Cryptocurrencies failed to break the 42-day long downtrend after the $1.95 trillion capitalization resistance was rejected on March 20. Even though Bitcoin (BTC) gained a modest 3.7% over the past seven days, altcoins presented a robust rally.

Crypto markets' aggregate capitalization showed a 6.2% increase to $1.92 trillion between March 14-21. Such performance was positively impacted by Ether's (ETH) 14% gains, Cardano (ADA) increasing 13%, and Solana (SOL) gaining 10%.

While those assets were not the biggest weekly gains among the top-80 coins, Ether may have fueled investors' expectations after Glassnode's on-chain data showed that ETH balances on crypto exchanges reached their lowest levels since 2018.

Comparing the winners and losers provides skewed results as only two names presented negative performances over the past seven days:

Ethereum Classic (ETC) rallied 51% after the HebeSwap decentralized exchange application surpassed $290 million in total value locked. With liquidity pools growing on the protocol, Ethereum Classic appears to have a decentralized finance (DeFi) hub of its own.

AAVE gained 35% following its v3 liquidity pool upgrade on March 16, adding cross-chain asset functionality, a community contribution tool, and a gas optimization model. Several wallet-based decentralized applications (DApps) will be integrated, including Instadapp, Debank, 1Inch, Paraswap, Zapper, DeFisaver, Zerion and more.

Kusama (KSM) gained 31% after Parity Technology confirmed that it will enable parachain (sidechain) swaps on the upcoming 0.9.18 release. Moreover, Manta Network's on-chain privacy Dolphin Testnet reached 30,000 transactions on March 14.

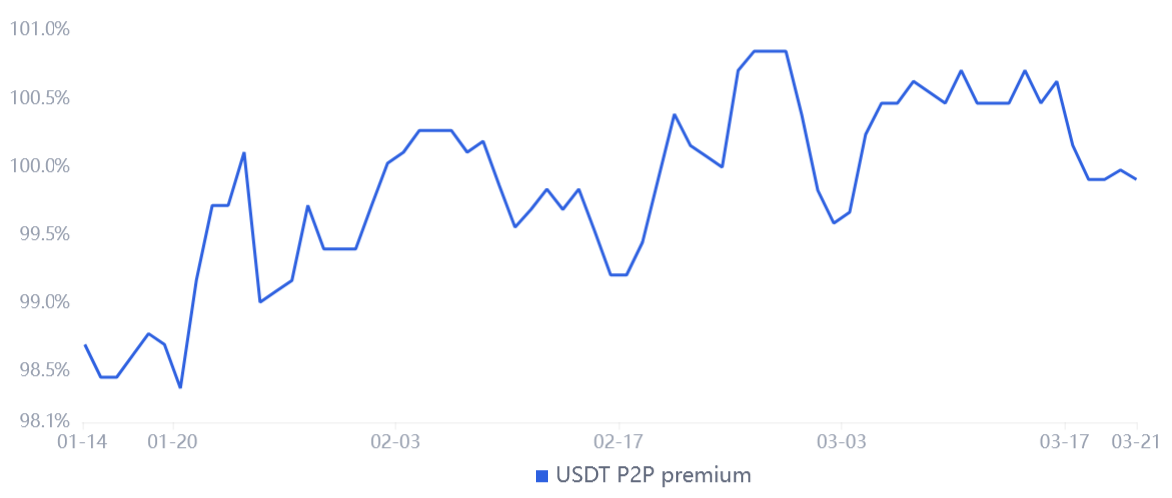

Tether premium shows slight discomfort

The OKX Tether (USDT) premium is a good gauge of China-based retail trader crypto demand. It measures the difference between China-based peer-to-peer trades and the U.S. dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, Tether's market offer is flooded, causing a 4% or higher discount.

Currently, the Tether premium stands at 99.9%, its lowest level since March 3. While distant from retail panic selling, the indicator showed a modest deterioration over the past week.

Still, weaker retail demand is not worrisome as it partially reflects the total cryptocurrency capitalization, which is down 46% year-to-date.

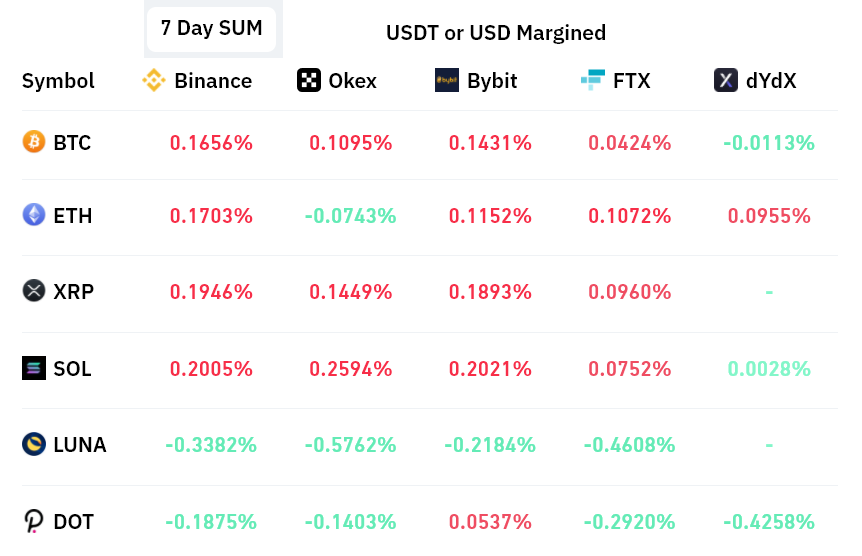

Futures markets show mixed sentiment

Perpetual contracts, also known as inverse swaps, have an embedded rate usually charged every eight hours. Exchanges use this fee to avoid exchange risk imbalances.

A positive funding rate indicates that longs (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

As depicted above, the accumulated seven-day funding rate is slightly positive for Bitcoin and Ether. This data indicates slightly higher demand from longs (buyers), but it is insignificant. For example, Solana's positive 0.20% weekly rate equals 0.8% per month, which should not be a concern for most futures traders.

On the other hand, both Terra (LUNA) and Polkadot (DOT) futures showed slightly more demand from shorts (sellers). Thus, the absence of Tether demand in Asia and mixed perpetual contract premiums signal a lack of confidence from traders despite the recent price gains.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: 2 metrics signal traders do not expect $2T crypto market cap anytime soon

Sourced From: cointelegraph.com/news/2-metrics-signal-traders-do-not-expect-2t-crypto-market-cap-anytime-soon

Published Date: Mon, 21 Mar 2022 19:13:44 +0000