Bitcoin (BTC) recently reclaimed $35,000 but top traders at Huobi, OKEx, and Binance are not buying the breakout. Unlike the savvy institutional investors who may be desperate for protection against the debasement of fiat, the more crypto-focused investors seem to be waiting for dips.

Institutional investors might also be celebrating the Jan. 4 announcement that the Office of the Comptroller of the Currency (USOCC) would allow banks to include stablecoins in bank-permissible functions. This further validates the crypto sector and may result in a rise in institutional participation in the space.

Typically, after a new all-time high is achieved, Bitcoin price pulls back as some traders take profits and bears consider opening short positions near the new ‘top’.

Crypto-focused traders are well aware of Bitcoin's volatility and the recent dip to $27,000 serves as a perfect example.

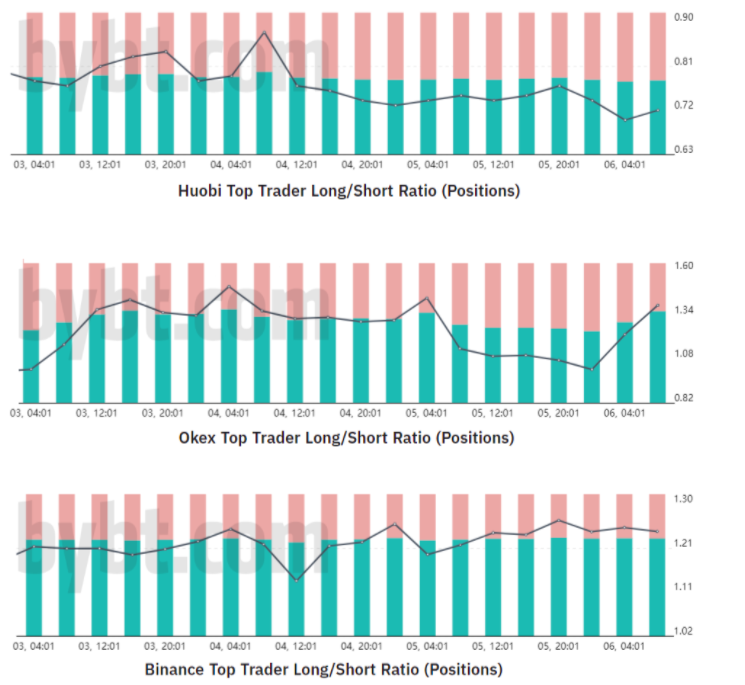

To effectively measure how crypto-focused traders have been positioning themselves, investors should monitor the top traders' long-to-short ratio at leading crypto exchanges.

Notice how Huobi top traders have been reducing their long positions over the past two days. Meanwhile, Binance top traders have been sitting mostly sideways this entire period.

It is worth noting that exchanges gather data on top traders differently as there are multiple ways to measure clients net exposure. Therefore, any comparison between different providers should be made on percentual changes instead of absolute numbers.

OKEx has been the only exception, as its top traders metric showed investors entered short positions as BTC momentarily dumped on Jan. 4, but this trend reverted as the $31,000 support was re-established. This data indicates that those traders are chasing the market instead of placing bets ahead of the move.

Generally speaking, it is safe to conclude that ‘top’ traders have not been responsible for the current bull run.

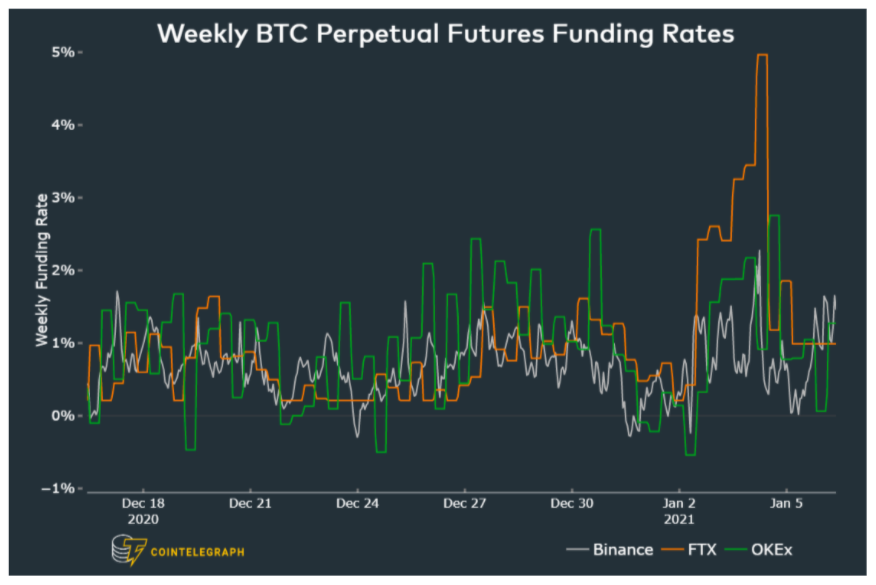

The futures funding rate is holding steady

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours. When buyers (longs) are the ones demanding more leverage, the funding rate turns positive. Therefore, the buyers will be the ones paying up the fees. This issue holds especially true during bull runs, when there is usually more demand for longs.

As shown above, the funding rate climbed to an unusually high 5% weekly level on FTX exchange on Jan. 4. Regardless of this oddity, the average 1% weekly funding rate seems exceptionally modest considering Bitcoin's 18% rally over the past six days.

At the moment, it’s clear that top traders at major exchanges are not the ones leading the recent buying activity. These short-term traders seem to be waiting for lower entry points according to their long-to-short position data and the funding rate on derivatives exchanges.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: 2 key Bitcoin price indicators show pro traders are waiting for $36K

Sourced From: cointelegraph.com/news/2-key-bitcoin-price-indicators-show-pro-traders-are-waiting-for-36k

Published Date: Wed, 06 Jan 2021 18:13:24 +0000

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/covid19-vaccination-records-stored-on-vechain-as-use-cases-grow-