WASHINGTON — Senior House Democrats are coalescing around a draft proposal that could raise as much as $2.9 trillion to pay for most of President Biden’s sweeping expansion of the social safety net by increasing taxes on the wealthiest corporations and individuals.

The preliminary proposal, which circulated on and off Capitol Hill on Sunday, would raise the corporate tax rate to 26.5 percent for the richest businesses and impose an additional surtax on individuals who make more than $5 million.

The plan could be a critical step for advancing the $3.5 trillion package, which is expected to include federally funded paid family leave, address climate change and expand public education. While it is unclear whether the entire House tax-writing committee supports the proposal, it suggests plans to undo key components of the 2017 Republican tax law, although some provisions fall short of what Mr. Biden proposed earlier this year.

But the revenue provisions outlined in a document obtained by The New York Times and reported earlier by The Washington Post fall short of fully financing the entire package Democrats are cobbling together, despite promises by Mr. Biden and Democratic leaders that it would be fully paid for in order to assuage concerns from moderates in their caucus.

People briefed on the details cautioned that the plan was still in flux. The committee is scheduled to convene this week to continue work on the legislation and the Senate returns on Monday, as Democrats aim to reconcile their policy differences by the end of the month.

The outline “makes significant progress toward ensuring our economy rewards work and not just wealth by cutting taxes for middle-class families, reforming the tax code to prevent the offshoring of American jobs and making sure the wealthiest Americans and big corporations pay their fair share,” said Andrew Bates, a White House spokesman.

The proposal would raise the corporate tax rate to 26.5 percent from 21 percent for businesses that report more than $5 million in income. The corporate tax rate would be lowered to 18 percent for small businesses that make less than $400,000 and remain at 21 percent for all other businesses. Mr. Biden had originally proposed raising the corporate tax rate to 28 percent, a larger increase that both corporations and moderate Democrats have resisted.

To help raise what the draft’s authors estimate could be $900 billion in taxes on corporations, Democrats suggest additional changes to the tax code that are intended to bolster a global push to set minimum taxes for corporate income and crack down on multinational companies shifting profits to tax havens, a process that the administration is championing abroad.

House Democrats are also considering an increase to the top marginal income tax rate to 39.6 percent from 37 percent for households that report taxable income over $450,000 and for unmarried individuals who report more than $400,000. For people who make more than $5 million, the proposal would impose a 3 percent surtax, which is expected to raise $127 billion.

It also increases the top tax rate for capital gains — the proceeds from selling an asset like a boat or stocks — to 25 percent from 20 percent. Mr. Biden had proposed essentially doubling that tax rate. The proposal would also provide $80 billion over the next 10 years for the Internal Revenue Service to beef up tax enforcement, a provision that budget scorekeepers estimate would raise $200 billion.

And while Mr. Bates, the White House spokesman, said that the draft outline adhered to Mr. Biden’s pledge to avoid raising taxes on Americans who make less than $400,000, the document suggests increasing the tax rate for tobacco products and imposing a tax on other products that use nicotine, such as e-cigarettes. That provision is expected to raise $96 billion.

The document also outlines the possible inclusion of drug pricing provisions and changes in tax rules to “treat cryptocurrency the same as other financial instruments.”

The full committee still needs to release and advance text of the legislation, and it is unclear if enough Democrats will embrace the package in the House and the Senate. In order to protect the economic package from a Republican filibuster and pass it with a simple majority, Democrats can spare only three votes in the House and must remain united in the Senate.

