Fake License Data

Several cryptocurrency platforms that report billions in daily trades on CoinMarketCap have been found to mislead their customers about holding certain crypto licenses, according to an investigation by Cointelegraph.

Bitspay's Fake License Claims

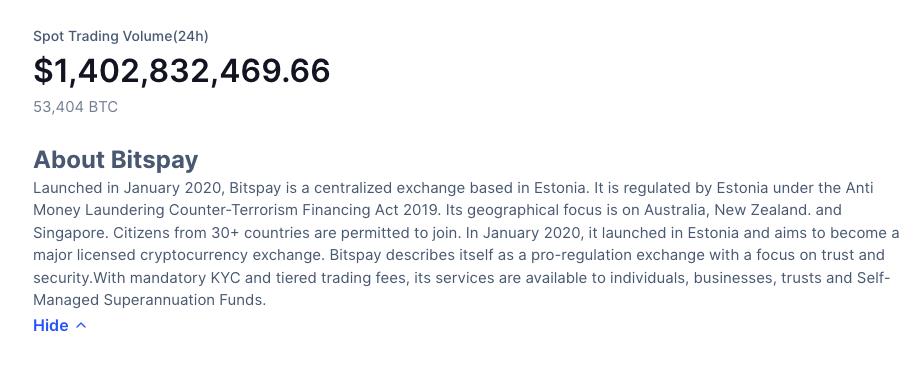

Bitspay, a crypto exchange reporting $1.4 billion daily trades on CoinMarketCap, claimed to be licensed and regulated by Estonia. However, when questioned about this license, the company quickly removed the reportedly fake license information from its website.

Impressive Trading Volumes

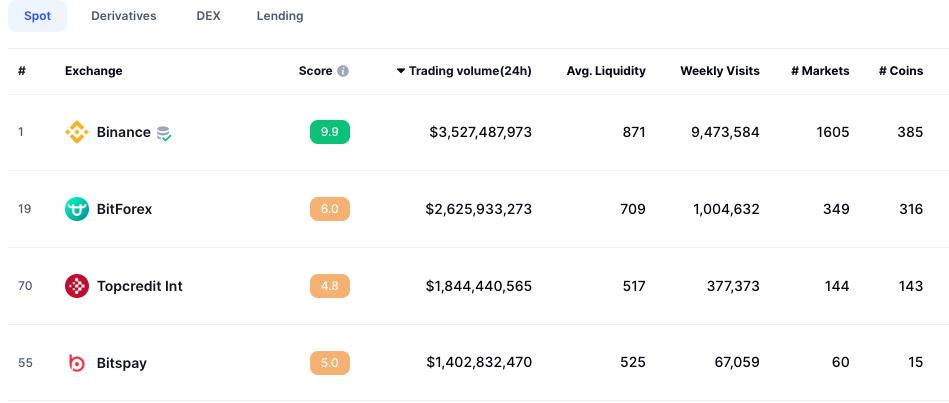

Bitspay is currently the fourth-largest crypto exchange on CoinMarketCap in terms of daily trading volumes, following platforms like Binance, Bitforex, and Topcredit.

Misleading Information

Bitspay had claimed on its CoinMarketCap page to be a centralized exchange based in Estonia, regulated by Estonian authorities under Anti-Money Laundering and Countering the Financing of Terrorism regulations. However, Estonia’s Financial Intelligence Unit (FIU) confirmed that Bitspay did not hold a valid license in Estonia.

Rebranding and Lack of Information

After being questioned by Cointelegraph, Bitspay rebranded its website and removed all information about being registered or regulated in Estonia. The exchange also has not provided any information about its registration or license on its new website. Bitspay claims a daily trading volume of 65,249 Bitcoin (BTC), despite having a relatively small following on social media.

Other Suspicious Platforms

Bitspay is not the only platform reporting massive trading volumes on CoinMarketCap while providing little information about its licenses, founders, or background. Platforms like Topcredit and Bika have also been unwilling to disclose such information.

CoinMarketCap's Response

CoinMarketCap, the platform on which these exchanges are listed, acknowledged that self-reported data can be problematic but stated that APIs are the only viable source for data collection. CoinMarketCap encourages users to perform their own due diligence and emphasized that its role is as an objective information aggregator, not a regulator.

Frequent Criticism of Trading Volume Data

Websites like CoinMarketCap have faced criticism in the past for providing inflated exchange trading volumes. Previous investigations have suggested that a significant portion of reported trading volume in the crypto industry appears suspicious.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoins-future-at-risk-us-dollar-strength-index-signals-potential-challenges