Exploring Use Cases for Potential e-AUD

Australia's central bank, the Reserve Bank of Australia (RBA), has recently concluded its pilot of a central bank digital currency (CBDC). The pilot, conducted in partnership with the Digital Finance Cooperative Research Centre (DFCRC), examined the potential use cases for a digital Australian dollar (e-AUD). The findings, outlined in a report released on August 23, revealed several areas where a CBDC could be advantageous.

Improved Payment Arrangements and Asset Tokenization

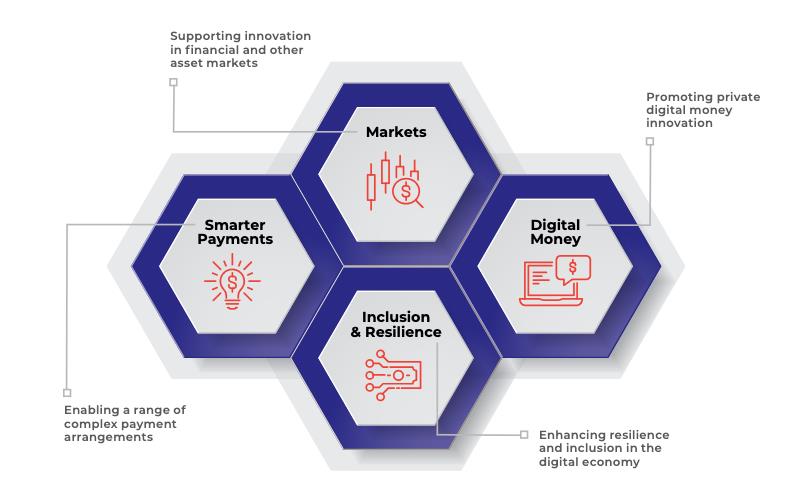

The pilot identified four main areas where a CBDC could provide improvements. Firstly, it highlighted the potential for "smarter" payments, where a tokenized CBDC enabled more complex payment arrangements that are currently unsupported by existing systems. Additionally, the report noted that a CBDC could promote innovation in financial markets, including debt securities markets. It could also stimulate innovation in emerging private digital money sectors and enhance resilience and inclusion within the wider digital economy.

Legal Status and Regulatory Treatment Concerns

During the pilot program, participants raised concerns over the legal status and regulatory treatment of the CBDC. The program operated as a real legal claim on the RBA, rather than as a proof-of-concept, which created uncertainty for participants. Some were uncertain whether they were providing custody services or dealing in a regulated financial product by holding or transacting with the pilot CBDC. The report emphasized the need for legal and regulatory reforms to address such issues before the issuance of a CBDC.

This is a developing story, and as more information becomes available, further updates will be provided.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/world-mobile-launches-dewi-app-on-google-play-for-uk-users