Introduction

Bitcoin's correlation with other assets has always been a topic of interest in the financial media. While it is commonly compared to tech stocks and the US dollar, it's worth examining whether these correlations can actually help predict future price movements. In this article, we will explore several reports that analyze Bitcoin's relationship with different asset types.

Bitcoin's historic correlations

A report published by the Multidisciplinary Digital Publishing Institute in October 2022 revealed some key findings regarding Bitcoin's correlations with traditional financial assets. It concluded that long-term correlations are stronger than short-term correlations due to Bitcoin's extreme volatility. It also noted that Bitcoin can be positively correlated with risk assets and negatively correlated with the US dollar, making it a potential hedge against the dollar. While some of these conclusions may have changed with newer price data, they still offer valuable insights.

Crypto-specific stocks

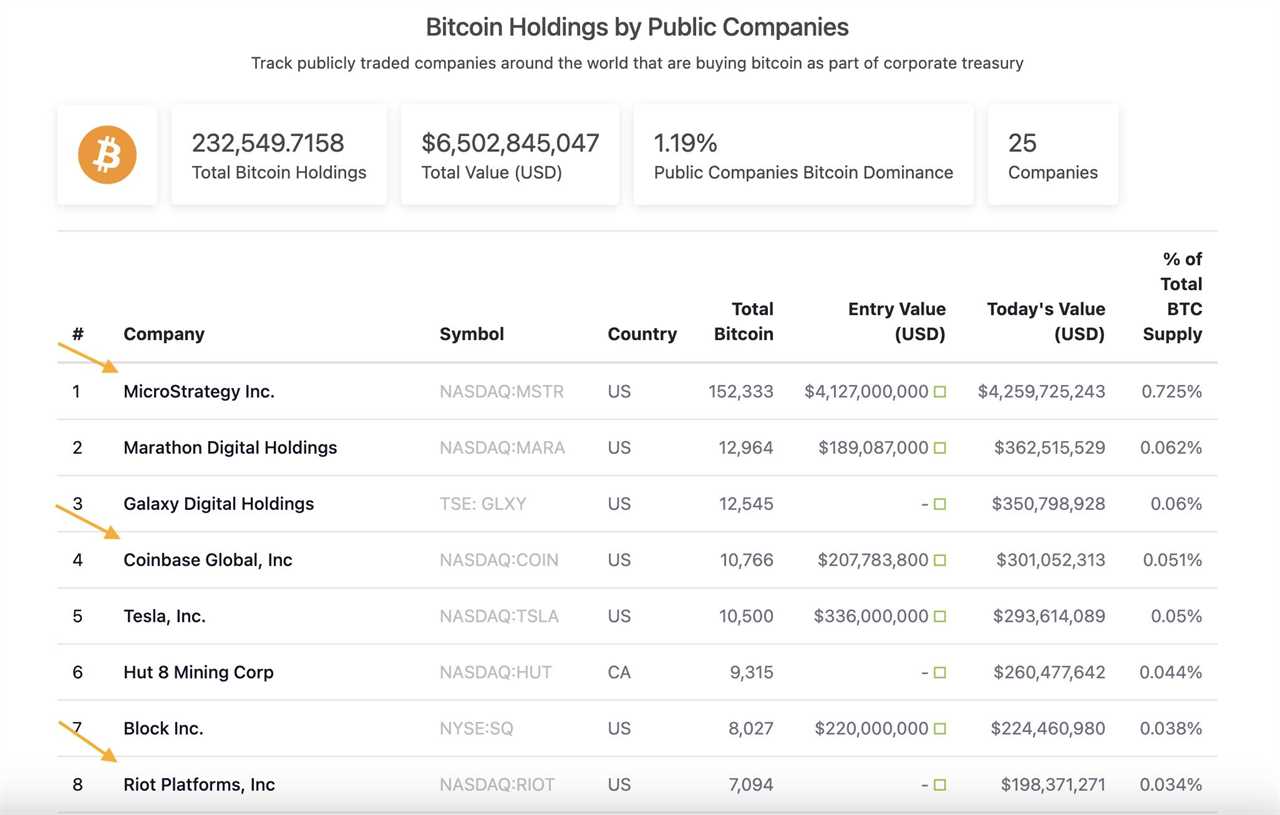

Several crypto-related equities have shown a strong correlation with Bitcoin. The 90-day correlation coefficient for BTC/MSTR, BTC/COIN, and BTC/RIOT has remained close to 1 in recent months. These stocks have outperformed Bitcoin this year while also exhibiting greater volatility. This correlation is attributed to the substantial amount of Bitcoin holdings these companies have on their balance sheets. For example, MSTR holds 152,333 Bitcoin, making it the public company with the most holdings.

