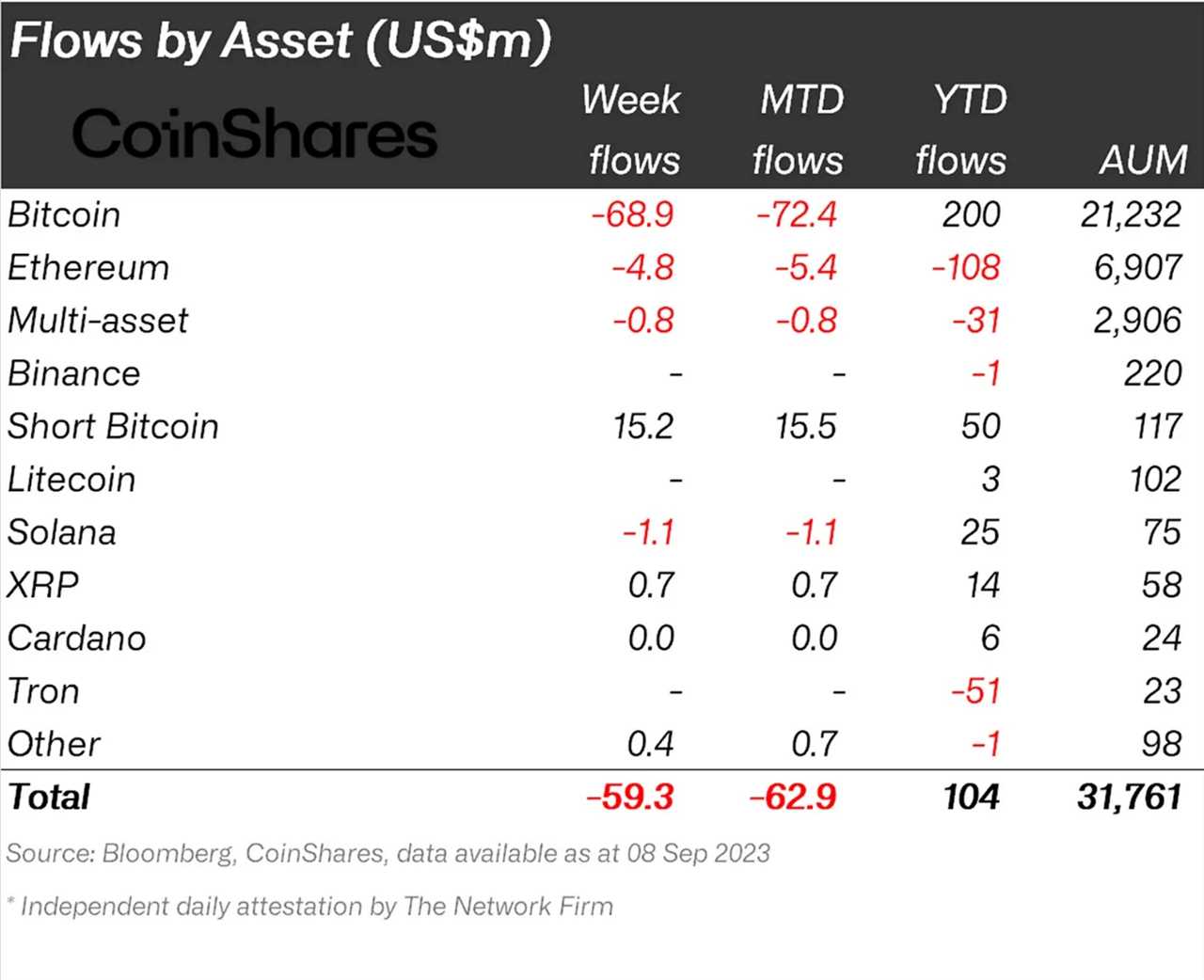

Cryptocurrency asset outflows for the week of Sept. 3 through 9 amounted to $59.3 million, bringing the current run to $249 million over four consecutive weeks. Bitcoin led the way, with $68.9 million in outflows, while Short Bitcoin inflows reached $15.2 million and XRP saw $0.7 million in inflows. Regulatory concerns and financial market insecurity have been cited as the main reasons for the streak. CoinShares also reported a significant drop in trading volumes.

Solana's run comes to an end

Solana, which enjoyed nine weeks of inflows totaling $14.1 million, saw $1.1 million in outflows last week. Despite being dubbed "the most loved altcoin amongst investors" by CoinShares, the recent outflows indicate a change in sentiment.

Ether experiences outflows as well

Ether, the second largest cryptocurrency by market capitalization, also experienced outflows during the week, totaling $4.8 million. This brings its year-to-date outflows to $108 million, leading CoinShares to label it the "least loved digital asset amongst ETP investors this year."

Germany, Canada, and the United States see significant outflows

Germany, Canada, and the United States were the top three countries with significant outflows, totaling $20 million, $17.6 million, and $12.3 million, respectively. In contrast, only Brazil registered inflows, with a modest $0.1 million. Switzerland and Sweden also saw notable outflows, with $7.4 million and $2.3 million lost, respectively.

Experts predict Bitcoin's slump to continue

Expert analysts are forecasting a continuation of Bitcoin's slump, with some predicting the coin to reach as low as $20,000. This negative sentiment could contribute to further outflows, as the current four-week run suggests that altcoins are unlikely to disrupt the balance of flows.