The Power of AI in Finance

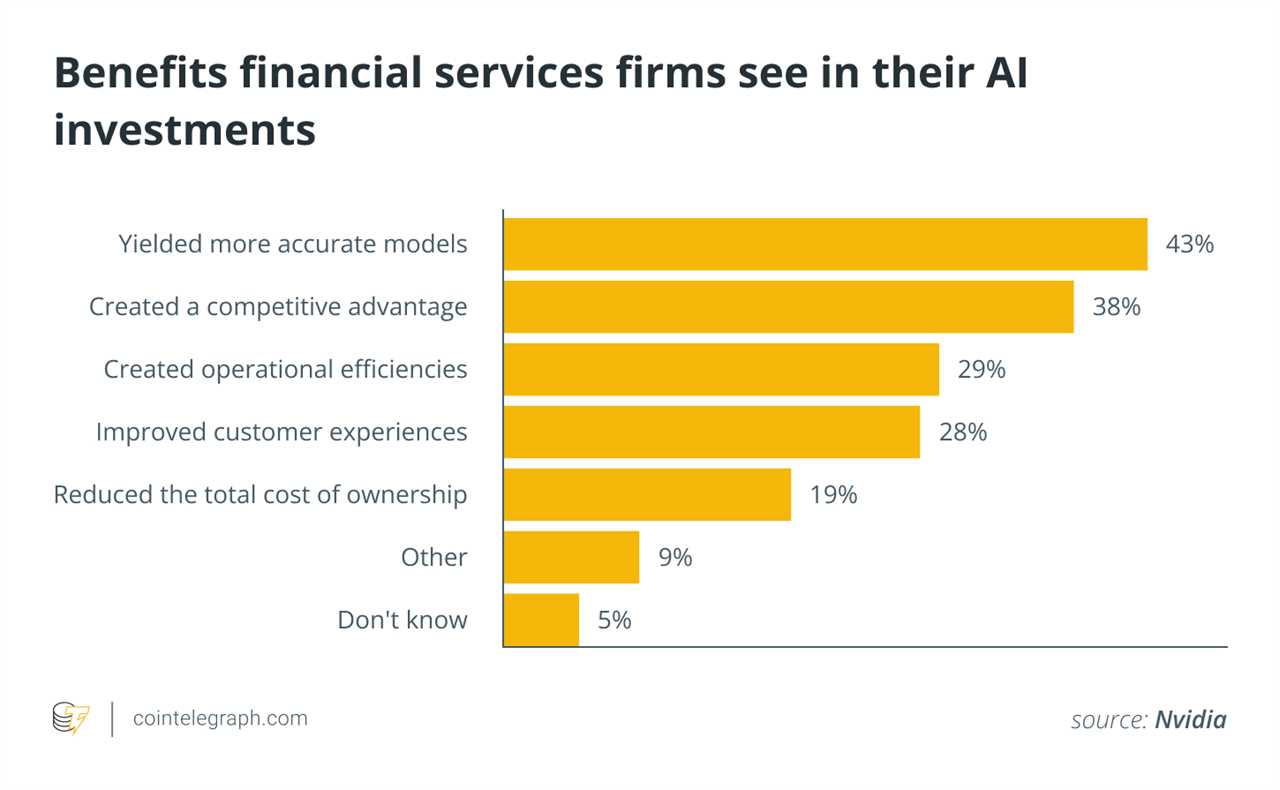

Artificial intelligence (AI) and machine learning (ML) are making a significant impact on the financial sector. According to a report by Nvidia, over 75% of financial companies are utilizing ML to optimize their operations. Many firms state that AI has helped them achieve more accurate prediction models and increase annual revenue by over 10%.

Transforming Data Processing

AI is bringing changes to the financial sector similar to computer-driven trading models introduced by Wall Street traders in the 1980s. Machine learning is being used to develop trading models, analyze risk from borrowers, and predict short-term price movements. These advancements enable traders to make better investment choices and improve decision-making capabilities.

Enhancing Data Security

AI-enabled platforms are enhancing the security capabilities of blockchain systems. They provide real-time threat feeds that help detect various scams and threats. Forta, for example, detected attacks and hacks on protocols like Euler and SushiSwap. As a result, Forta gained financial backing from industry players such as Coinbase Ventures and a16z.

Solving Liquidity Fragmentation in Crypto Markets

The crypto market still faces challenges with illiquidity compared to traditional finance. AI can help address this issue by predicting digital asset order book prices in real time, providing deeper liquidity for trading pairs. Platforms like FluidAI use AI-based Smart Order Router and Matching Engine to enhance liquidity reserves and minimize adverse market impacts.

Sentiment Analysis in a Globalized Economy

Sentiment analysis plays a crucial role in various industries, including crypto. AI-powered sentiment analysis tools can understand the tone of a statement and help businesses personalize their marketing efforts. These tools also enable companies to outperform competitors, attract and retain consumers, and understand market conditions.

The Future of Finance

AI and blockchain technology have the potential to reshape global finance. By combining distributed ledger technology and AI's ability to process blockchain data, market participants can make informed decisions. Financial institutions should consider utilizing technologies like natural language processing, deep learning, reinforcement learning, generative models, and edge computing to stay ahead.

Overall, AI and ML are revolutionizing the finance industry by optimizing operations, improving security, solving liquidity issues, and providing intelligent insights. While AI is not a magic wand, it serves as a valuable assistant in enhancing productivity.