Precious metals

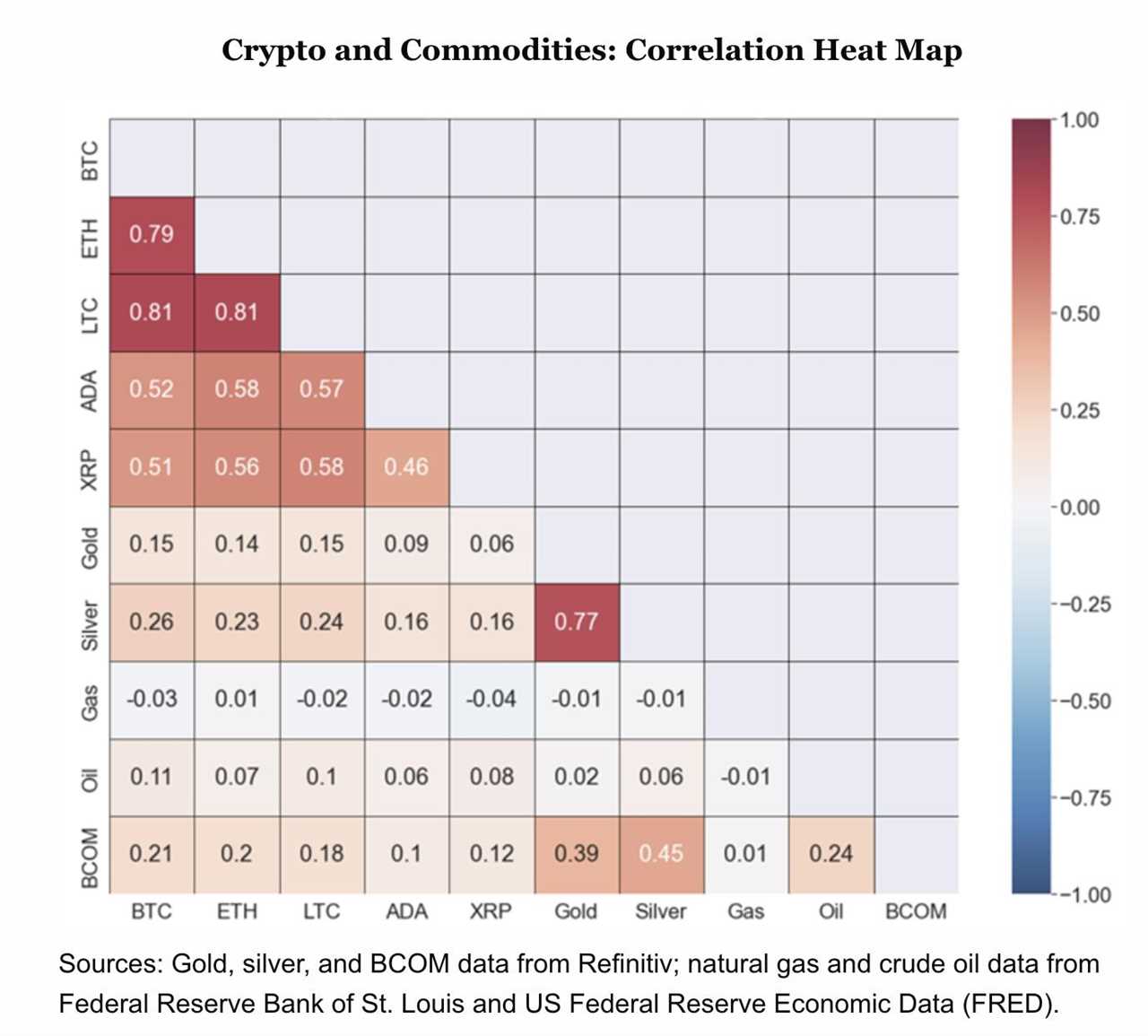

When it comes to the correlation with commodities and precious metals, silver has actually surpassed gold in mirroring Bitcoin's price moves since 2019. According to a report by the CFA Institute, silver has had the highest correlation with Bitcoin, reaching 0.26, while gold's correlation was only 0.15, potentially due to silver's greater volatility. This suggests that silver may be a better indicator of Bitcoin's movements in the market.

Passive and active equity funds and bonds

Looking at the correlation between stocks as a whole and Bitcoin, examining an index or ETF provides a broader overview. Growth funds have shown a stronger correlation with cryptocurrencies than value funds, with a correlation coefficient of 0.41 compared to 0.35. In terms of bonds, there is little to no relationship with Bitcoin. Passive bond funds had a correlation of 0.11, while active bond funds were slightly higher at 0.13.

Bitcoin's correlations are not definitive

It's important to note that Bitcoin's correlations with other assets can change rapidly due to its volatile nature. However, the data used in this article provides an accurate representation of the assets that have been most closely correlated with Bitcoin in the recent past. It is likely that crypto-specific stocks will continue to have a strong correlation due to their Bitcoin holdings, while the correlation with commodities and equity funds may change in the future.

This article does not provide investment advice. Readers should conduct their own research and consider the risks involved before making any investment decisions.