Bullish Resilience in the Face of Bearish News

The cryptocurrency market has defied expectations yet again as Bitcoin (BTC) maintains its price near $37,000, despite recent bearish events. This surprising performance comes in the wake of Binance's plea deal with US authorities over money laundering and terror financing charges. While many expected these events to have a severe negative impact on Bitcoin's price, it seems that entities may have been manipulating the market to avoid contagion.

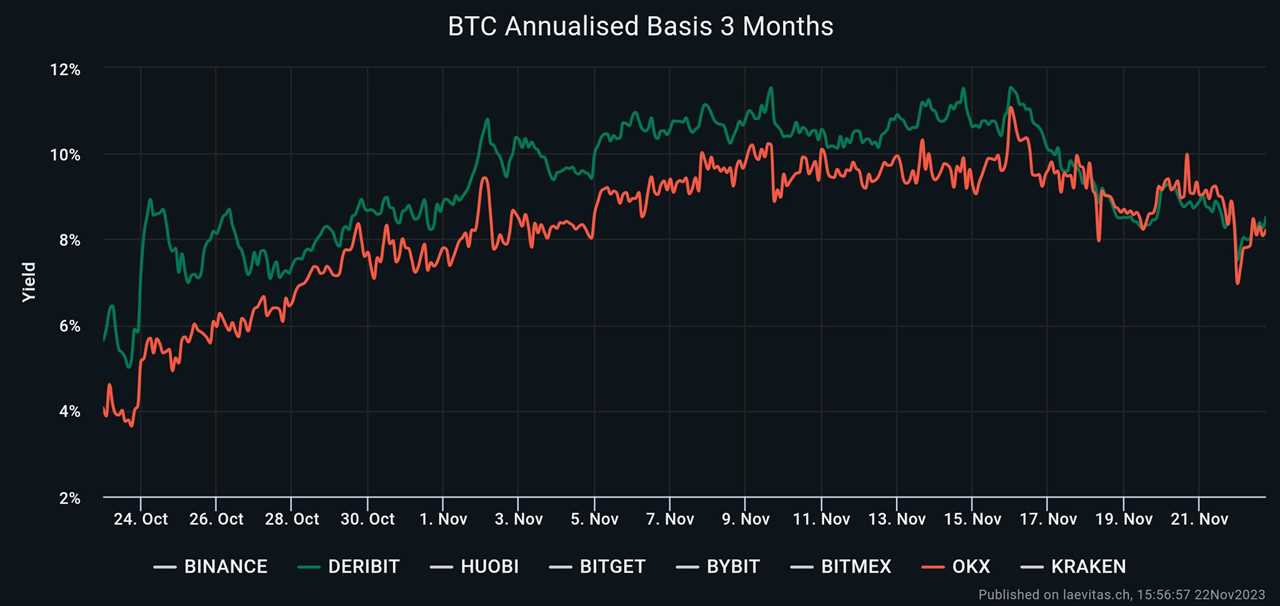

Examining Bitcoin Derivatives for Risk Assessment

To truly understand investor sentiment and risk aversion, it is crucial to analyze Bitcoin derivatives rather than solely focusing on current price levels. By looking at BTC futures and options metrics, we can gain insights into how traders are hedging their positions and whether there has been a significant influx of hedge operations.

Bitcoin Derivatives Display Resilience

Despite recent regulatory actions and news surrounding Mt. Gox, Bitcoin derivatives have shown resilience. The premium on Bitcoin monthly futures contracts, which reflects the demand for leverage longs, is currently at 8%, indicating strong but not excessive demand. Similarly, the options 25% delta skew, which measures the pricing of upside or downside protection, suggests optimism among professional traders.

A Positive Outlook for Bitcoin

Given the positive indicators from Bitcoin derivatives and the lack of impact from regulatory actions and Mt. Gox news, the market seems to be in a good mood. The recent liquidation of $70 million leverage BTC longs has also reduced the pressure for negative price oscillations. With the final round of ETF decisions set for January and February, there is little incentive for bears to pressure the market. As a result, the path to $40,000 becomes more certain.