan B, the creator of the popular model, to feel “uneasy” about BTC's most recent dip to the lower bound of the model.

Even for me it is always a bit uneasy when bitcoin price is at the lower bound of the stock-to-flow model. Will it hold (like Mar 2019 when I published S2F, or Mar 2020 Covid, or Sep 2020 with BTC stuck at $10K) and is this another buying opportunity? Or will S2F be invalidated? pic.twitter.com/iIjTC2Ncy3

— PlanB (@100trillionUSD) June 23, 2021

Signs of a bearish breakdown

While bull market advocates look for any sign to validate a move higher, the price action on June 30 caught the eye of another pseudonymous Twitter analyst called John Wick. According to the analyst, there is a bearish topping pattern that can be se in the most recent BTC chart.

#BTC (4h update)

— John Wick (@ZeroHedge_) June 30, 2021

Just as we were getting off to a good start, a topping signal printed & confirmed. Had confluence from Bearish RSI cross + Bearish Thrust

Lets see if we can hold $34k support. If not we are still range bound. Getting above upper $36k & $41k are the resistances pic.twitter.com/RZ4IAGoi16

According to Wick, Bitcoin now needs to hold support at $34,000 or the market could be in for another extended period of sideways, range-bound trading rather than a fledgling move higher.

Bearish sentiments were also highlighted in the following tweet from the Twitter personality Nunya Bizniz, who points out that BTC would need to close above $37,400 to avoid three consecutive down months, which has historically indicated more downside in the future.

BTC monthly:

— Nunya Bizniz (@Pladizow) June 29, 2021

Month closes tomorrow.

A close above $37.4K would avoid 3 consecutive down months.

Three down months have marked more down side.

What happens?

Note: Green boxes = sort term bounce pic.twitter.com/aj1IWuGXXe

Signs of rising sentiment

While the debate about a bullish or bearish future rages on, there are several indicators pointing to the possibility of rising sentiment amid the noise.

Grayscale #Bitcoin premium is returning to zero.

— Bitcoin Archive (@BTC_Archive) June 30, 2021

Purpose #Bitcoin ETF is buying again.

Market sentiment seems to be recovering pic.twitter.com/CmztgqHPvE

Twitter personality 'Bitcoin Archive' pointed to the Grayscale Bitcoin premium approaching zero and renewed buying activity by the Purpose Bitcoin ETF as evidence that sentiment is on the rise.

Related: NYDIG set to bring Bitcoin adoption to 650 US banks and credit unions

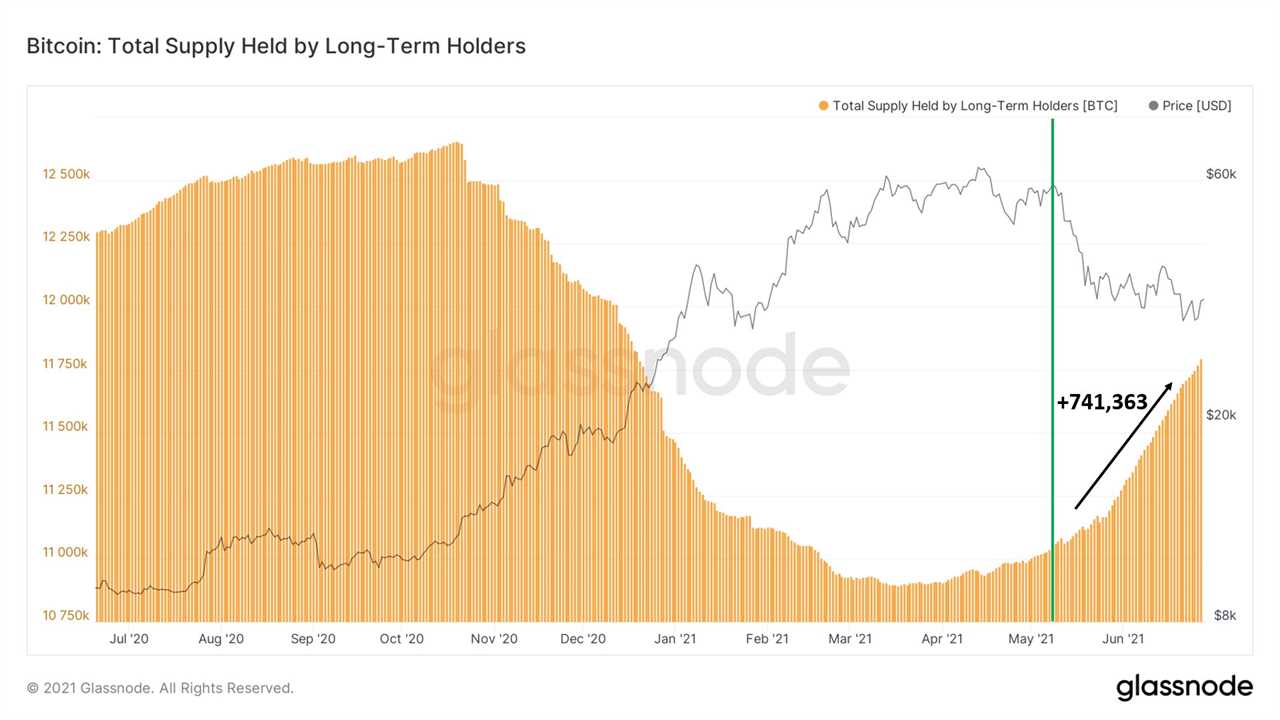

On-chain analyst William Clemente III also posted the following chart to highlight the fact that long-term BTC holders have been accumulating since late May after the price of Bitcoin bottomed out below $29,000.

Clemente said:

“Bitcoin is cheap and Long-Term BTC Holders know it. They've added 741,363 BTC to their holdings since the initial price drawdown in late May.

For a simplified explanation of important levels to keep an eye on, John Bollinger, a technical analyst and creator of Bollinger Bands, simply said that $41,000 and $31,000 are the key "logical levels" to watch and he also cited the $35,000 to $36,000 zone as crucial support levels to monitor.

These are the logical levels I am watching for $btcusd

— John Bollinger (@bbands) June 30, 2021

41,000

35/36,000

31,000

So far they have been important milestones.#Bitcoin

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: 3 key areas traders are watching as Bitcoin’s monthly close occurs

Sourced From: cointelegraph.com/news/3-key-areas-traders-are-watching-as-bitcoin-s-monthly-close-occurs

Published Date: Wed, 30 Jun 2021 20:51:25 +0100