Introduction

Bitcoin (BTC) traders have become accustomed to less volatility in recent months, but history shows that the cryptocurrency is no stranger to price swings. The recent correction from $29,340 to $25,980 took many by surprise, leading to the largest liquidation since November 2022. But was this correction significant in terms of the market structure?

The role of reduced liquidity in volatility spikes

Some experts argue that reduced liquidity is the reason behind recent spikes in volatility. Graphs from Kaiko Data show that the decline in Bitcoin's order book depth has mirrored the decrease in volatility. This suggests that market makers may have adjusted their algorithms to match the current market conditions.

Examining the derivatives market

To assess the impact of the drop to $26,000, it is important to delve into the derivatives market. This analysis aims to determine whether whales and market makers have become bearish or if they are demanding higher premiums for protective hedge positions.

Similar instances in the recent past

Two events stand out when looking at similar instances of price declines:

- In March 2022, Bitcoin plummeted by 11.4% to $19,600 following the liquidation of Silvergate Bank, a key operational partner for cryptocurrency firms.

- In April 2022, Bitcoin's price dropped by 10.4% and revisited the $27,250 level after Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), addressed the House Financial Services Committee, providing little reassurance regarding regulatory efforts.

Not every 10% Bitcoin price crash is the same

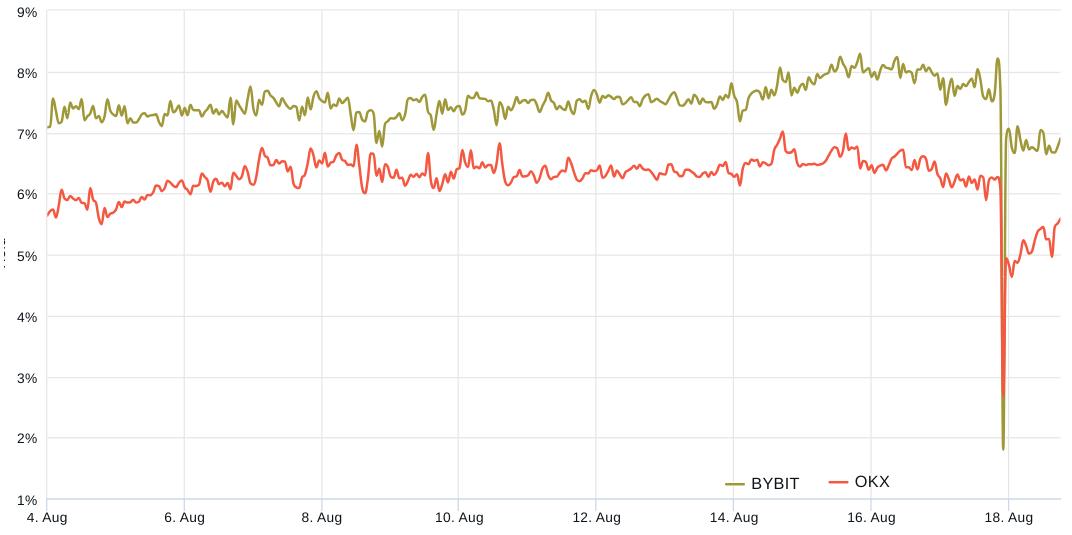

Bitcoin quarterly futures typically trade with a slight premium compared to spot markets, reflecting sellers' desire for additional compensation for delaying settlement. Prior to the March 2022 crash, the futures premium was at 3.5%, indicating moderate comfort. However, when the price dipped below $20,000, the premium shifted to a discount of 3.5%, indicating bearish market conditions. In contrast, the April 2022 correction had minimal impact on the futures premium, remaining around 3.5%. The recent 11.4% crash in August 2022 showed distinct differences from previous instances, with the futures premium starting at a higher level and swiftly returning to a bullish position after the crash.

Options markets confirm lack of bearish momentum

Analysis of options markets also reveals no signs of professional traders adopting a bearish stance. The demand for call (buy) BTC options remained high ahead of the August 15 crash but stayed within the neutral range after the correction.

Conclusion

While the derivatives data does not guarantee a swift return of BTC to the $29,000 support level, it does suggest that professional traders are not adopting a bearish stance. This reduces the likelihood of an extended price correction.