Eliminating the "Poor Optics" for Companies Holding Digital Assets

The United States Financial Accounting Standards Board (FASB) has recently approved new rules for cryptocurrency accounting, aiming to address the "poor optics" that have impacted companies holding digital assets. Analysts from Berenberg Capital argue that these changes will particularly benefit companies like MicroStrategy, allowing them to report their digital asset holdings each quarter without incurring impairment losses.

The Impact on MicroStrategy and Other Companies

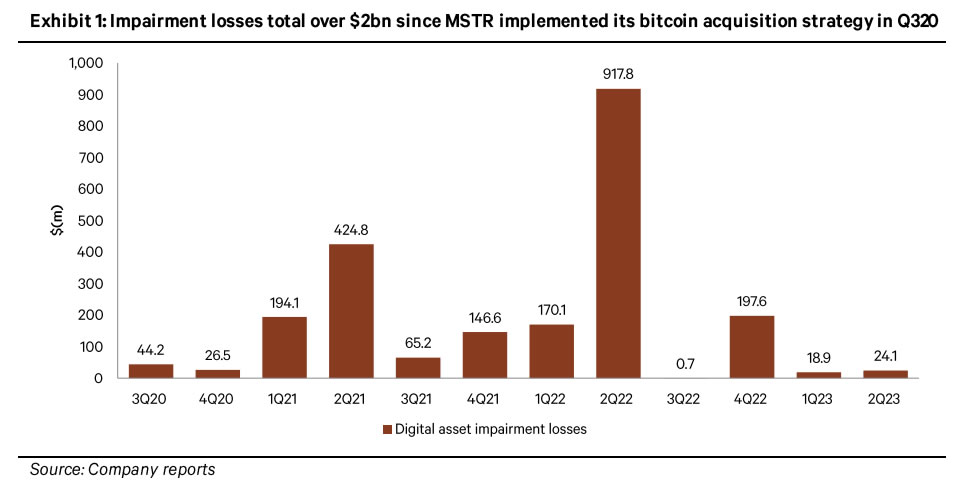

MicroStrategy is one of the companies that will benefit from the new rules. Since August 2020, the company has accumulated $2.23 billion in cumulative impairment losses due to downward moves in the price of Bitcoin. These losses have led to negative news coverage, falsely implying that the company's value had been negatively impacted. With the new rules, MicroStrategy and other firms can report their crypto holdings at fair value, reflecting current market prices and potential price rebounds.

Positive Outcome for Bitcoin Adoption

The changes in accounting treatment are seen as a significant positive catalyst for the price of Bitcoin by MicroStrategy CEO Michael Saylor. Saylor has previously criticized the FASB's treatment of crypto as "hostile" and "punitive." He believes that the new rules will encourage adoption of Bitcoin by tech companies, ultimately benefiting the cryptocurrency's price.

MicroStrategy's Bitcoin Holdings

As of July 31, MicroStrategy holds 152,800 BTC, making it the world's largest corporate holder of the cryptocurrency. With the new rules, Berenberg estimates that the company's BTC holdings will be valued at $8.8 billion by April 2024. Berenberg suggests that MicroStrategy will apply the new rules in advance.

Overall, the approval of new accounting rules by the FASB is expected to bring more transparency and accurate reporting for companies holding digital assets. It also has the potential to positively impact the adoption of cryptocurrencies by tech companies in the United States.