Bitcoin Derivatives Hold Strong Amidst Price Resistance

Bitcoin (BTC) recently reached $38,000 but faced significant resistance at that price level. However, despite the dip to $37,000, Bitcoin traders maintain their bullish sentiment.

Tether Trading Below Fair Value in China Raises Questions

An intriguing development is taking place in China as Tether (USDT) trades below its fair value in the local currency. This discrepancy may be due to differing expectations between professional traders and retail clients.

Regulatory Impact on Bitcoin Derivatives

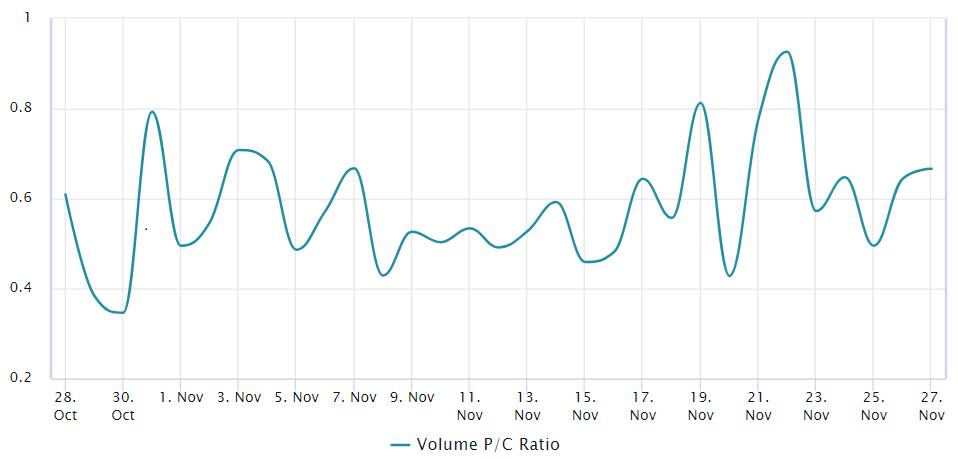

Regulations have been a hot topic in the cryptocurrency market. By examining BTC options volume, we can gauge the exposure of whales and arbitrage desks using Bitcoin derivatives. Surprisingly, there has been a diminished demand for protective measures despite increased regulatory scrutiny.

Bitcoin Futures Premium in Neutral Territory

Bitcoin futures contracts, particularly the monthly ones, typically trade at a premium to account for the extended settlement period. However, the BTC futures premium dipped to a more neutral level as Bitcoin's price tested the $37,000 support.

Retail Traders Less Optimistic About Short-Term Triggers

Retail interest in Bitcoin has waned due to the absence of a short-term positive trigger, such as the potential approval of a Bitcoin exchange-traded fund (ETF). The USDT premium relative to the Yuan has also hit a low point, suggesting decreased demand among China-based retail crypto traders.

Professional Traders Unfazed by Short-Term Corrections

Despite recent regulatory actions, professional traders remain unfazed and optimistic about the future. The divide between professional traders and retail investors may be attributed to differences in time horizons.

Note: This article is for general information purposes and should not be taken as legal or investment advice.