RICH pensioners are being targeted with a “stealth tax” in the budget to try and repair Britain’s post-pandemic finances.

Chancellor Rishi Sunak is reportedly drawing up plans to freeze the lifetime allowance people can have in their pension pot at just over £1million.

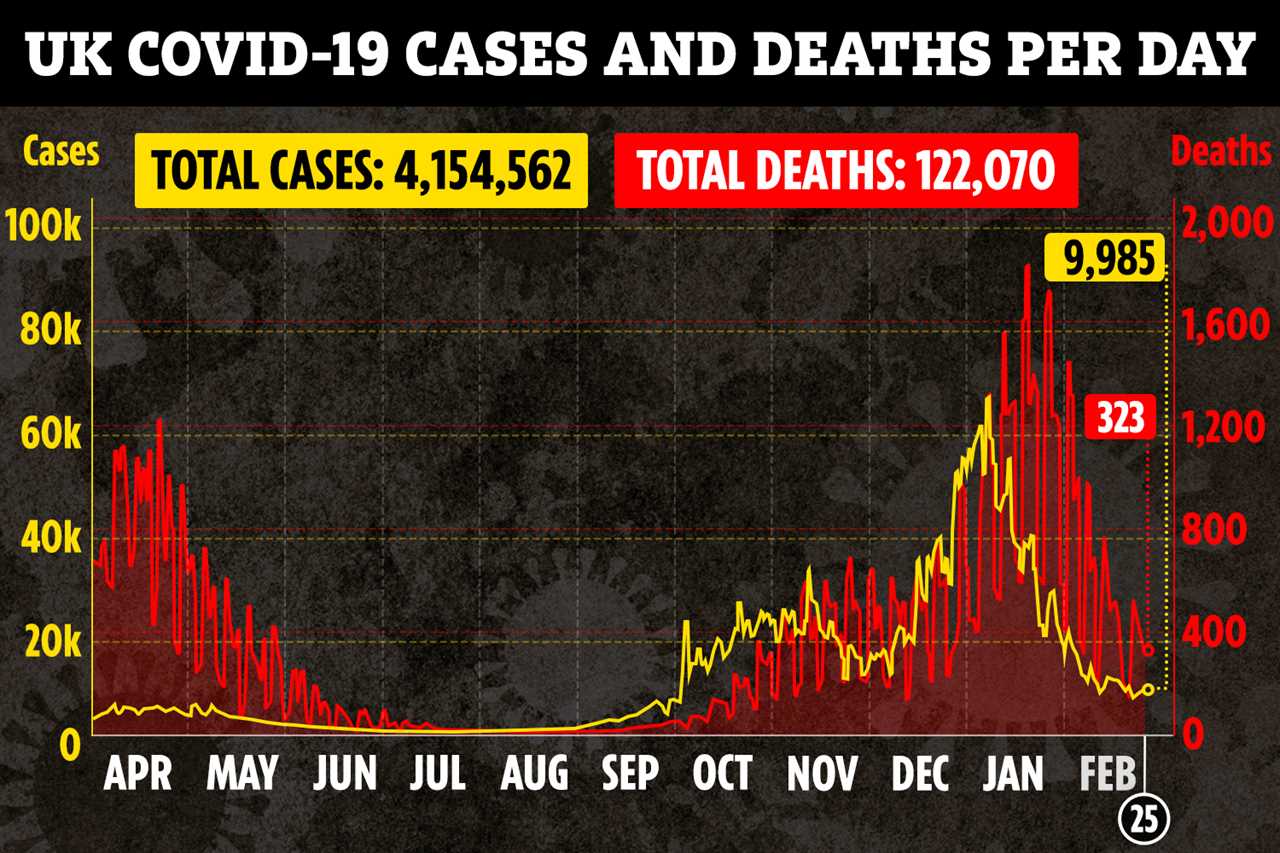

Read our coronavirus live blog for the latest news & updates…

Those who go over face a 25 per cent tax on any extra savings which rises to 55 per cent if they draw a lump sum.

Instead of the threshold rising with inflation by almost £90,000 over the course of the parliament the figure would be frozen at just over £1million.

It would mean around 10,000 people would end up paying more than £22,000 in extra tax by 2024 – netting some £250m for the Treasury.

The move will also affect the 1.2million people projected to exceed the threshold by the time they start drawing down income.

The Chancellor is also expected to freeze the £50k threshold for higher rate of income tax – raising around £1billion.

Finance consultant Sir Steven Webb told The Times: “It’s a stealth tax. Many people pay their finances carefully and the constant change in the policy is unhelpful.

“We have had huge cuts in the lifetime allowance followed by two years of freezing then linking to prices and now another freeze.

“It is time the government took a proper look at the whole system rather than just fiddling with it from one year to the next.”

EX-PM’S WARNING

David Cameron warned Mr Sunak not to press ahead with tax rises in next week’s Budget.

The former PM compared the Covid crisis to a wartime situation that means the Chancellor should cast normal spending rules out the window.

He told CNN that circumstances today are “very different” to the ones he inherited in the aftermath of the 2008 banking crash.

And he said: “Piling tax increases on top of that before you’ve even opened up the economy wouldn’t make any sense at all.

“I think it’s been right for the government here in the UK and governments around the world to recognise this is more like a sort of wartime situation.”

Insiders have described the Budget as a sandwich of good and bad news for families.

Some have likened it to “two big slices of bread with very thin jam”.

The first piece is a £30billion coronavirus support bundle that will see furlough, business relief, the Universal Credit uplift and stamp duty holiday all extended until June.

Trending In The News has previously reported how furlough will carry on beyond its April deadline to help the millions of people still unable to work.

The Universal Credit uplift of £20 per week, amounting to £1,040 for families over the year, was also reported to be likely to remain in place beyond April as coronavirus rules are still in force.

ITV’s Peston reports that an extension could be granted for six months.

Meanwhile, the Chancellor has come under pressure to extend stamp duty by families who have been left scrambling to complete their transactions before the deadline of March 31.