Decentralized exchanges (DEX) are a giant leap in permissionless and transparent trading, and they exist as fantastic alternatives to centralized exchanges.

While DEXs ease the process of listing new ERC-20 tokens and remove the need to pay a central authority high listing fees, they stil have the issue of high gas fees. This is precisely the issue 0x Protocol (ZRX) aims to solve.

The 0x Protocol (ZRX) ICO raised $24 million in August 2017 for 50% of its supply, with no pre-sale. As an ERC-20 token, the permissionless Protocol connects liquidity providers through smart contracts, therefore aggregating liquidity.

The protocol allows interoperability between different decentralized applications and DEXs. Thus, ZRX should not be seen as a Uniswap competitor, as it benefits from the sectors' increased liquidity.

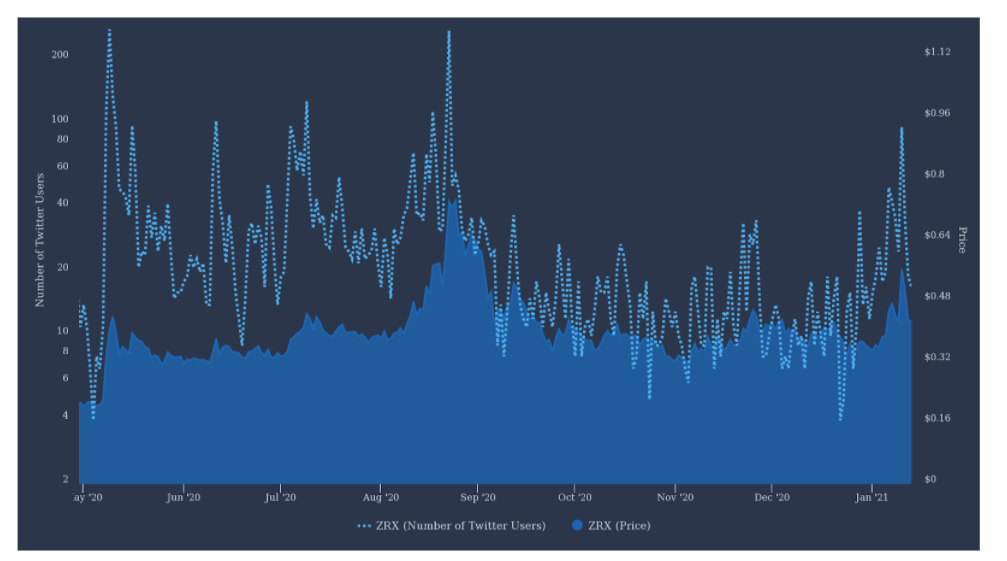

Although the ZRX token has been quite volatile over the past weeks, there's an uptrend happening as it tries to establish $0.50 as a support level after a 22% price increase past 24 hours.

From servers to service

Initially launched as a voting mechanism for governance proposals, ZRX tokens received staking capabilities after its v3 update in late-2019. Market makers were then able to earn ETH rewards for liquidity providing services. Meanwhile, holders could benefit by delegating their tokens using pools.

In June 2020, the project launched a DEX liquidity aggregator service, known as Matcha. After serving exclusively as a backbone for three years, 0x Protocol created a smart order routing service that encompasses DEX like Uniswp, Curve, and Kyber.

