International bank messaging network Swift has released a report outlining how it can connect with blockchains to address the lack of interoperability between different blockchain networks. The report, titled "Connecting blockchains: Overcoming fragmentation in tokenised assets," suggests that an incremental approach that links existing systems to blockchains is a more feasible option for market development in the near term, rather than merging central bank digital currencies (CBDCs), tokenized assets, and deposits into a single ledger.

Interoperability problem

Swift highlights the problem of a "lack of secure interoperability" between different blockchain networks, resulting in inefficiencies and a poor user experience. However, the financial giant believes that it has the potential to solve this issue.

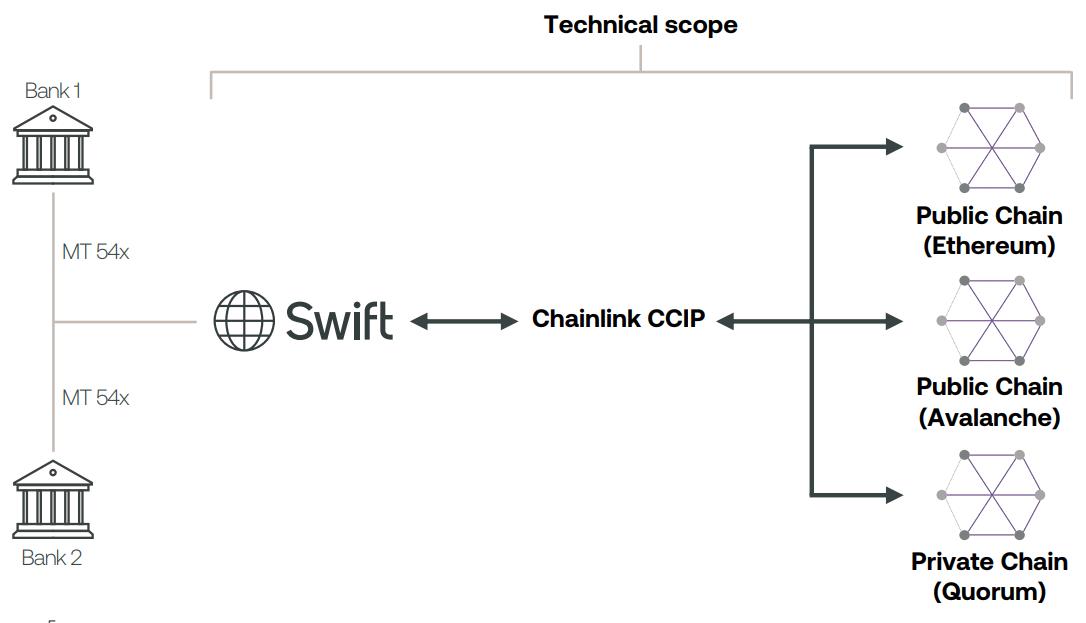

Collaboration with financial institutions and Chainlink

Swift collaborated with various financial institutions and blockchain oracle network provider Chainlink to demonstrate its ability to provide a single access point to multiple networks using existing infrastructure. This approach significantly reduces operational challenges and costs for institutions in supporting tokenized assets.

Tokenization benefits

The report highlights several potential benefits of tokenization, including increased liquidity, automation, transparency, and security. Swift's Chief Innovation Officer, Tom Zschach, emphasized the importance of connecting to the entire financial ecosystem for tokenization to reach its full potential.

Challenges of tokenization

Despite its benefits, Swift acknowledges that tokenization faces significant hurdles, such as the ongoing development of legal and regulatory frameworks. This poses a challenge for institutions looking to engage in tokenized asset transactions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/cryptocurrency-exchanges-in-australia-prioritize-communication-to-combat-scams