In most years, the notion that Congress could pass a $1.2 trillion plan to fix the nation’s bridges, highways, tunnels and rail lines without raising taxes would be a politician’s dream, a vision of endless ribbon-cuttings with no angry cries of “tax and spend.”

But that pitch, by a group of senators negotiating a bipartisan infrastructure deal, is receiving a hostile reception from many Democrats who favor a package five times as large, to be paid for in part with at least $2.5 trillion in new taxes. It is not just a much larger economic package they want; they also see a rare opportunity to harness the political popularity of infrastructure spending to achieve their long-held policy goal of raising taxes on the rich.

For liberal Democrats in particular — including newcomers like Representative Alexandria Ocasio-Cortez of New York and more senior members like Senator Ron Wyden of Oregon — the tax side of the ledger is not a mere accounting exercise to pay for spending, but a critical policymaking tool unto itself.

“What we’re doing is generating revenue, but we are also making a major area of American government more fair, so people don’t feel they’ve been played while the rich person gets off scot-free,” said Mr. Wyden, the chairman of the tax-writing Finance Committee.

Centrist senators who have been toiling to find a bipartisan infrastructure compromise have steered clear of tax increases, after Republicans made it clear they were unwilling to touch the vast tax cut they muscled through Congress in 2017. But leading Democrats — following President Biden’s own budget prescriptions — appear determined to move forward on an array of fronts to reshape the tax code as part of any major infrastructure effort.

For weeks now, Mr. Wyden’s committee has been drafting detailed tax policy changes targeting three major areas: corporations, the energy industry and individual taxpayers.

“Taxes need to be raised on corporations and need to be raised on that wealthiest of people who got a terrible, tremendous windfall from the Trump tax game,” said Representative Steve Cohen, Democrat of Tennessee.

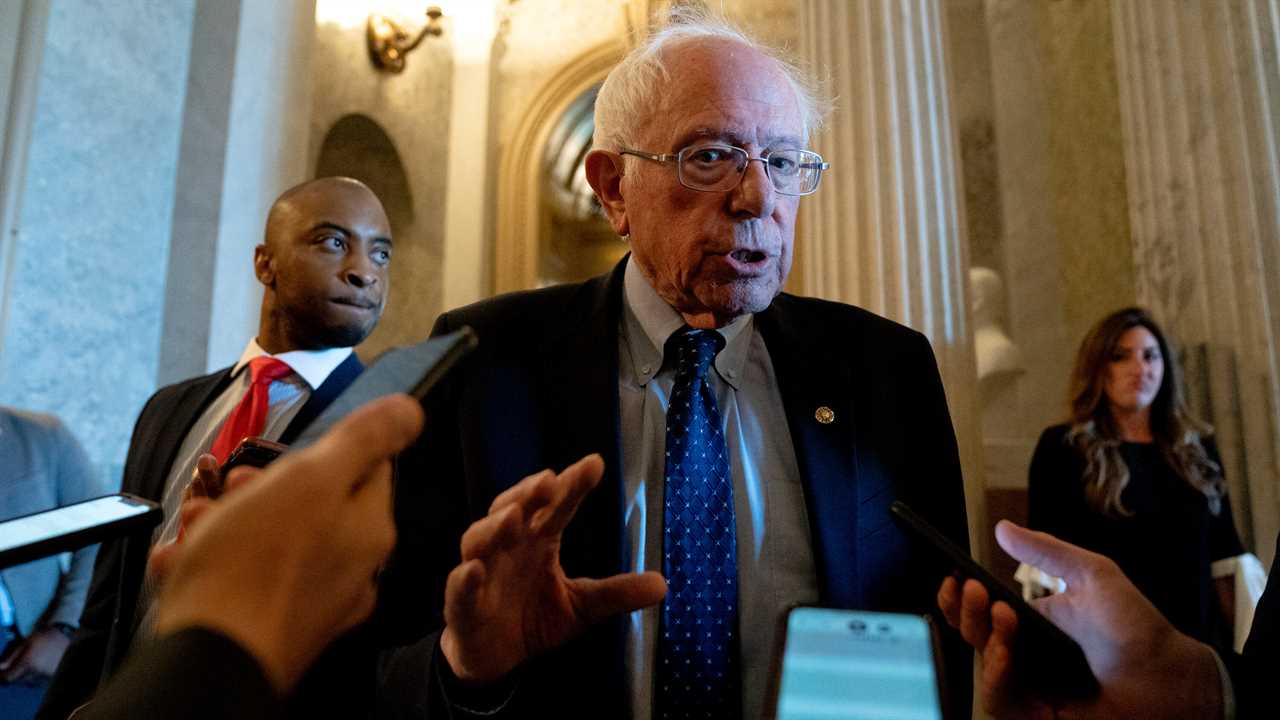

A tentative plan floated by Senator Bernie Sanders, the Vermont independent who is the chairman of the Senate Budget Committee, envisions spending as much as $6 trillion over 10 years on an economic package that would tackle what Democrats call “human infrastructure,” not just roads and bridges, with about half of it paid for. It would include investments in child care, health care, anti-climate-change programs, universal prekindergarten and community college access. Mr. Wyden’s committee would be expected to raise $2.5 trillion, a huge sum that could require significantly reordering the tax code.

The emerging $1.2 trillion proposal — which still faces substantial obstacles — omits tax increases and focuses entirely on physical infrastructure, leaving out the expansions of the social safety net that Mr. Biden and congressional Democrats argue must be part of any infrastructure initiative.

Even as the White House has pushed hard for a bipartisan agreement, officials have also made it clear they support a reconciliation package to push through the rest of Mr. Biden’s economic agenda, including tax increases. Doing so would allow them to sidestep a Republican filibuster and advance it with 50 votes, but they can do so only if their entire caucus backs it.