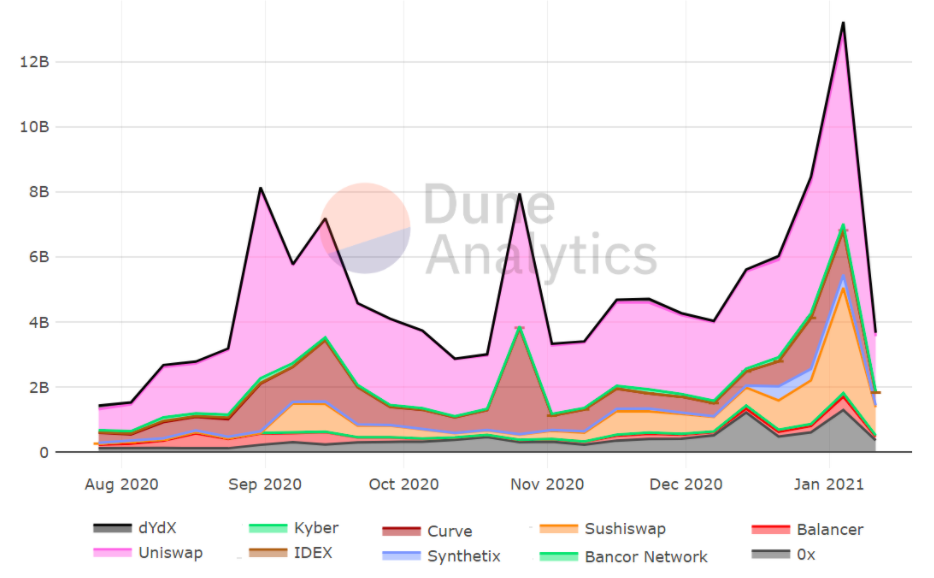

Community and DEX activity are probably the most vital metrics for measuring DeFi token growth. Data from Dune Analytics shows that Uniswap and SushiSwap both account for over 60% of the volume but it’s important to remember that liquidity aggregators are not direct competitors to 0x Protocol.

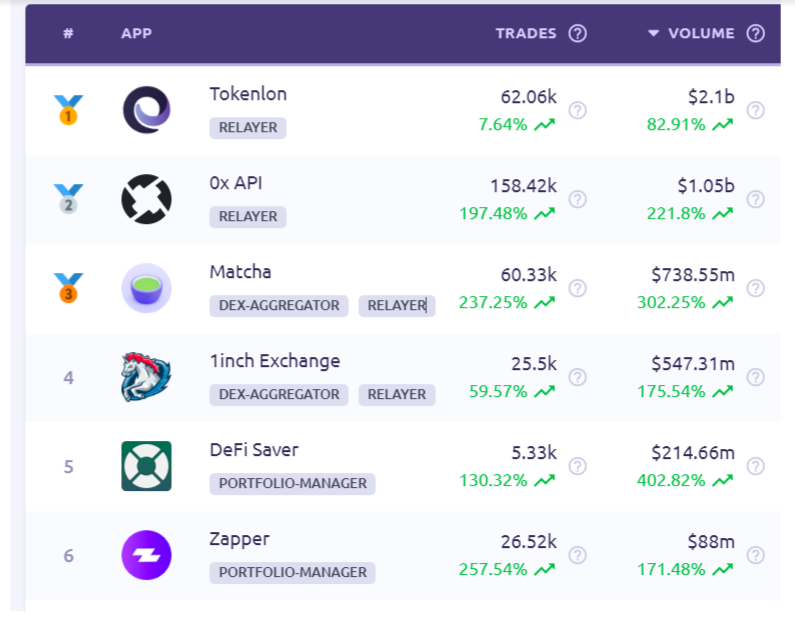

Therefore, the general DEX market growth of the past year is actually a positive driver for ZRX token. Looking at 0x Protocol usage, we can see that 0x weekly volume more than doubled from the October to November $350 million weekly average, reaching 10% market share.

Taking a more detailed view of 0x network activity, the chart above shows that multiple platforms use 0x Protocol's liquidity aggregation capabilities. These trades can take place at numerous DEXs, including Uniswap, Curve, and Balancer.

Market makers returns and v4 update

On Dec. 15, Theo Gonella, 0x Labs product manager, showed data from a market maker that made a 100% return in 2020 by providing liquidity on 284 ETH across 41,000 trades. More recently, 0xTracker stated that 1,782 ETH were distributed to 0x market markers as liquidity rewards in 2020.

The 0x Project v4 voting process will occur from Jan. 16 to Jan. 23 and aims to reduce requests for quotation gas costs by 70%. According to the 0x Labs blog, this version enables customizable modules to execute atomic operations, including token wrapping and unwrapping.

Front-running problem

For those unfamiliar with front-running, the problem lies in on-chain data. Savvy arbitrage desks monitor Ethereum's main chain for transactions, to then add extra gas on a similar trade and buy (or sell) the asset ahead of the other party. Thus, the higher fee transaction will be able to front-run other users' executions.

Albeit not exclusively an 0x problem, this certainly limits DeFi aggregators use.

Data from TheTie shows that the recent price spike has been accompanied by increased social network activity. Nevertheless, the indicator remains 50% below the previous May and August peaks. Therefore, judging by social network metrics, there is possibly an enormous upside for ZRX price.

0x Protocol may find further success as the DeFi sector continues to grow and mature. As long as there is a need for lower gas costs and multiple price providers, liquidity aggregators will have a void to fill.

To conclude, for those who believe that the v4 update will be a game-changer, there's room for plenty of growth in DEX market share, and therefore price potential.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: 0x (ZRX) price rallies 35% ahead of v4 mainnet update

Sourced From: cointelegraph.com/news/0x-zrx-price-rallies-35-ahead-of-v4-mainnet-update

Published Date: Thu, 14 Jan 2021 18:19:40 +0000