CHANCELLOR Rishi Sunak will tomorrow outline where the majority of taxpayers’ cash will be spent in the government’s Spending Review.

Pay freezes for teachers and firefighters could be on the cards as the government looks to plug the black hole in the country’s finances caused by the coronavirus crisis.

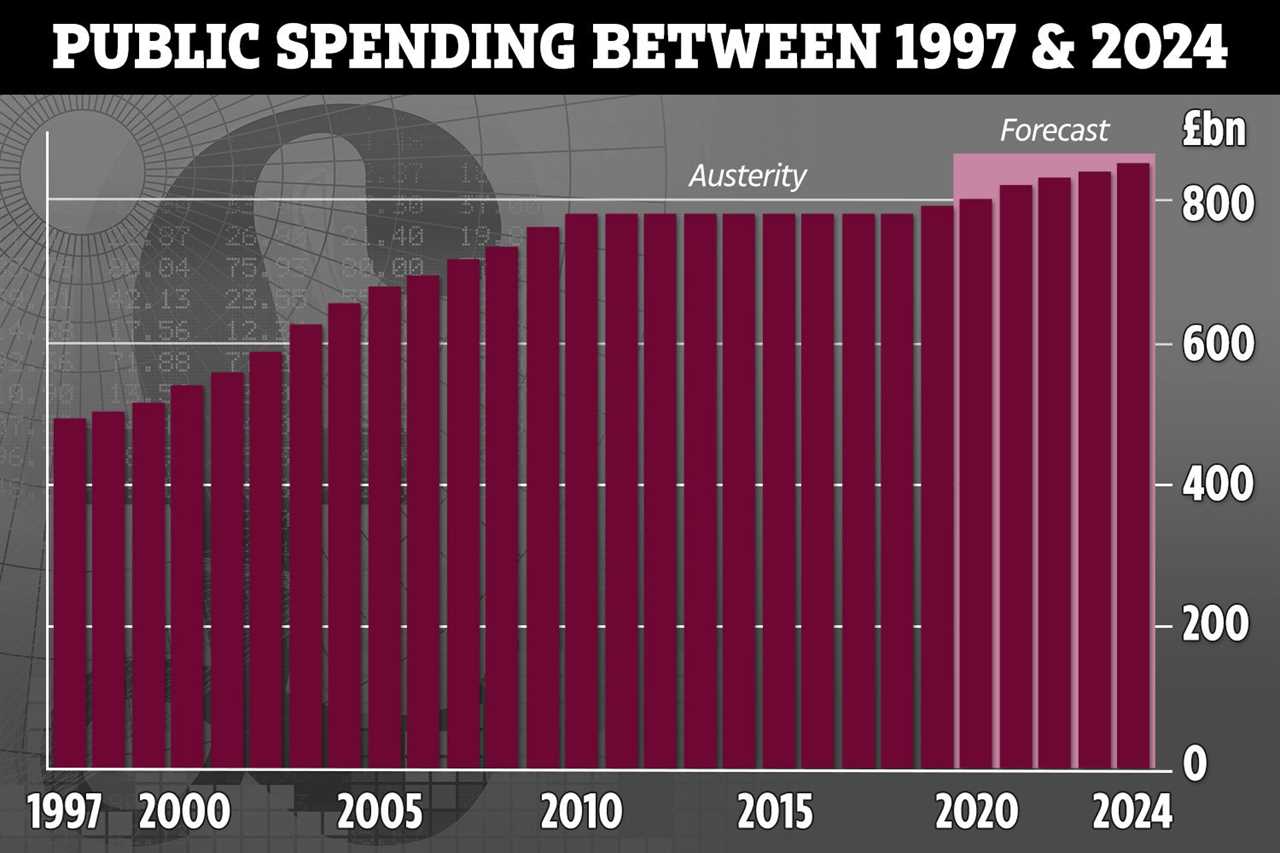

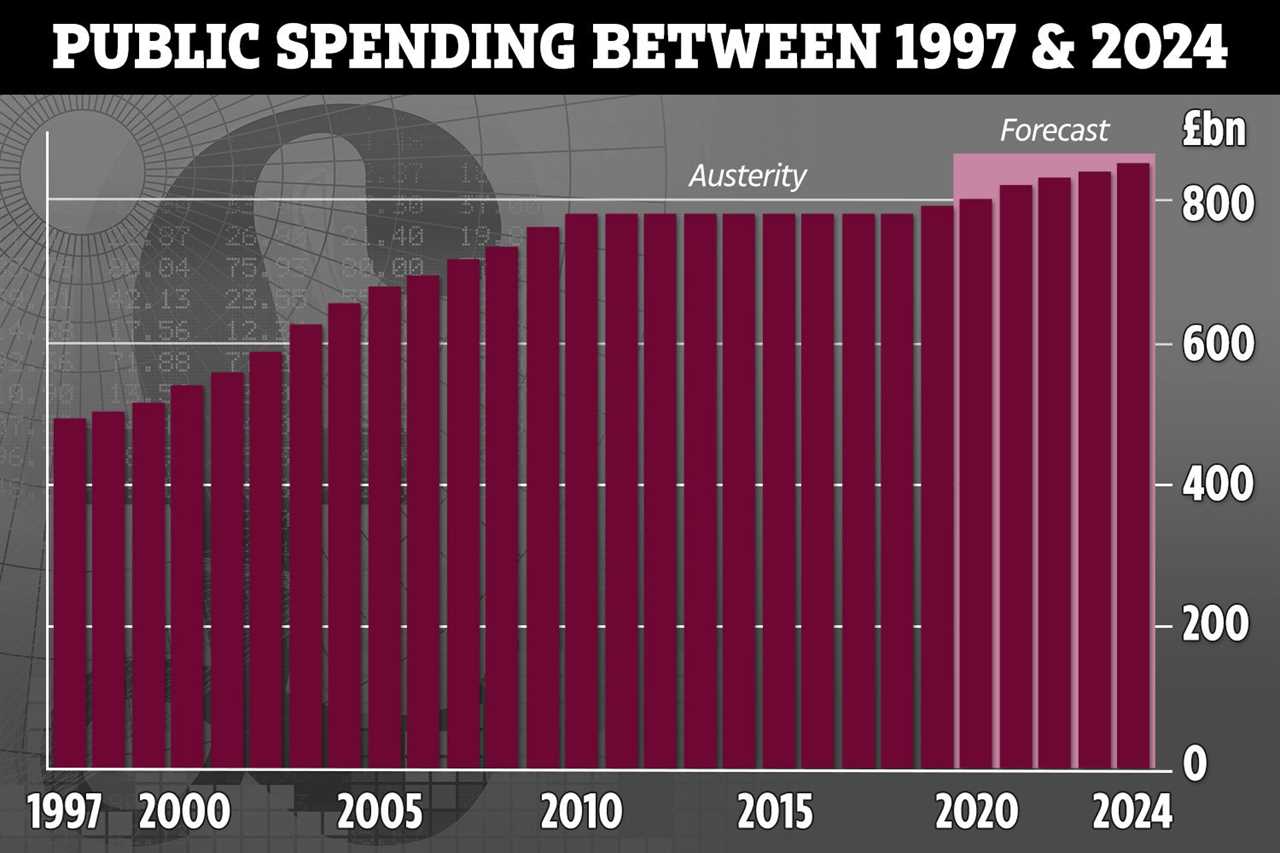

The Office for Budget Responsibility (OBR) predicts public spending will rise over the next four years

Mr Sunak has said that Britain won’t see a return to austerity but warned we will see an “economic shock laid bare”.

He told Sky News: “You will not see austerity next week, what you will see is an increase in government spending, on day-to-day public services, quite a significant one coming on the increase we had last year.

“So, there’s absolutely no way in which anyone can say that’s austerity, we’re spending more money on public services than we were.”

The Office for Budget Responsibility (OBR) predicts public spending will rise to more than £800billion by 2024 as a result of the pandemic.

Here we take you through everything you can expect from the Spending Review, from what it actually means to how it will affect your finances.

Chancellor Rishi Sunak will set out next year’s funding for government departments in tomorrow’s Spending Review

What is a Spending Review and is it the same as the Budget?

A Spending Review is where the Chancellor outlines how much funding government departments will get for the next financial year.

It includes details of how much public money will go towards funding the NHS, roads, police and education.

The review also sets out money for devolved governments in Scotland, Wales and Northern Ireland.

It’s different to the Budget, which includes details of tax hikes and cuts, and changes to the minimum wage.

The next Budget was due to be delivered this autumn but was cancelled back in September.

