RISHI Sunak will today go on a last spending splurge to get the nation through the worst of the coronavirus crisis – before tax rises and pay freezes may come next year.

The Chancellor will spell out the details of his one-year spending review today, allocating cash to departments to get them through the winter – but it will come with a gloomy set of economic forecasts.

The Chancellor said this morning: “Individuals, families and communities must become stronger, healthier and happier as a result of this Spending Review.

“That is the true measure of our success.”

Yet, dire financial warnings are expected to say Britain faces years of disruption as a result of the coronavirus crisis – and it will take years to pay back the billions of pounds borrowed this year.

He told Cabinet this morning that “the forecasts will show the impact the coronavirus pandemic has had on our economy will make for a sobering read, showing the extent to which the economy has contracted and the scale of borrowing and debt levels.”

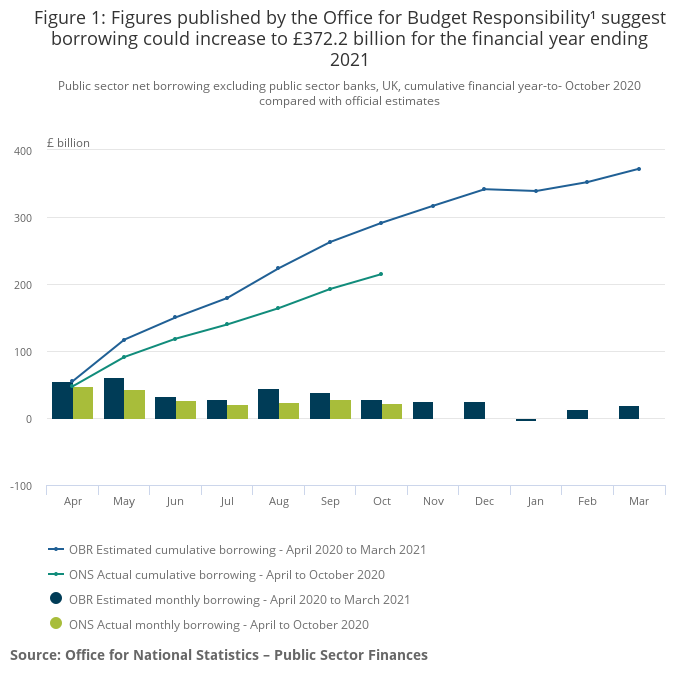

He is due to present Parliament with updated economic predictions from the Office for Budget Responsibility (OBR), which is due to show government borrowing will be close to a whopping £400 billion this year.

The official figures are due to show public spending jumping above 50 per cent of GDP – the highest ration since World War II, with national debt at an eye-watering 60-year high.

Mr Sunak will promise to protect people’s lives and livelihoods with the “support they need to get through Covid”.

Last month, he extended the furlough scheme to last through until March as Boris Johnson warned the UK faced a “hard winter” of further coronavirus restrictions.

And he will stick to promises to fund public services with more cash for schools, hospitals and the police.

But in a glimmer of hope the OBR forecasts now show Britain is on course to defy previous gloomy predictions with a historic V-shaped recovery by recording the fastest GDP growth since 1941.

That will come after the economy shrunk an estimated 10 per cent this year in the deepest recession in 300 years.

But as it’s not a Budget or an Autumn Statement, today’s event won’t contain huge tax tweaks or other major fiscal changes.

BACK TO WORK

He will reveal a three-year programme — the Restart Scheme — to try to assist more than a million long-term unemployed.

The concept is to give those who have been out of work for 12 months-plus regular intensive support to suit their circumstances.

But the Treasury estimates the scheme could be successful for only around 300,000, though they claim this will make it worthwhile.

That is just 70,000 more than would find work without the extra support, costing taxpayers around £42,000 for each job found.

A similar scheme launched by the 2010 Coalition Government stimulated £3.21 of extra economic activity for every £1 spent in four years.

There will be a further £1.4billion of funding for Job Centre Plus.