FOMC Minutes and Options Expiry Fuel Bitcoin Price Decline

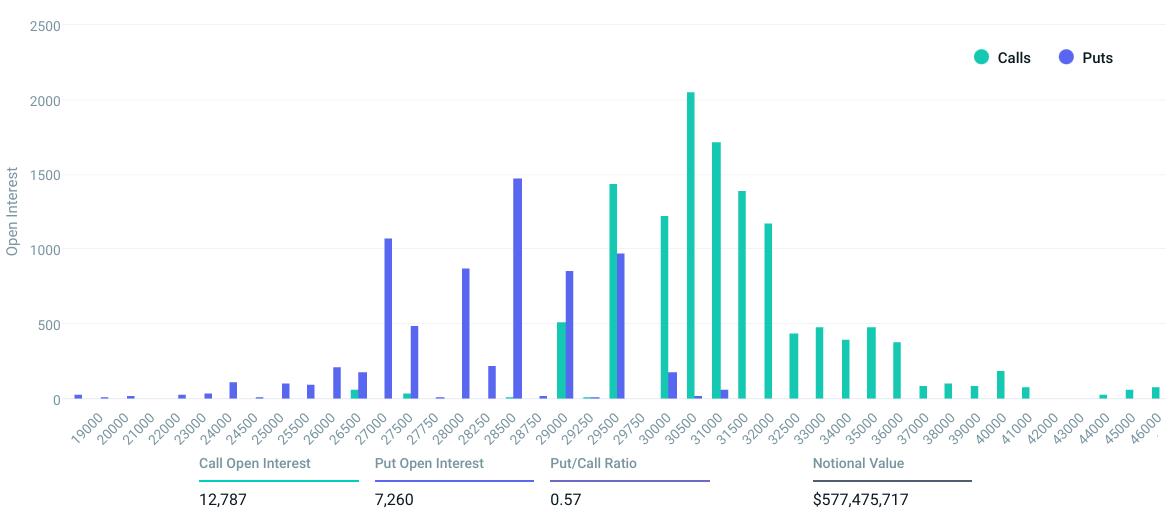

Bitcoin (BTC) closed below $29,000 on August 16, marking the lowest point in 56 days. Analysts speculate that the recent release of the Federal Open Market Committee (FOMC) minutes, expressing concerns about inflation and the possibility of interest rate hikes, contributed to the drop in Bitcoin's price. In addition, the upcoming $580 million Bitcoin options expiry on August 18 has favored the bears, potentially adding further downward pressure on the cryptocurrency.

Fed Minutes Have Limited Impact on Traditional Markets

Federal Reserve Chair Jerome Powell's emphasis on the 2% inflation target in the FOMC minutes led to a rise in U.S. 10-year Treasury yields. This prompted investors to shift away from riskier assets like cryptocurrencies and towards cash positions and companies prepared for a potential economic slowdown. Despite this, the impact of the Fed minutes on traditional markets was limited, with S&P 500 index futures only dropping slightly and crude oil and gold showing mixed results.

China's Economic Concerns Contribute to Decline

Concerns about China's economy may have also played a role in the decline of Bitcoin's price. Lower-than-expected retail sales growth and fixed asset investment in the country could potentially affect the demand for cryptocurrencies.

Bulls Caught Off Guard

Bitcoin bulls placed optimistic bets as the price briefly crossed the $29,700 mark. However, the recent drop below $29,000 caught them off guard. The outcome of the options expiry on August 18 is likely to favor the bears, potentially adding to the downward pressure on Bitcoin's price.

Possible Scenarios Based on Options Contracts

Based on the current price action, there are three possible scenarios for the options contracts available on August 18:

- Between $26,000 and $28,000: 100 calls vs. 5,300 puts. The net result favors the put (sell) instruments by $140 million.

- Between $28,000 and $28,500: 100 calls vs. 3,900 puts. The net result favors the put (sell) instruments by $60 million.

- Between $28,500 and $29,500: 600 calls vs. 1,300 puts. The net result favors the put (sell) instruments by $20 million.

Bears Maintain Advantage Amid Growing Economic Concerns

With investors increasingly concerned about an economic slowdown, the advantage remains with the Bitcoin bears. This trend is expected to continue, especially considering the slim chances of the approval of a spot exchange-traded fund (ETF) for Bitcoin. As a result, those on the bullish side may face further challenges in the short term, with a potential correction in Bitcoin's price.

Please note that this article is for general information purposes only and should not be considered legal or investment advice.