Ethereum Co-Founder Proposes Privacy Pools for Financial Transactions

Ethereum co-founder Vitalik Buterin has published a research paper exploring the use of privacy pools and zero-knowledge proofs to enhance financial transaction privacy and prove dissociation from illicit funds. The paper discusses the popular privacy-enhancing protocol Tornado Cash, which recently faced criminal charges due to alleged extensive use by bad actors. Buterin's research proposes an extension of Tornado Cash's approach that would enable users to publicly prove the source of funds on-chain through membership proofs and exclusion proofs.

Balance Between Honest and Dishonest Users

According to the research paper, the proposed concept could strike a balance between honest and dishonest protocol users, potentially enabling financial compliance on-chain in the future. By allowing users to publish zero-knowledge proofs, they can demonstrate that their funds do not originate from known unlawful sources while still preserving transaction privacy. This could be achieved by proving membership in custom association sets that satisfy certain properties required by regulation or social consensus.

Privacy Pools and Zero-Knowledge Proofs

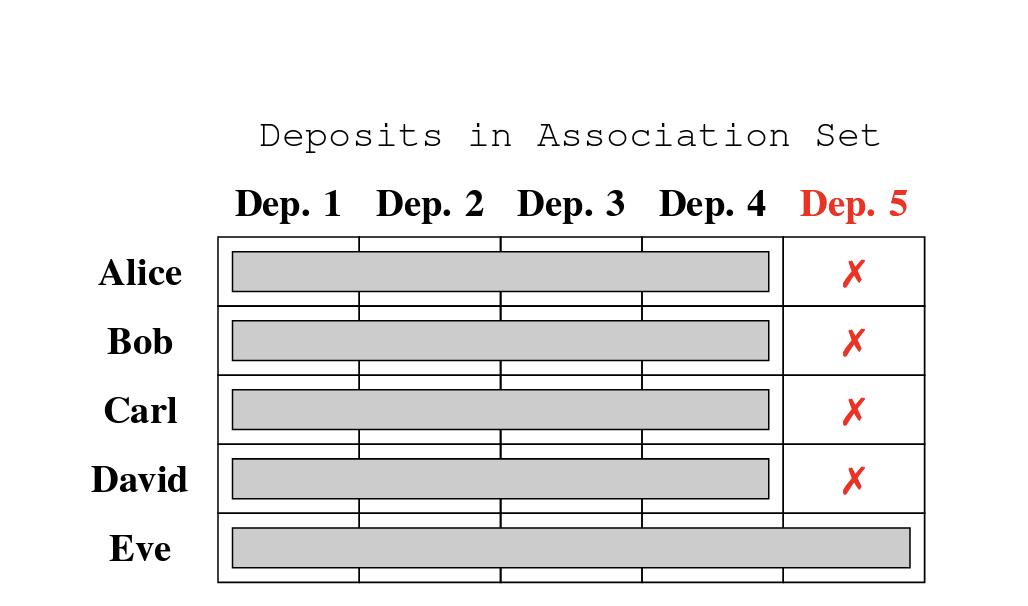

Privacy pools, based on zero-knowledge proofs, allow users to exclude themselves from anonymity sets that include addresses related to illegal activities. Zero-knowledge proofs enable users to provide evidence without disclosing the details of the statement. The research proposes using association sets that are more restrictive than simply linking withdrawals to previously-made deposits. Users can specify the association set they want, incentivizing them to make the sets larger to safeguard privacy. The example provided in the paper demonstrates how users can prove their disassociation from a known criminal while avoiding suspicion from merchants or exchanges.

Potential Use Cases and Compatibility with Regulation

The paper outlines several other potential use cases for zero-knowledge proofs, such as demonstrating funds are not tied to illicit sources or proving funds originate from a specific set of deposits without revealing further information. It suggests that privacy and regulatory compliance can coexist if privacy-enhancing protocols allow users to prove certain properties regarding the origin of their funds. The rise of protocols working on zero-knowledge solutions, particularly in the Ethereum network, aligns with the growing need for financial privacy as global regulations evolve and users seek to protect their privacy.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoins-volatility-squeeze-raises-questions-about-future-direction