Instead, Mr Sunak updated MPs on plans “to continue protecting jobs”, including furlough extensions and support for businesses to get them through the coronavirus crisis.

It follows a “mini-budget” which the Chancellor unveiled in the House of Commons on July 8.

What can we expect the Chancellor to say?

Mr Sunak is set to address the Commons tomorrow so we won’t know for sure what will be included until then.

But here is what to expect based on expert opinions and hints from the Chancellor himself .

£1,000 a year Universal Credit boost

Mr Sunak is expected to make a decision on whether to extend the temporary boost to Universal Credit announced back in March.

Twenty pounds a week was added to the standard allowance to help low-income households through the crisis.

It means that for a single Universal Credit claimant, who’s 25 or older, the standard allowance increased from £317.82 to £409.89 per month.

The measure is only supposed to last for 12 months but MPs, charities and campaigners have been calling on the government to extend it.

Around six million of the poorest households will see benefits drop by £1,000 a year if the policy is axed.

Trending In The News revealed last month that the Chancellor is expected to extend the uplift beyond April next year.

Pay freeze for NHS workers, teachers and firefighters

Five million public sector workers could have their wages frozen to help pay for the pandemic, some reports have suggested.

Mr Sunak is expected to announce the squeeze in tomorrow’s review.

It’s understood the Chancellor thinks it is “unfair” public sector workers should get inflation busting pay rises while private sector employees face stagnant wage growth and redundancies.

But frontline NHS workers battling the deadly bug won’t be included in the freeze – which could save the Treasury £23billion by 2023.

The decision could spark fury with unions and workers after eight years of frozen wages came to an end in 2018.

Better transport links and “green spending”

The Spending Review typically only outlines public spending for the next year but it’s believed the Chancellor will leave room for a handful of longer term projects too.

This may include details of how the £100billion National Infrastructure Strategy will be spent.

The fund has been set aside to fulfil Boris Johnson’s election promise to “level up” the country through investments and improving infrastructure, such as transport links.

Ben Zaranko from the Institute of Fiscal Studies (IFS) says we should expect to see plans already announce brought forward to tie in with the government’s plans to “build back better”.

He also says Mr Sunak may announce a review of the Treasury’s “green book”.

This is a set of rules that determine how valuable government investments are and is believed to favour London and the south east of England.

Mr Zaranko said: “Together, these have the potential to influence and determine not just what the government invests in, but also where and how well.”

Cuts to foreign aid budget

Earlier this month, No10 confirmed cuts will be made to the foreign aid budget to help plug the Covid blackhole.

The pot of cash – up to £15billion a year – could instead be used to fund Foreign Office and Ministry of Defence projects, and invested in the charities sector.

The commitment to spend 0.7 per cent of GDP on foreign giveaways was a flagship policy of ex-PM David Cameron.

As well as poorer nations, rich countries such as China, led by President Xi Jinping, and India, have benefited from UK taxpayers’ cash.

Foreign aid has included funding for dementia care in the Chinese province of Qingdao and yoga lessons for Indians at risk of heart failure.

What about tax hikes for pensions and inheritance?

Many experts believe tax hikes are on the way to help pay for the coronavirus crisis spending.

Pensions, capital gains tax, fuel duty and inheritance tax have all been earmarked by commentators as areas that could see levies raised – but this is unlikely to be addressed in tomorrow’s review.

Increasing taxes now could cause even more damage to the economy and undermine any recovery.

Daniel Bunn, from the Tax Foundation, said: “The challenge that the pandemic has created for public finances should be met with sound policies for the longer term. Now is not the time for tax hikes, however.”

What has already been announced?

Last week, the Prime Minster announced a huge £24.1billion war chest to transform our Armed Forces and become Europe’s naval superpower once again.

It’s the biggest investment in defence since the Cold War will be used to create a new space command, cyber force and artificial intelligence agency.

But the PM dodged questions on how it was being funded, which has led many to believe there will be a cuts to foreign aid.

In July, Boris Johnson also said that schools will get a £2.2billion boost in funding from next year, bringing the total spend on education to £14.4billion over the next three years.

Secondaries will get a minimum of £5,150 a pupil — up from £5,000 this year — while primaries will get at least £4,000 a pupil, up from £3,750.

Schools also get grants from a £1billion pot to help catch up following the first national lockdown.