THE UK is heading towards a double-dip recession according to economic experts.

The resurgence of coronavirus and the closing of borders along with Brexit in January has led economists to predict another recession in 2021.

The country plunged into the “worst ever” recession earlier this year, when the economy shrank for two quarters in a row – the technical definition of recession.

The economy bounced back and grew by 15.5% in the three months to September, meaning the UK is no longer in recession.

But a combination of factors means economists now think the economy will shrink again at the start of next year.

It’s called a double-dip recession when the economy enters recession, briefly recovers, and then enters recession again.

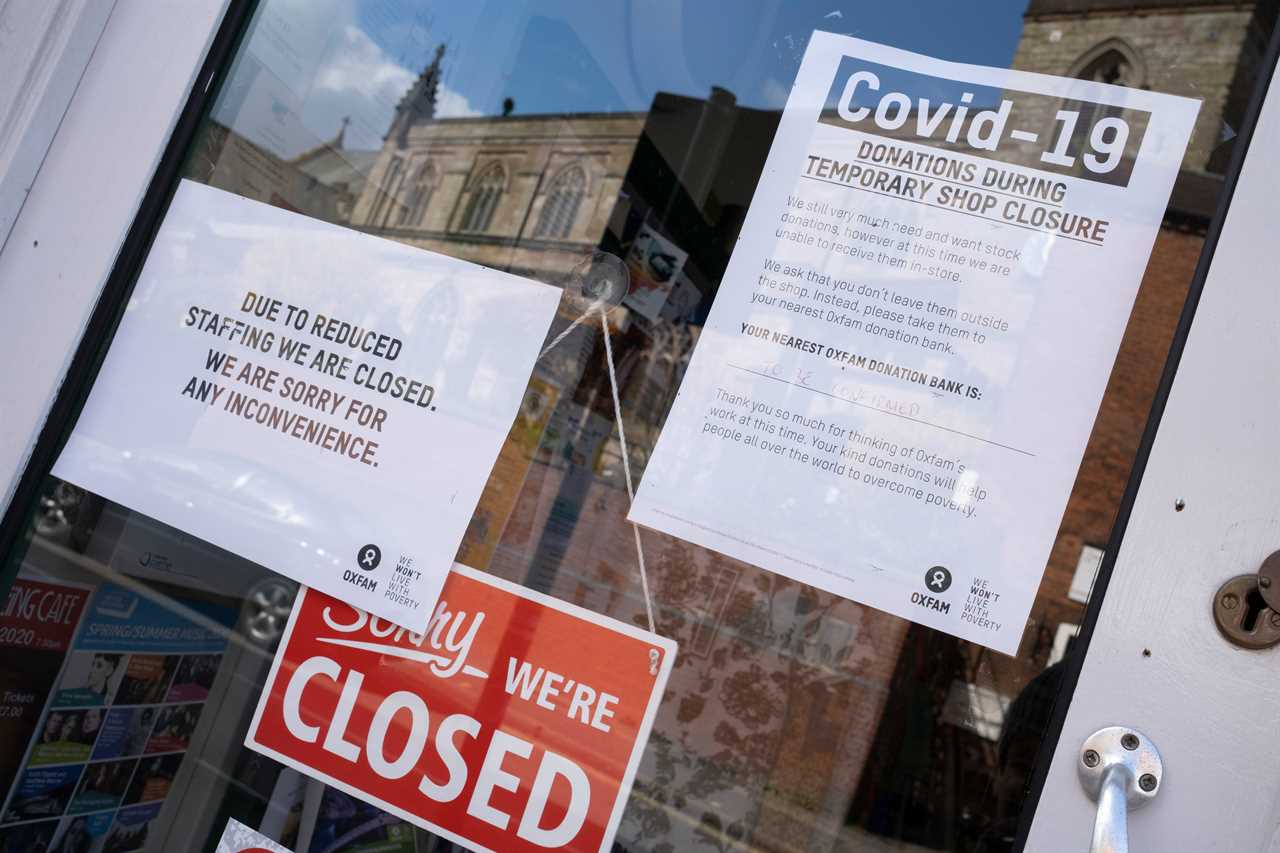

The rising cases of a new “mutant” coronavirus has lead to tighter Tier 4 restrictions which have closed many shops during the busiest shopping time of the year.

Travel bans have been imposed by several countries halting freight transport on one of the busiest trade routes, which threatens the delivery of goods to the UK, including some food.

More areas of the UK are expected to be put in Tier 4 while in January the UK will officially leave the EU and there is no deal on trade agreed with the EU yet.

Before the weekend when the new restrictions were introduced, the economy was expected to grow in the first quarter of 2021.

Dan Hanson of Bloomberg Economics said: “The first quarter will depend on how quickly any restrictions are eased.

“We’re skeptical about whether the government will be willing to relax the measures significantly making it highly likely the UK economy will contract again.”

Philip Rush, chief economist a research company Heteronomics, told Bloomberg “It’s a double-dip recession” with the new lockdown rules “likely to extend into the first couple of months of the year”.