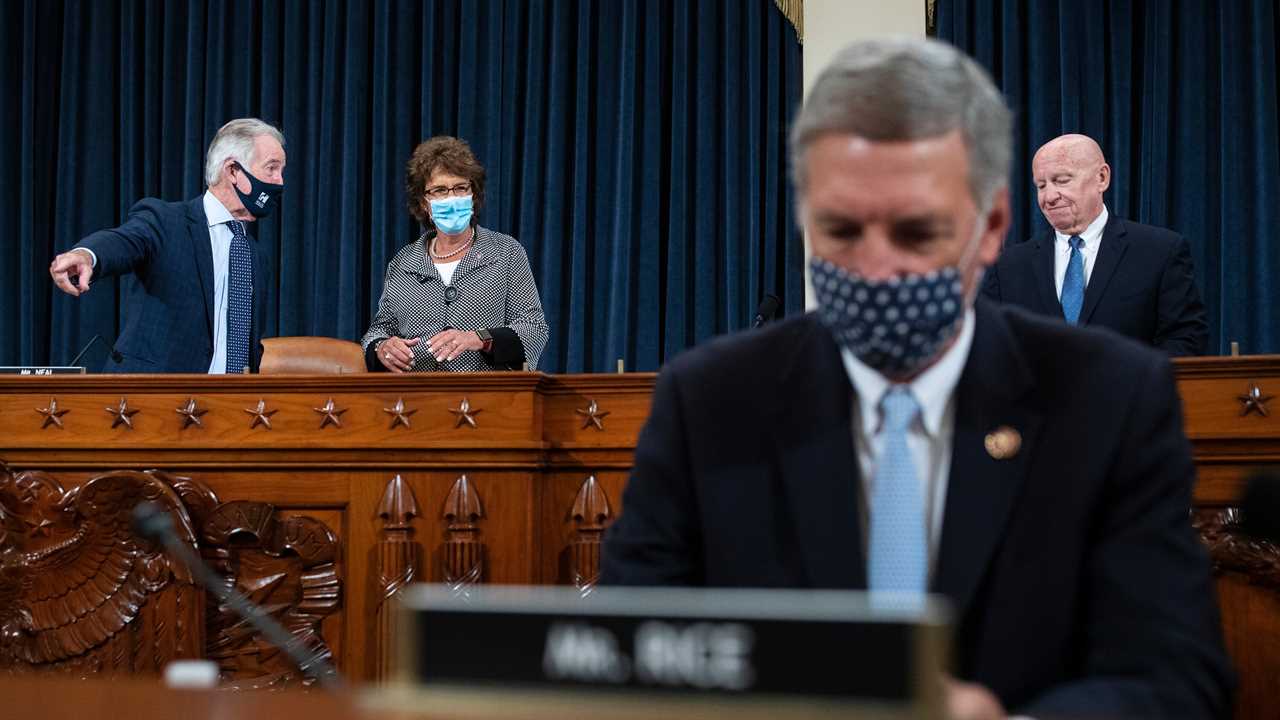

In part because of the deep divisions in the Democratic caucus over the scope and structure of the package, Representative Richard E. Neal of Massachusetts, the chairman of the Ways and Means Committee, had remained remarkably enigmatic about his own preferences for the legislation. Before hearings this week, the committee has been releasing key components of the package, including an extension of monthly payments to families with children through 2025 and tax incentives for cleaner energy.

A dueling round of commentary on Sunday underscored the competing perspectives in the Democratic caucus, as Senators Joe Manchin III of West Virginia, a key moderate, and Bernie Sanders, the Vermont independent who serves as the chairman of the Budget Committee, staked out their respective positions in multiple news show interviews.

Mr. Manchin reiterated that he would not support spending $3.5 trillion, saying that Senator Chuck Schumer of New York, the majority leader, “will not have my vote” on a package of that size.

“Chuck knows that — we’ve talked about this,” Mr. Manchin said on CNN’s “State of the Union.” “We’ve tried to help Americans in every way we possibly can, and a lot of the help that we’ve put out there is still there, and it’s going to run clear until next year, 2022, so what’s the urgency?”

He voiced skepticism that the legislation would be finished by the end of the month, adding that the hasty time frame “makes no sense at all.” Mr. Manchin also raised concerns about some critical clean energy provisions, as well as the proposed tax increases.

Mr. Sanders, speaking later on “State of the Union,” said that reducing the size of the package as much as Mr. Manchin suggested was “absolutely not acceptable to me.”

“I don’t think it’s acceptable to the president, to the American people or to the overwhelming majority of the people in the Democratic caucus,” he added. “Many of us made a major compromise in going from the $6 trillion bill that we wanted.”

Jim Tankersley contributed reporting.

Did you miss our previous article...

https://trendinginthenews.com/usa-politics/behind-the-texas-abortion-law-a-persevering-conservative-lawyer