Whales Accumulating or Asymmetric Picture?

Bitcoin's open interest on derivatives exchanges experienced a sudden surge of $1 billion on Sep. 18, prompting investors to question whether whales were accumulating in anticipation of the unsealing of Binance's court filings. However, a closer look at derivatives metrics suggests a more nuanced picture, as the funding rate did not exhibit clear signs of excessive buying demand.

Unsealing of Binance's Court Filings

The decision to unseal these documents was granted to the U.S. Securities and Exchange Commission (SEC), which had accused Binance of non-cooperation despite previously agreeing to a consent order related to unregistered securities operations and other allegations.

Little Concrete Information Revealed

The open interest spiked to $12.1 billion while Bitcoin's price concurrently increased by 3.4%, the highest point in over two weeks at $27,430. However, investors soon realized that, aside from a comment by the Binance.US auditor regarding the challenges of ensuring full collateralization, there was little concrete information revealed in the unsealed documents.

Court's Outcomes Disappoint Whales

By the end of Sep. 18, Bitcoin's open interest had receded to $11.3 billion as its price dropped by 2.4% to $26,770. This decline indicated that the entities behind the open interest surge were no longer inclined to maintain their positions. These whales were likely disappointed with the court's outcomes, or the price action may not have unfolded as expected. In any case, 80% of the open interest increase disappeared in less than 24 hours.

Does Binance's Court Ruling Solely Affect Bitcoin's Price?

It can be assumed that most of the demand for leverage was driven by bullish sentiment, as Bitcoin's price climbed alongside the increase in open interest and subsequently plummeted as 80% of the contracts were closed. However, attributing cause and effect solely to Binance's court rulings seems unwarranted for several reasons.

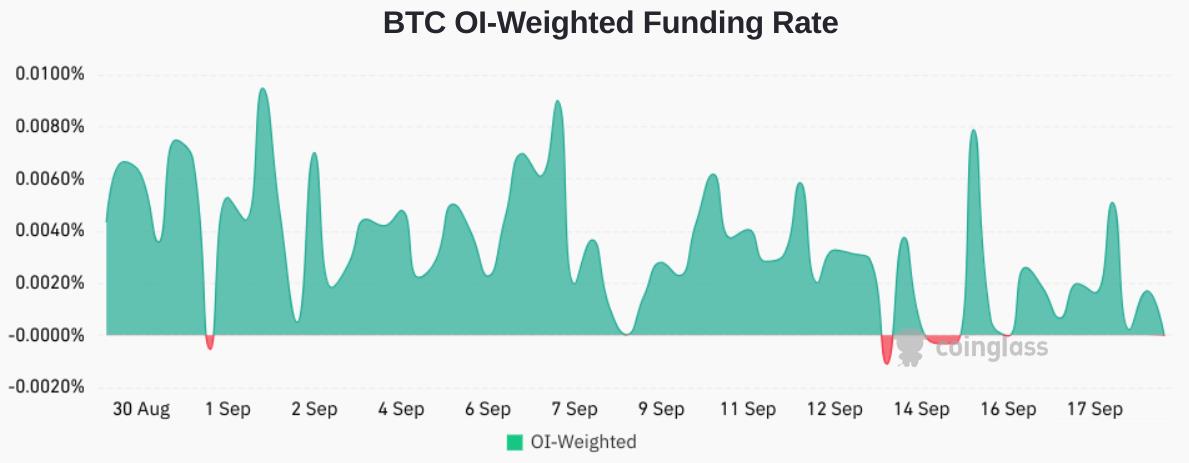

No Spike in Funding Rate

If there had indeed been an unforeseen demand surge of $1 billion in open interest, primarily driven by desperate buyers, it's reasonable to assume that the funding rate would have spiked above 0.01%. However, quite the opposite unfolded on Sept. 19, as Bitcoin's open interest expanded to $11.7 billion while the funding rate plunged to zero.

Price Pressure Tends to be Upward

With Bitcoin's price rallying above $27,200 during the second phase of open interest growth, it becomes increasingly evident that, regardless of the underlying motives, the price pressure tends to be upward. While the exact rationale may remain elusive, certain trading patterns could shed light on this movement.

Involvement of Market Makers?

One plausible explanation could be the involvement of market makers executing buy orders on behalf of substantial clients. This would account for the initial enthusiasm in both the spot market and BTC futures, propelling the price higher. After the initial surge, the market maker becomes fully hedged, eliminating the need for further buying and leading to a price correction.

Delve into Arbitrage Desks and BTC Futures Funding Rate

Rather than hastily labeling every "Bart" formation as manipulation, it is advisable to delve into the operations of arbitrage desks and carefully analyze the BTC futures funding rate before jumping to conclusions. Thus, when there is no excessive demand for leveraged long positions, an increase in open interest does not necessarily signify a buying spree, as was the case on Sep. 18.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/cryptocurrency-lender-hodlnaut-rejects-buyout-deal-as-settlement-token-plummets-90