HOUSE prices soared in the second half 2020 – but what’s in store for them this year and are they likely to fall again?

Buyers and sellers face some big changes this year, including the end to a stamp duty holiday and the unpredictability of the coronavirus crisis.

Here, we look ahead to find out what the experts think will happen to house prices over the next year:

Will house prices fall in 2021?

Mortgage lender Halifax reckons in general, house prices will fall over the next year by as much as 6%.

This would almost wipe out all of the gains seen in the “mini boom” in the second half of 2020.

The lender, which monitors UK house prices, said that fresh national lockdowns and a sharp rise in unemployment is expected to bring property prices down.

It added there are already signs the market is slowing. Prices in December rose by 0.2%, the slowest monthly rise in the past six months.

The Centre for Economics and Businesses Research (CEBR) said it also expects prices to fall by 5% over 2021.

“With the pace of the UK’s economic recovery expected to be constrained by the renewed national lockdown, and unemployment widely predicted to rise in the coming months, downward pressure on house prices remains likely as we move through 2021,” said Russell Galley, managing director at Halifax.

However, property portal Zoopla says it expects to see prices rise by 5% by February before it slows to 1% by the end of the year.

Richard Donnell, director of research and insight at Zoopla, said: “We expect housing demand to slow further over 2021 and this will ease the upward pressure on prices which we expect to be 1% higher by December 2021.

“Lower sales volumes over the second half of 2021 and a growing scarcity of supply will offset weaker demand and support headline pricing levels.”

Where will house prices fall the most?

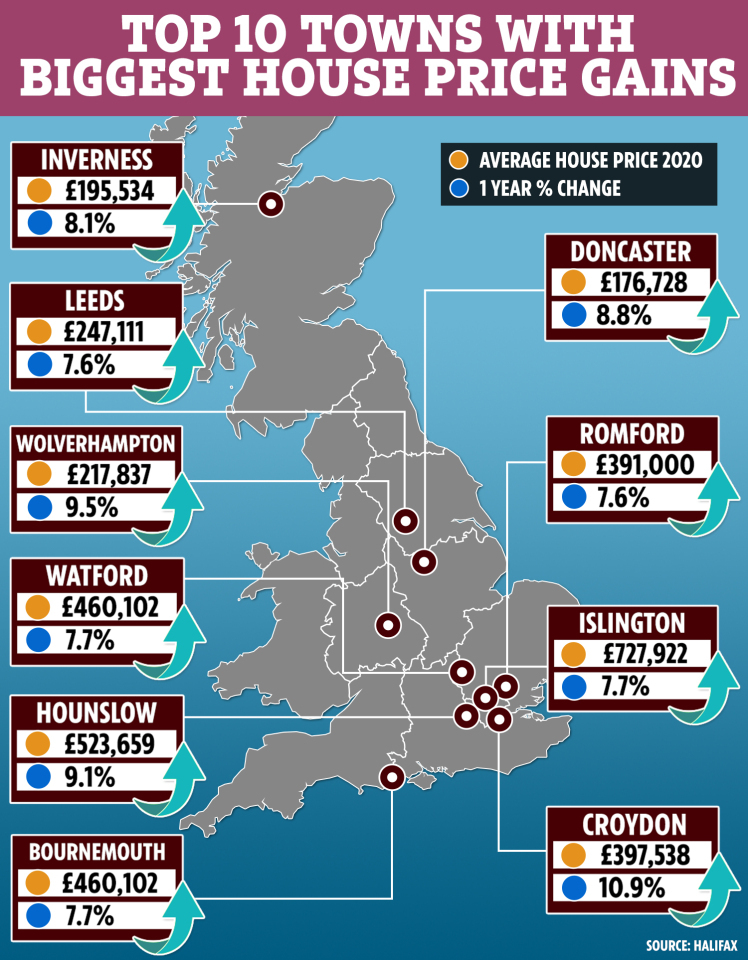

Many city workers seized the opportunity to move to the suburbs in 2020, thanks to the government’s prolonged working from home guidance.

The first lockdown created a thirst for more rooms, outdoor space and cheaper property.

Research by online mortgage brokers Trussle found that an overwhelming 71% of first-time buyers are now planning to buy in towns and rural locations.

It means house prices outside the city may see a boost if this trend continues into 2021.