Background

A community member of the decentralized autonomous organization (DAO), Mantle, has called for a halt to the token migration process to prevent the conversion of $43 million worth of BitDAO (BIT) tokens to Mantle (MNT). This comes as a response to suspicions that Alameda Research, a participant in the collapsed FTX exchange, has been involved in dumping the tokens and causing a significant decline in BIT's value.

The Trade and Allegations

On November 2, 2021, BitDAO exchanged 100 million BIT tokens for over 3.3 million FTX tokens (FTT) with Alameda. As part of the agreement, both parties committed to holding each other's tokens for three years, until November 2, 2024. However, following the FTX fallout in 2022, BitDAO accused Alameda of dumping the tokens, which led to a decline in BIT's value. Former Alameda CEO Caroline Ellison denied any involvement in the dump at the time.

Merging the Ecosystem

Several months later, the BitDAO community proposed combining the BitDAO ecosystem, with BitDAO as the governance arm and Mantle as the product. A governance vote was initiated on May 12 by community member Cateatpeanut to unify both entities under the Mantle banner. The proposal received overwhelming community support and was passed on May 19.

The Discussion

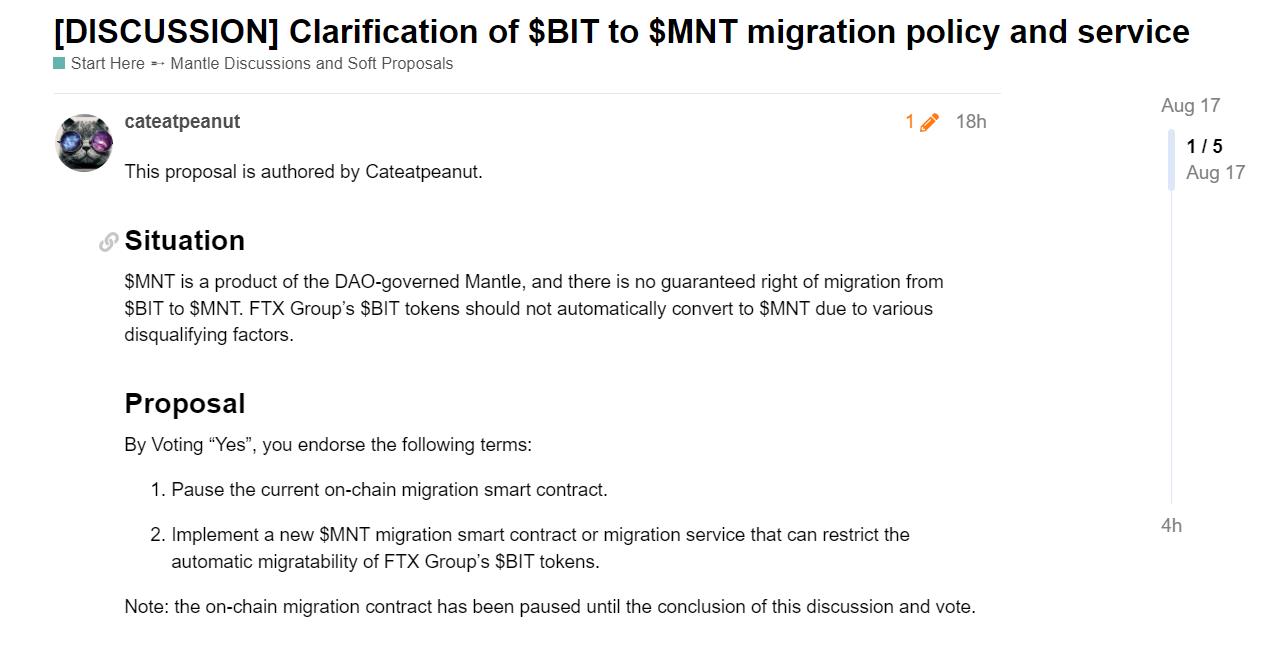

On August 17, community members of Mantle raised concerns about the BIT tokens held by Alameda. Cateatpeanut argued that FTX Group's BIT tokens should not be automatically converted to MNT due to "various disqualifying factors." The community member called for the implementation of a new MNT migration smart contract that would restrict the automatic migration of FTX-owned tokens. As a result, the on-chain migration contract has been temporarily paused until the conclusion of the discussion and voting process.

Overall, the Mantle community is taking steps to address the concerns surrounding the conversion of BIT tokens and ensure a fair token migration process.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoin-drops-below-29k-as-bears-gain-advantage-ahead-of-options-expiry