The US Dollar Strength Index (DXY) reached its highest level in almost 10 months on September 22, demonstrating growing confidence in the US dollar compared to other major fiat currencies. This surge in demand for the US dollar has raised concerns among investors about the potential impact on Bitcoin and cryptocurrencies.

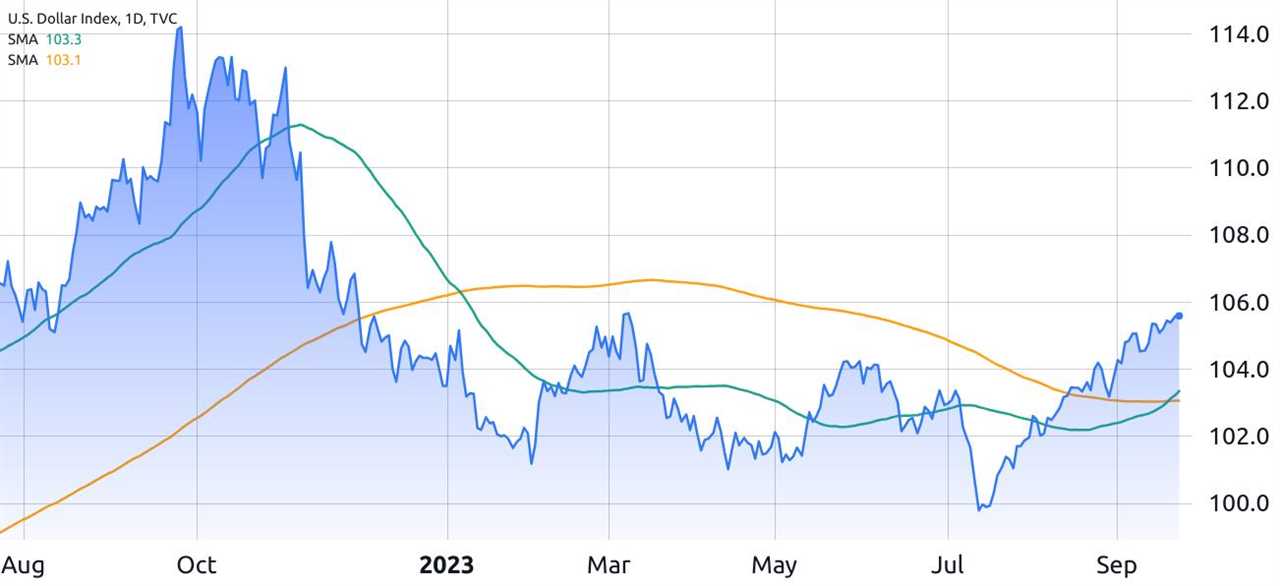

DXY Confirms "Golden Cross" Pattern

The DXY index recently confirmed a "golden cross" pattern when the 50-day moving average surpassed the longer 200-day moving average. Technical analysts often view this signal as a precursor to a bull market, indicating potential for further strength in the US dollar.

Recession and Inflation Risks

Despite concerns about inflation and economic growth in the US, the US dollar has exhibited strength in September. Slower GDP growth expectations for 2024, tighter monetary policy, rising interest rates, and diminishing fiscal stimulus are factors contributing to this trend. However, not every increase in the DXY index reflects confidence in the US Federal Reserve's economic policies.

When the current inflation rate is 3.7% and rising, investors may choose to sell US Treasuries and hold onto cash instead, suggesting potential recession or significant inflation. This shift in investor behavior reinforces the need to wait for a more favorable entry point.

Bitcoin's Potential

While a stronger US dollar may initially decrease demand for risk-on assets like Bitcoin, it is important to consider that increased money supply due to inflation and recession pressures may favor Bitcoin in the long run. Scarce assets like Bitcoin and leading tech companies may continue to perform well even during an economic slowdown.

As the government raises the debt ceiling and increases the money supply, investors face dilution, making nominal returns less significant. This explains why alternative assets like Bitcoin could be seen as a haven against stagnant economic growth and rampant inflation.

Overall, the impact of the DXY golden cross on Bitcoin's future is uncertain, especially in the context of longer timeframes.

Please note that this article is for general information purposes only and should not be considered legal or investment advice. The opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.